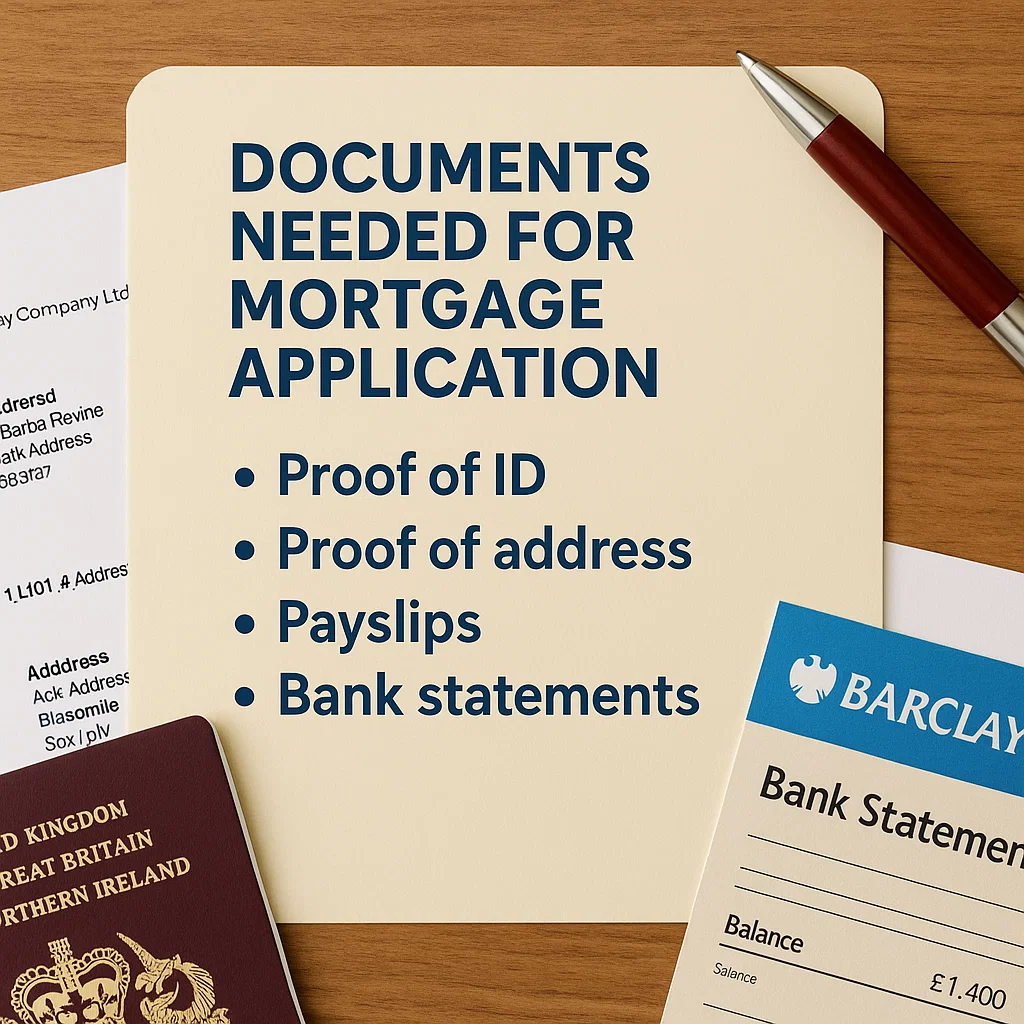

Many homebuyers and property investors wonder what documents are needed for a mortgage and how to organise them. Gathering the right paperwork is often the first step towards a smoother application, helping lenders check your financial profile and credit history. In the UK, mortgage application documents vary slightly based on whether you’re employed, self-employed, or purchasing a buy-to-let property. Having the right evidence for identity, income, and deposit sources makes the journey more efficient. Mortgages RM specialises in guiding first-time buyers, home movers, landlords, and homeowners through every stage of the document process, ensuring a transparent approach when presenting your case to the right lender.

