Purchasing your first home represents one of life’s most significant financial decisions, and the UK government provides extensive support to help first-time buyers navigate this challenging process. From stamp duty relief and government-backed schemes to specialist mortgage products and savings incentives, first-time buyers in the UK have access to a comprehensive range of benefits designed to make homeownership more accessible and affordable.

Understanding these benefits and how to maximise their potential can save thousands of pounds and significantly accelerate your journey onto the property ladder. This comprehensive guide explores all available first-time buyer benefits, government schemes, and practical strategies to help you secure your first home whilst minimising costs and maximising financial advantages.

Understanding UK First-Time Buyer Status

First-time buyer status in the UK provides access to exclusive benefits and schemes unavailable to those who have previously owned property. The definition typically requires that you have never owned a residential property anywhere in the world, though some schemes have specific variations in their eligibility criteria that may allow certain exceptions.

The UK government recognises the challenges facing first-time buyers, particularly in areas with high property prices, and has developed a comprehensive framework of support measures. These range from direct financial assistance through government schemes to tax reliefs and preferential lending arrangements with participating mortgage providers.

Your first-time buyer status opens doors to significant financial advantages, including potential savings of tens of thousands of pounds through various government initiatives. However, these benefits come with specific eligibility requirements, application processes, and time limits that must be carefully understood and managed to ensure maximum benefit.

The value of first-time buyer benefits varies significantly depending on your circumstances, location, and the type of property you wish to purchase. Understanding how these different schemes work together can help you develop a comprehensive strategy that maximises your purchasing power whilst minimising your financial commitment.

Government Schemes for First-Time Buyers

The Help to Buy Equity Loan scheme, whilst now closed to new applications, provided significant support to first-time buyers purchasing new-build properties. Understanding how this scheme worked provides insight into the government’s approach to supporting first-time buyers and may inform future policy developments in this area.

The First Homes scheme represents the government’s current flagship initiative for supporting first-time buyers, offering new-build homes at a minimum discount of 30% below market value. This scheme prioritises local residents and key workers, ensuring that those with strong community connections have preferential access to affordable homeownership opportunities in their local areas.

Shared Ownership schemes provide an alternative route to homeownership for first-time buyers who cannot afford to purchase a property outright. These arrangements allow you to purchase a share of a property, typically between 25% and 75%, whilst paying rent on the remaining portion, with the option to increase your ownership share over time through a process called staircasing.

The Mortgage Guarantee Scheme supports first-time buyers by encouraging lenders to offer mortgages with just 5% deposits. The government provides guarantees to participating lenders, reducing their risk and enabling them to offer competitive mortgage products to buyers with limited deposit funds, though this scheme has specific eligibility criteria and participating lender requirements.

Stamp Duty Relief for First-Time Buyers

First-time buyers benefit from significant stamp duty relief, with no stamp duty payable on properties costing up to £300,000. This relief can save thousands of pounds compared to the standard stamp duty rates, providing immediate financial benefits that can be redirected towards deposit funds or property improvements.

For properties valued between £300,001 and £500,000, first-time buyers pay reduced stamp duty rates only on the portion above £300,000. This progressive approach ensures that first-time buyers receive meaningful support even when purchasing higher-value properties, though the relief diminishes as property values increase beyond the threshold limits.

The stamp duty relief applies automatically when you complete your property purchase, provided you meet the first-time buyer criteria and your solicitor correctly declares your status on the relevant forms. This relief cannot be claimed retrospectively, making it essential to ensure proper declaration during the conveyancing process.

Understanding how stamp duty relief interacts with other first-time buyer benefits helps maximise your overall savings. The relief applies regardless of whether you use other government schemes, meaning you can combine stamp duty savings with Help to Buy, Shared Ownership, or other support programmes to maximise your financial advantages.

Lifetime ISA Benefits and Strategy

The Lifetime ISA provides first-time buyers with a 25% government bonus on savings up to £4,000 per year, effectively providing free money towards your deposit fund. This bonus can contribute up to £1,000 annually towards your home purchase, making it one of the most valuable savings vehicles available to prospective first-time buyers.

