Your Complete Guide to UK Mortgage Types and How They Work

Navigating the UK mortgage market can feel like deciphering a complex puzzle, especially for first-time buyers stepping onto the property ladder. If you’ve found yourself confused about the various mortgage options available and which might be best for securing your dream home, you’re certainly not alone.

This scenario is remarkably common, and we encounter it regularly in our practice. Interestingly, recent data suggests that over half of first-time buyers in certain regions choose their mortgage based primarily on attractive interest rates, without fully understanding the implications and features of different mortgage products.

Our comprehensive research and extensive experience in the UK market have helped us clarify these complexities for countless clients across the country.

Throughout this article, we’ll explore the distinguishing features of various UK mortgage types, discussing definitions, the range of products available, eligibility criteria, and crucial differences such as interest rates and repayment terms. We’ll also examine how recent changes in Bank of England base rates and FCA regulations affect your mortgage choices.

Our objective is to provide you with sufficient knowledge to feel confident making an informed decision about which mortgage product best suits your circumstances. Are you ready to demystify the UK mortgage landscape together? Let’s begin this exploration.

What is a Mortgage?

Moving from our introduction, let’s explore mortgages in detail—a fundamental concept for first-time buyers, homeowners, and property professionals throughout the UK. A mortgage is a secured loan where you borrow money to purchase or maintain a property, with the property itself serving as security for the loan.

The borrower agrees to repay the borrowed amount plus interest over an agreed period, typically ranging from 15 to 35 years. This arrangement means that if you fail to maintain your mortgage payments, the lender has the legal right to repossess your property to recover their funds—a process governed by strict FCA regulations and court procedures.

UK mortgages come in various forms, including fixed-rate mortgages where your interest rate remains constant throughout a specified period, and variable-rate mortgages that fluctuate based on the Bank of England base rate and lender’s standard variable rate (SVR). Understanding these distinctions is crucial for making informed decisions about your property finance.

As the saying goes, “A home without a mortgage is like a castle with its drawbridge permanently raised—secure, but requiring significant upfront investment.”

Definition and Purpose of UK Mortgages

A mortgage is specifically designed to help individuals purchase property or land within the UK housing market. We provide mortgage advice to clients who wish to buy their own homes but cannot afford to pay the full purchase price upfront. Instead, they borrow money from a regulated lender and agree to repay it over time, typically with interest calculated on the outstanding balance.

The purpose of a UK mortgage extends beyond simply enabling property purchase; it facilitates investment in real estate without requiring the full amount immediately. This system has been fundamental to UK homeownership for decades, enabling millions to access the property ladder despite rising house prices.

Lenders take the property as security for the loan, creating what’s legally known as a “charge” over the property. This means if mortgage payments cease, the lender can initiate repossession proceedings through the courts to recover their money. UK mortgages are heavily regulated by the Financial Conduct Authority (FCA), ensuring fair treatment of borrowers and proper affordability assessments.

The mortgage system is essential for most UK homeowners, as it makes property ownership accessible and affordable over time rather than requiring substantial cash sums upfront. Different mortgage products cater to various circumstances, from first-time buyer schemes to buy-to-let investments, each with specific terms and regulatory requirements.

