First-time buyer mortgage calculators have become indispensable tools in the UK property market, offering prospective homeowners initial insights into borrowing capacity and monthly repayment obligations. These digital instruments provide valuable preliminary assessments by evaluating key financial variables including income levels, deposit amounts, existing debt obligations, and prevailing interest rates to generate estimated mortgage scenarios that help first-time buyers understand their potential purchasing power within the current UK housing market.

The accuracy and reliability of these calculators for comprehensive financial planning represents a critical consideration for first-time buyers navigating the complexities of UK mortgage applications and property purchases. Whilst these tools offer convenient starting points for financial assessment, their effectiveness depends significantly on the quality of input data, the sophistication of underlying algorithms, and their ability to reflect the nuanced lending criteria employed by UK mortgage providers operating under Financial Conduct Authority regulations.

For many first-time buyers, knowing how a mortgage works with a down payment is vital, as the deposit size directly impacts affordability results produced by calculators.

Understanding the capabilities and limitations of UK mortgage calculators enables first-time buyers to utilise these tools effectively whilst recognising when professional mortgage advice becomes essential for accurate financial planning and successful property acquisition. This comprehensive analysis examines the accuracy of first-time buyer mortgage calculators within the UK market context, exploring their practical applications, inherent limitations, and optimal integration with professional mortgage guidance for effective homebuying strategies.

Understanding UK First-Time Buyer Mortgage Calculator Fundamentals

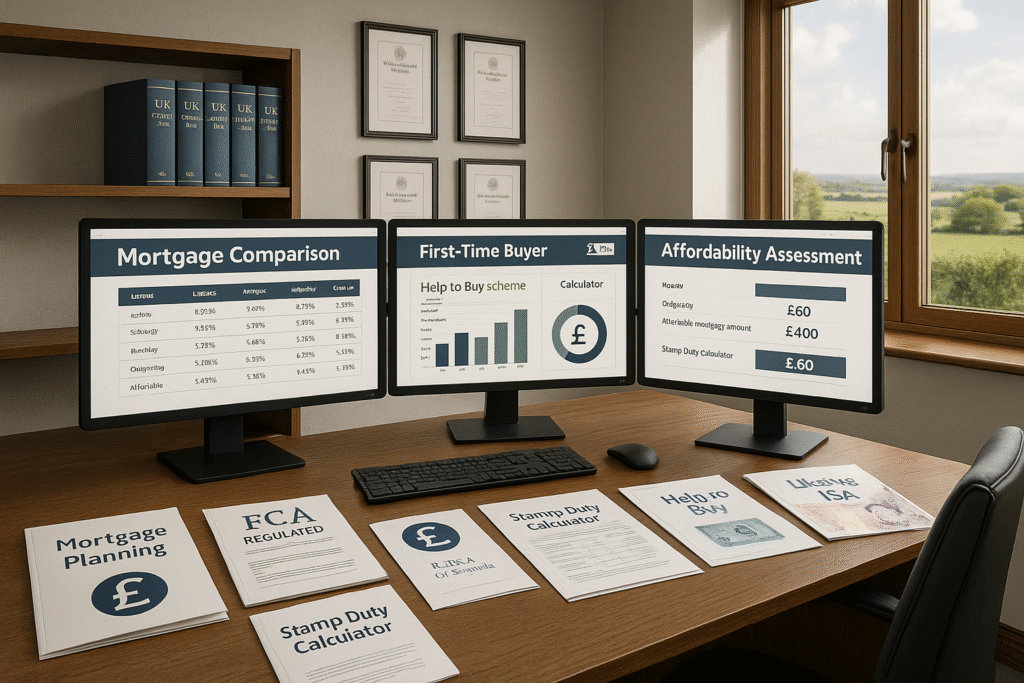

UK first-time buyer mortgage calculators operate on sophisticated algorithms designed to process multiple financial variables and generate preliminary assessments of borrowing capacity and monthly repayment obligations. These tools typically evaluate gross annual income, existing monthly financial commitments, available deposit amounts, preferred mortgage terms, and current interest rate environments to produce estimated scenarios that reflect potential mortgage arrangements available within the UK lending market.