Lifetime ISAs can be opened by anyone aged 18 to 39, with contributions and bonuses continuing until age 50. The funds can be used to purchase your first home worth up to £450,000 anywhere in the UK, providing flexibility for buyers in different regional markets whilst maintaining the government bonus structure.

The strategic use of Lifetime ISAs requires careful planning, as funds must remain in the account for at least 12 months before they can be used for property purchase. Early withdrawal for non-qualifying purposes results in penalty charges that effectively remove the government bonus plus additional charges, making commitment to the savings plan essential.

Couples can each open separate Lifetime ISAs, potentially doubling the available government bonuses and significantly accelerating deposit accumulation. This joint approach can provide up to £2,000 in annual government contributions, making it particularly attractive for couples planning to purchase their first home together.

Specialist Mortgage Products

First-time buyer mortgages often feature preferential terms compared to standard mortgage products, including competitive interest rates, reduced fees, and flexible deposit requirements. These products recognise that first-time buyers typically have limited deposit funds but represent lower risk due to their commitment to homeownership.

Many lenders offer specific first-time buyer mortgage products with features such as cashback payments, free valuations, or reduced arrangement fees. These benefits can save hundreds or thousands of pounds during the mortgage arrangement process, though it’s important to compare the overall cost of borrowing rather than focusing solely on upfront incentives.

Some lenders also accommodate situations where there is one applicant as first-time buyer mortgage, allowing flexibility when buyers apply jointly but only one partner qualifies as a first-time buyer.

Guarantor mortgages provide another option for first-time buyers, allowing family members to support your mortgage application by providing additional security. These arrangements can enable access to better mortgage rates or higher loan amounts, though they create financial obligations for the guarantor that must be carefully considered.

Shared equity mortgages, offered by some lenders in partnership with housing associations or local authorities, provide additional support by reducing the amount you need to borrow. These products typically involve the lender or partner organisation taking a stake in your property, which must be repaid when you sell or remortgage.

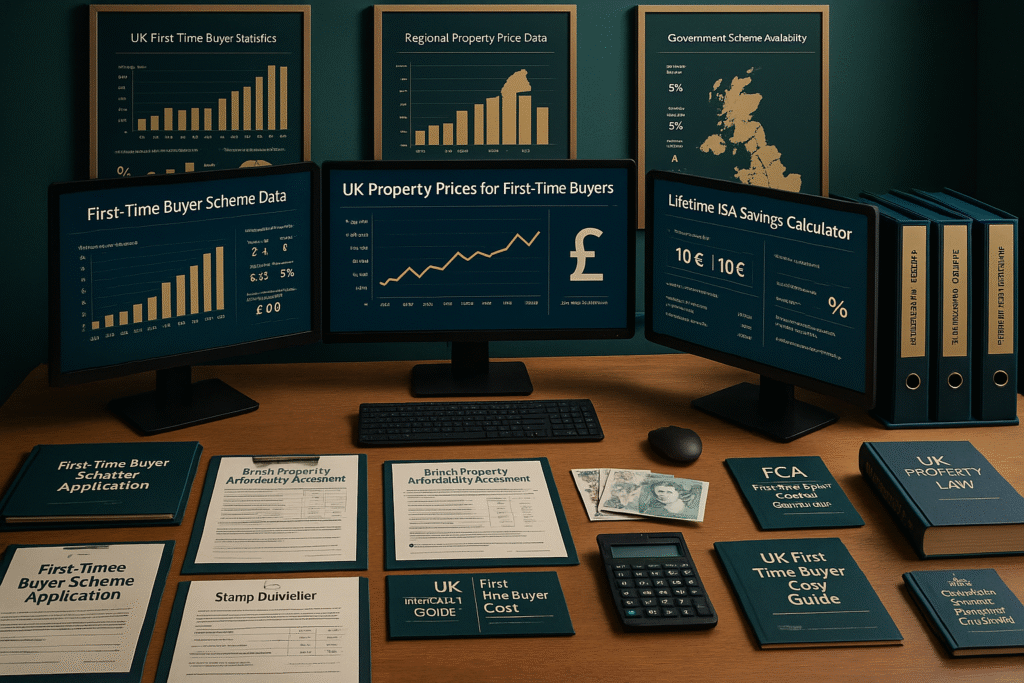

Regional and Local Authority Support

Many local authorities offer additional first-time buyer support schemes tailored to local housing market conditions and community needs. These schemes may include shared ownership opportunities, discounted sale properties, or deposit assistance programmes that complement national government initiatives.