Why Accurate Mortgage Documentation Is Essential

Lenders want clear evidence of a borrower’s ability to handle monthly repayments. Missing paperwork can delay approvals or raise concerns about affordability. Complete documentation builds trust, allowing lenders to see where your income comes from and how you manage household expenses. Many applicants in the UK face setbacks when crucial items like payslips or proof of identity are overlooked. Thorough preparation avoids last-minute surprises and keeps the mortgage process on track.

Proof of Identity and Residence

Verifying who you are is a core part of what documents are needed for mortgage applications. Lenders usually request a valid passport or driving licence serving as confirmation of your identity details and photo ID. A recent household bill, bank statement, or council tax notification often serves as proof of residence. These items need to be up to date, and occasionally certified copies are required. Having these essential documents ready supports a clear, credible application.

Payslips and P60 for Employed Applicants

For employed borrowers, recent payslips and a valid P60 show consistent income. Mortgage affordability checks rely on verifying earnings, so lenders often examine at least three months of payslips alongside your P60 for an annual overview. Bank statements for mortgage approval must align with the figures disclosed. This evidence assures lenders that you receive a steady salary and can manage repayments responsibly. It also demonstrates transparency around your personal finances.

Self-Employed Mortgage Requirements

Self-employed applicants often ask, “What documents do I need to get a mortgage?” In the UK, lenders typically need SA302 forms or tax year overviews from HMRC, plus profit-and-loss statements if you’re a sole trader, partner, or limited company director. A minimum of one to two years’ trading history allows lenders to gauge consistent cash flow. Demonstrating stable profits is key when underlining your ability to meet monthly mortgage obligations.

Bank Statements and Outgoings

Lenders closely review bank statements to confirm income deposits and everyday outgoings. Regular transactions in line with your declared earnings help support your mortgage application. Proof of expenses for affordability can involve credit card bills, car finance, personal loans, or childcare costs. Showing healthy saving habits and manageable spending patterns strengthens lender confidence. Thorough records of monthly incomings and outgoings back up your financial stability and help illustrate a consistent approach to money management.

Special Circumstances Documents

Certain scenarios prompt extra paperwork. First-time buyers using government-backed schemes often provide official confirmations related to these programmes. Landlords applying for buy-to-let mortgages might supply tenancy agreements or rental statements. Situations like divorce settlements or legal name changes may require marriage certificates, court documents, or deeds of assignment. Each case presents unique considerations, and ensuring you have the correct paperwork in advance helps maintain momentum towards mortgage approval.

Credit History and Decision in Principle

Before issuing a binding offer, many lenders perform a thorough credit history and affordability check, which influences whether you receive a Decision in Principle (DIP). This provisional agreement shows you’ve passed initial screenings. Applicants with visible CCJs, missed payments, or incomplete financial records may need further clarification. Lenders often revisit the documents required for first-time buyers or existing homeowners at this stage. Maintaining an organised set of statements, proof of identity, and income records supports a favourable DIP.

Final Submission and Timelines

Once complete, applications and supporting documents are reviewed by underwriting teams. Turnaround times vary, but comprehensive submissions usually progress faster. Employed and self-employed applicants alike benefit from verifying every detail in their mortgage paperwork checklist beforehand. Lenders appreciate clarity on fund sources, current liabilities, and any relevant certificates. Ensuring the right documents do not expire during the review period is also important. Swift responses to follow-up questions reduce avoidable delays and increase the chance of a prompt mortgage offer.

Conclusion

Thorough, accurate paperwork is essential for a successful UK mortgage application. Having valid identification, proof of consistent income, clear records of outgoings, and solid evidence of deposit funds strengthens your position when seeking a lender’s approval. Whether you’re applying for a repayment mortgage or considering an interest-only mortgage, ensuring your paperwork is in order will make the process smoother and improve your chances of approval. Mortgages RM specialises in making this process more transparent and straightforward, tailoring document support for first-time buyers, home movers, landlords, or homeowners in search of remortgage options. Book your free mortgage consultation with Mortgages RM and secure the deal that matches your property goals with confidence and peace of mind.