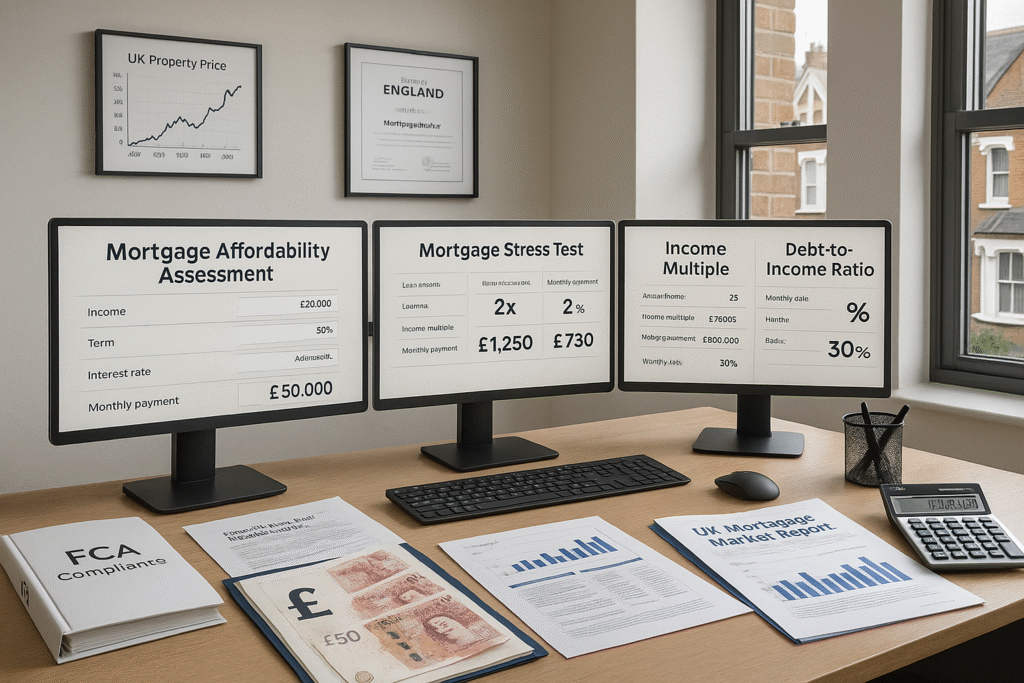

The fundamental methodology employed by these calculators involves applying standard income multiples commonly used by UK lenders, typically ranging from 4.5 to 5.5 times annual income, whilst factoring in debt-to-income ratios and affordability stress testing requirements mandated by Financial Conduct Authority regulations. This approach enables the calculators to generate preliminary borrowing estimates that align broadly with industry lending standards, though individual lender criteria may vary significantly from these generalised assessments.