Right to Buy schemes, whilst primarily designed for existing council tenants, can provide first-time buyer opportunities for those who qualify. These schemes offer substantial discounts on council properties, though eligibility is restricted to tenants with qualifying periods of residence and the schemes have specific regional variations.

Regional variations in property prices mean that first-time buyer benefits have different values across the UK. Understanding how national schemes interact with local market conditions helps identify the most beneficial locations and timing for your first home purchase, potentially maximising the value of available support.

Some areas offer additional incentives such as council tax reductions for first-time buyers, local authority mortgage schemes, or partnerships with housing associations that provide enhanced shared ownership opportunities. Researching local provisions can uncover additional benefits that significantly improve your purchasing position.

Financial Planning and Budgeting

Effective financial planning for first-time buyers involves understanding not just the purchase price but all associated costs including surveys, legal fees, removal costs, and immediate property expenses. Government schemes and first-time buyer benefits can help with purchase costs but may not cover all associated expenses.

Budgeting for ongoing homeownership costs including mortgage payments, insurance, maintenance, and potential interest rate increases ensures sustainable homeownership. First-time buyers should plan for mortgage payments that remain affordable even if interest rates increase, providing financial security throughout the mortgage term.

Building emergency funds alongside deposit savings provides financial resilience for unexpected expenses or income changes. First-time buyers benefit from maintaining accessible savings even after property purchase, ensuring they can manage unforeseen costs without jeopardising their mortgage payments.

Credit score improvement before applying for mortgages can significantly impact available mortgage products and interest rates. First-time buyers should focus on building positive credit history, reducing existing debts, and avoiding credit applications in the months before mortgage applications to optimise their borrowing position.

Professional Advice and Support

Independent mortgage advice provides valuable support for first-time buyers navigating complex mortgage markets and government schemes. Professional advisers understand how different benefits interact and can identify optimal strategies for individual circumstances, potentially saving significant amounts through better product selection.

Solicitor selection for conveyancing affects both costs and service quality during property purchase. First-time buyers benefit from choosing solicitors experienced in government schemes and first-time buyer transactions, ensuring smooth processing of scheme applications and benefit claims.

Financial planning advice helps first-time buyers understand the long-term implications of different mortgage products and government schemes. Professional guidance can identify strategies that optimise both immediate affordability and long-term financial outcomes, supporting sustainable homeownership.

Estate agent relationships can provide valuable market insight and property opportunities for first-time buyers. Agents familiar with first-time buyer schemes and local market conditions can identify suitable properties and guide buyers through competitive purchasing processes.

Maximising Your First-Time Buyer Advantages

Combining multiple first-time buyer benefits requires careful coordination and timing to ensure eligibility for all relevant schemes. Understanding how different benefits interact helps develop comprehensive strategies that maximise financial advantages whilst meeting all scheme requirements and deadlines.

Timing your property purchase to align with scheme availability and personal circumstances can significantly impact the benefits available. Some schemes have limited funding or time-restricted availability, making strategic timing essential for accessing maximum support.

Property selection affects the value of first-time buyer benefits, with some schemes restricted to new-build properties or specific price ranges. Understanding these limitations helps focus your property search on options that maximise available benefits whilst meeting your housing needs.

Conclusion

Long-term planning considers how first-time buyer benefits affect future property decisions, including potential restrictions on selling or remortgaging. Some schemes include provisions that affect future property transactions, making it important to understand long-term implications before committing to specific arrangements.

Professional mortgage and financial advice is recommended when considering first-time buyer benefits and government schemes. Your home may be repossessed if you do not keep up repayments on your mortgage. This information is for general guidance only and should not be considered as personalised financial advice.