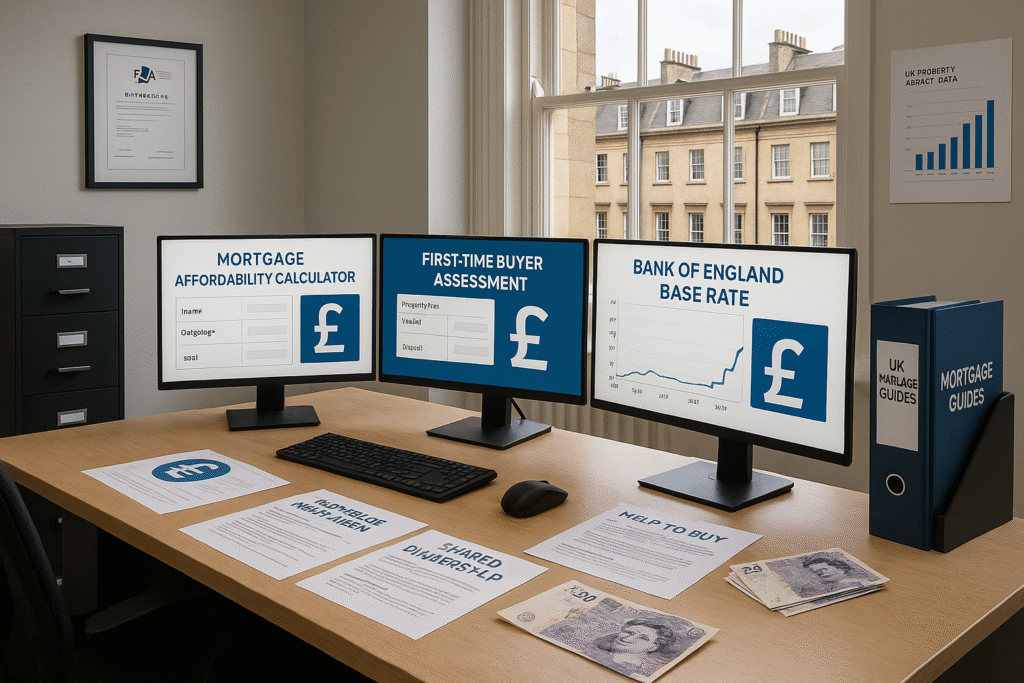

Modern UK mortgage calculators incorporate increasingly sophisticated features including regional property price data, stamp duty calculations, and first-time buyer scheme eligibility assessments that enhance their relevance for contemporary homebuying scenarios. These advanced functionalities enable users to explore various mortgage products, compare different deposit scenarios, and understand the financial implications of different property price ranges within their target locations.

The integration of real-time interest rate data and market conditions enables these calculators to provide more current and relevant estimates, though the rapidly changing nature of UK mortgage markets means that calculator outputs represent snapshots of market conditions at specific points in time. Understanding this temporal limitation is crucial for first-time buyers who may be planning purchases over extended periods or in volatile market conditions.

The user interface design of UK mortgage calculators typically emphasises simplicity and accessibility, enabling users with varying levels of financial literacy to input their information and receive comprehensible results. However, this simplification necessarily involves assumptions and generalisations that may not accurately reflect individual circumstances or the specific requirements of different mortgage lenders operating within the UK market.

Accuracy Assessment of UK Mortgage Calculator Outputs

The accuracy of UK first-time buyer mortgage calculators varies significantly depending on the sophistication of their underlying algorithms, the currency of their data sources, and their ability to reflect the diverse lending criteria employed across the UK mortgage market. High-quality calculators that incorporate current market data, regulatory requirements, and comprehensive affordability assessments typically provide estimates within reasonable ranges of actual lending decisions, though individual variations remain substantial.

Research conducted across UK mortgage applications indicates that calculator estimates generally align within 10-15% of actual lending decisions for straightforward applications involving employed borrowers with standard financial profiles. However, this accuracy diminishes significantly for complex financial situations involving self-employment income, irregular earnings, existing credit issues, or non-standard property types that require specialist lending criteria and individual underwriting assessments.

The temporal accuracy of calculator outputs represents a critical limitation, as UK mortgage markets experience frequent changes in interest rates, lending criteria, and regulatory requirements that can substantially affect borrowing capacity and monthly repayment calculations. Calculators that fail to incorporate recent market changes may provide outdated estimates that mislead users about current borrowing possibilities and market conditions.

Regional variations in property prices, local authority charges, and market conditions create additional accuracy challenges for UK mortgage calculators, particularly those that fail to incorporate location-specific data into their calculations. First-time buyers targeting specific regions or property types may find that generic calculator estimates fail to reflect local market realities and associated costs that significantly impact overall affordability assessments.

The treatment of government schemes and first-time buyer incentives represents another accuracy variable, as calculators may not adequately reflect the complex eligibility criteria and application processes associated with programmes such as Help to Buy, Shared Ownership, or First Homes schemes. These programmes can substantially affect borrowing requirements and monthly costs, making their accurate incorporation essential for realistic financial planning.

Lender-specific variations in criteria, product features, and assessment methodologies create inherent limitations in calculator accuracy, as no single tool can adequately reflect the diverse approaches employed across the UK mortgage market. Individual lenders may have significantly different approaches to income assessment, credit scoring, and affordability calculations that result in substantial variations from generic calculator estimates.

UK Regulatory Framework Impact on Calculator Reliability

The Financial Conduct Authority’s Mortgage Market Review regulations significantly influence the accuracy and relevance of UK mortgage calculators by establishing standardised affordability assessment requirements that lenders must implement across all mortgage applications. These regulations mandate comprehensive income and expenditure analysis, stress testing at elevated interest rates, and detailed verification procedures that may not be fully reflected in simplified calculator algorithms.

Affordability stress testing requirements, which assess borrowers’ ability to maintain payments at interest rates typically 3% above the initial rate, represent critical regulatory factors that sophisticated calculators must incorporate to provide realistic assessments. Calculators that fail to include stress testing scenarios may significantly overestimate borrowing capacity and mislead first-time buyers about their actual mortgage eligibility under current regulatory requirements.

The regulatory emphasis on responsible lending and borrower protection has resulted in more conservative lending approaches across the UK market, with lenders implementing enhanced verification procedures and stricter affordability criteria that may not be adequately reflected in calculator estimates. These regulatory influences mean that actual lending decisions often involve more stringent assessments than those suggested by simplified calculator algorithms.

Consumer protection regulations require mortgage lenders to provide clear information about total costs, interest rate variations, and long-term financial commitments that extend beyond the scope of basic calculator outputs. First-time buyers relying solely on calculator estimates may not fully understand the comprehensive financial implications of mortgage commitments or the additional costs associated with property ownership and maintenance.

The regulatory framework’s emphasis on individual circumstances and personalised advice creates inherent limitations in the standardised approach employed by mortgage calculators. Regulatory requirements for tailored assessments and individual consideration mean that calculator outputs represent generalised estimates rather than definitive lending decisions or comprehensive financial advice.

Data protection and privacy regulations influence the design and functionality of UK mortgage calculators, potentially limiting their ability to access comprehensive financial data or provide highly personalised assessments. These regulatory constraints may reduce calculator accuracy whilst protecting user privacy and ensuring compliance with data protection requirements.

Practical Applications and Optimal Usage Strategies

UK first-time buyer mortgage calculators serve most effectively as initial assessment tools that enable prospective buyers to understand broad borrowing parameters and explore different financial scenarios before engaging with mortgage lenders or professional advisers. This preliminary assessment function helps users identify realistic property price ranges, understand the impact of different deposit levels, and evaluate various mortgage term options within their financial circumstances.

The scenario modelling capabilities of advanced calculators enable first-time buyers to explore the financial implications of different property prices, deposit amounts, and mortgage terms, facilitating informed decision-making about savings targets and property search parameters. This exploratory function proves particularly valuable for buyers who need to understand how different financial strategies might affect their borrowing capacity and monthly commitments.

Budget planning represents another valuable application, as calculators help first-time buyers understand the relationship between property prices, deposit requirements, and ongoing monthly costs. This understanding enables more effective financial planning and helps buyers align their property aspirations with their financial realities and long-term affordability considerations.

Preparation for mortgage applications benefits significantly from calculator usage, as these tools help first-time buyers understand the information requirements and financial documentation needed for formal mortgage applications. This preparation can streamline the application process and help buyers present their financial circumstances more effectively to potential lenders.

The educational value of mortgage calculators extends beyond specific calculations to include broader financial literacy development, helping first-time buyers understand mortgage terminology, interest rate impacts, and the relationship between different financial variables. This educational function supports more informed decision-making throughout the homebuying process.

Timing considerations for calculator usage involve understanding market conditions, interest rate environments, and personal financial circumstances that may affect the relevance and accuracy of calculator outputs. Regular reassessment using updated calculators helps maintain current understanding of borrowing capacity and market conditions as circumstances change.

Limitations and Potential Inaccuracies in Calculator Estimates

UK mortgage calculators face inherent limitations in accurately reflecting the complex and individualised nature of mortgage lending decisions, particularly for applicants with non-standard financial circumstances or unique property requirements. These limitations stem from the necessarily simplified algorithms used in calculator design and the standardised assumptions that may not align with individual lender criteria or specific borrower circumstances.

Income assessment limitations represent significant accuracy challenges, particularly for self-employed borrowers, contractors, or those with variable income sources that require specialist evaluation methods. Standard calculators typically assume employed income with regular payslips, potentially overestimating borrowing capacity for applicants whose income requires more complex assessment procedures or additional verification requirements.

Credit history impacts on lending decisions often exceed the scope of basic calculator assessments, as these tools typically cannot access individual credit reports or reflect the nuanced approaches different lenders take to credit scoring and risk assessment. Borrowers with adverse credit history may find calculator estimates significantly overstate their actual borrowing capacity or fail to reflect the limited product options available to them.

Property-specific factors including location, type, construction, and condition can substantially affect lending decisions in ways that generic calculators cannot adequately assess. Specialist properties, new builds, or properties in specific locations may require different lending criteria or attract different interest rates that standard calculators fail to incorporate into their estimates.

Market timing and economic conditions create dynamic variables that calculator algorithms may not adequately reflect, particularly during periods of rapid change in interest rates, lending criteria, or regulatory requirements. The static nature of many calculator databases means they may not incorporate recent market developments that significantly affect lending conditions and borrowing capacity.

Lender-specific policies and product features create substantial variations in actual lending offers that no single calculator can adequately represent. Different lenders may have significantly different approaches to income multiples, deposit requirements, and risk assessment that result in substantial variations from generic calculator estimates, making individual lender consultation essential for accurate assessments.

Integration with Professional Mortgage Advice Services

The optimal utilisation of UK mortgage calculators involves their integration with professional mortgage advice rather than reliance on calculator outputs as standalone decision-making tools. Professional mortgage advisers can interpret calculator results within the context of current market conditions, individual circumstances, and specific lender requirements to provide more accurate and personalised assessments of borrowing capacity and mortgage options.

Mortgage brokers bring comprehensive market knowledge that enables them to identify lenders whose criteria align most closely with individual borrower profiles, potentially accessing more favourable terms or higher borrowing amounts than suggested by generic calculator estimates. This market expertise proves particularly valuable for first-time buyers with complex financial circumstances or specific property requirements that require specialist lending solutions.

The timing of professional advice engagement affects its effectiveness, with early consultation enabling more strategic financial planning and preparation for mortgage applications. Professional advisers can help first-time buyers understand how to optimise their financial profiles, improve their borrowing capacity, and navigate the application process more effectively than calculator-based planning alone.

Regulatory compliance and consumer protection benefits result from professional advice engagement, as qualified mortgage advisers operate under Financial Conduct Authority regulations that require them to provide suitable recommendations based on comprehensive assessment of individual circumstances. This regulatory framework provides additional protection and accountability that calculator-based planning cannot offer.

Cost-benefit analysis of professional advice versus calculator-only approaches typically favours professional engagement for most first-time buyers, as the potential benefits in terms of better mortgage terms, higher borrowing capacity, and reduced application risks often exceed the costs of professional advice fees. The complexity of the UK mortgage market and the significance of mortgage decisions for long-term financial wellbeing support the value of professional guidance.

Ongoing support throughout the mortgage application and property purchase process represents an additional benefit of professional advice that extends well beyond the initial assessment capabilities of mortgage calculators. Professional advisers can provide guidance through application procedures, property surveys, legal processes, and completion arrangements that ensure successful property acquisition.

Technology Evolution and Future Calculator Development

The evolution of UK mortgage calculator technology continues to enhance accuracy and functionality through integration of artificial intelligence, machine learning algorithms, and real-time data feeds that enable more sophisticated and current assessments of borrowing capacity and market conditions. These technological advances promise to address some current limitations whilst introducing new capabilities for personalised financial planning and market analysis.

Open banking integration enables more accurate income and expenditure assessment by accessing real-time bank account data with user consent, potentially providing more precise affordability calculations than traditional calculator approaches based on estimated or declared financial information. This technology development could significantly enhance calculator accuracy whilst maintaining user privacy and data security.

Machine learning applications in calculator development enable continuous improvement in accuracy through analysis of actual lending decisions and market outcomes, allowing algorithms to adapt to changing market conditions and lender behaviours more effectively than static calculation methods. These adaptive capabilities promise to enhance the relevance and accuracy of calculator outputs over time.

Integration with property market data and valuation services enables calculators to provide more location-specific and property-type-specific assessments that reflect local market conditions and property characteristics more accurately than generic national estimates. This integration enhances the practical utility of calculators for specific property search and purchase planning.

Regulatory technology developments may enable calculators to incorporate more sophisticated compliance checking and regulatory requirement assessment, helping users understand not only borrowing capacity but also regulatory compliance requirements and consumer protection provisions that affect their mortgage applications and ongoing obligations.

The future development of calculator technology may include enhanced scenario modelling capabilities, stress testing functionality, and long-term financial planning integration that enables more comprehensive assessment of mortgage decisions within broader financial planning contexts. These developments could enhance the strategic value of calculator tools for long-term financial planning and decision-making.

Comparative Analysis with Professional Assessment Methods

Professional mortgage assessment methods employed by qualified advisers and lenders typically involve more comprehensive evaluation procedures than those possible through automated calculator algorithms, including detailed income verification, credit analysis, and individual circumstance consideration that provides more accurate and reliable borrowing capacity assessments.

The depth of financial analysis conducted by professional assessors extends beyond basic income multiples to include detailed expenditure analysis, lifestyle considerations, and future financial planning that enables more realistic affordability assessments. This comprehensive approach often reveals factors that calculator algorithms cannot adequately assess or incorporate into their estimates.

Lender relationship management and market knowledge enable professional advisers to access specialist products, negotiate terms, and identify opportunities that generic calculators cannot reflect in their standard outputs. This market access can result in significantly better outcomes than those suggested by calculator-based planning alone.

Risk assessment capabilities of professional advisers include evaluation of market timing, interest rate risk, and long-term affordability considerations that extend beyond the immediate borrowing capacity calculations provided by standard mortgage calculators. This broader risk perspective supports more informed decision-making about mortgage timing and structure.

Quality assurance and regulatory oversight of professional advice services provide additional reliability and accountability that automated calculator systems cannot offer, ensuring that recommendations meet regulatory standards and professional competency requirements. This oversight provides consumer protection and recourse that calculator-based planning cannot provide.

The cost-effectiveness comparison between professional advice and calculator-only approaches typically favours professional engagement when considering the potential financial benefits, risk mitigation, and successful outcome probability that professional guidance provides compared to the limitations and potential inaccuracies of calculator-based planning alone.

Strategic Recommendations for First-Time Buyers

UK first-time buyers should utilise mortgage calculators as valuable preliminary assessment tools whilst recognising their limitations and the necessity of professional advice for accurate financial planning and successful property acquisition. This balanced approach maximises the benefits of calculator technology whilst ensuring access to comprehensive market knowledge and professional expertise.

Early engagement with both calculator tools and professional advisers enables more effective financial planning and preparation for property purchase, allowing first-time buyers to understand their options, optimise their financial profiles, and develop realistic timelines for property acquisition. This proactive approach supports better outcomes and reduces the risk of disappointment or financial difficulty.

Regular reassessment using updated calculators and professional advice helps maintain current understanding of borrowing capacity and market conditions as personal circumstances and market conditions change. This ongoing monitoring enables more responsive planning and better timing of property purchase decisions.

Documentation and preparation strategies should include gathering comprehensive financial information, understanding credit profiles, and preparing for professional advice consultations to maximise the effectiveness of both calculator assessments and professional guidance. This preparation supports more accurate assessments and more effective advice provision.

Risk management considerations should include understanding market volatility, interest rate risk, and affordability stress testing to ensure that mortgage commitments remain sustainable under various economic scenarios. Professional advice proves particularly valuable for understanding and managing these risks effectively.

Long-term financial planning integration should consider mortgage decisions within broader financial objectives including retirement planning, family planning, and career development to ensure that property purchase decisions support overall financial wellbeing and life goals. Professional financial planning advice can provide valuable guidance for this comprehensive approach.

Professional mortgage and legal advice is recommended when considering mortgage applications and property purchases. Your property may be repossessed if you do not keep up repayments on your mortgage. This information is for general guidance only and should not be considered as personalised financial or legal advice.