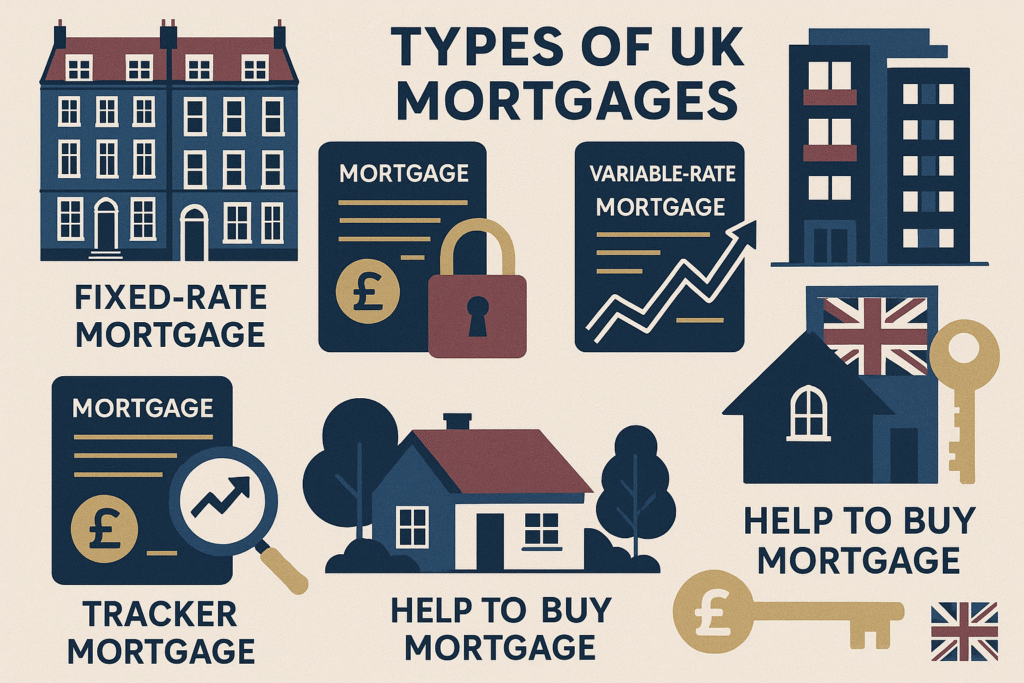

Types of Mortgages Available

We understand that the current mortgage landscape can be challenging for first-time buyers and existing homeowners alike. Examining the various mortgage types available helps you understand which option might best match your circumstances and financial goals.

Fixed-Rate Mortgages: This popular mortgage type locks your interest rate for a specific period, typically two, three, five, or even ten years. Whether you choose a shorter or longer fixed period, your monthly payments remain consistent during the fixed term, which assists with budgeting and financial planning. After the fixed period ends, you’ll typically move to the lender’s standard variable rate unless you remortgage.

Variable-Rate Mortgages: These mortgages see interest rates fluctuate based on the Bank of England base rate and the lender’s standard variable rate. Initially, you might pay lower rates than a fixed-rate mortgage, but payments can increase or decrease over time depending on economic conditions and monetary policy decisions.

Tracker Mortgages: These follow the Bank of England base rate directly, typically at a set margin above it (for example, base rate plus 1%). When the base rate changes, your mortgage rate changes immediately, providing transparency but less predictability than fixed rates.

Discount Mortgages: These offer a discount off the lender’s standard variable rate for a specified period. For instance, you might receive a 2% discount off the SVR for two years. Your rate will still fluctuate with the SVR, but you’ll always pay the discounted amount during the offer period.

Offset Mortgages: These link your mortgage to your savings account. Instead of earning interest on your savings, the balance reduces the mortgage amount on which you pay interest. This can be particularly tax-efficient for higher-rate taxpayers and provides flexibility to access your savings when needed.

Interest-Only Mortgages: For the mortgage term, you only pay the interest charges, not the capital amount borrowed. You’ll need a credible repayment strategy to pay off the capital at the end of the term. These are less common for residential purchases but still available for buy-to-let properties and certain circumstances.

Help to Buy Mortgages: Government-backed schemes designed to assist first-time buyers and those moving home. These include the Help to Buy equity loan scheme and shared ownership, both aimed at making homeownership more accessible with smaller deposits.

Shared Ownership Mortgages: These allow you to purchase a share of a property (typically 25% to 75%) and pay rent on the remaining portion. You can increase your share over time through a process called “staircasing,” eventually owning the property outright.

Buy-to-Let Mortgages: Specifically designed for property investment, these mortgages are assessed differently from residential mortgages. Lenders evaluate your eligibility based on the property’s rental income potential rather than solely your personal income. These mortgages typically require larger deposits and carry higher interest rates.

Right to Buy Mortgages: Available to council tenants purchasing their homes under the Right to Buy scheme, these mortgages consider the discount received and often have specific terms related to the government scheme.

Each mortgage type comes with distinct features regarding interest rates, repayment terms, and eligibility requirements. Understanding these variations helps you make an informed decision when selecting a mortgage that aligns with your financial circumstances and property aspirations.

How Do UK Mortgages Work?

A mortgage enables you to borrow money from a bank, building society, or specialist lender to purchase a home. In this arrangement, the property you’re buying becomes security for the loan. This means if you fail to maintain your mortgage payments, the lender has the legal right to repossess your home through court proceedings—a process strictly regulated by the FCA and requiring proper procedures to be followed.

To begin, you’ll need to undergo an affordability assessment where the lender evaluates your income, expenditure, and financial commitments. This process became more stringent following the Mortgage Market Review (MMR) in 2014, ensuring lenders only provide mortgages to borrowers who can afford them throughout the term.

You’ll agree on a loan amount with your lender and decide on repayment terms, typically ranging from 15 to 35 years, though some lenders now offer terms up to 40 years. Each month, you’ll repay part of the borrowed amount (capital) plus interest. The exact split between capital and interest changes over time—initially, you’ll pay more interest, but as the outstanding balance reduces, more of your payment goes towards the capital.

Over time, as you repay the mortgage, your equity in the property increases. Equity represents the portion of the property you own outright—the difference between the property’s current value and your outstanding mortgage balance. This equity can be valuable for future remortgaging or accessing additional funds through further borrowing.

Obtaining a mortgage requires meeting specific criteria set by the FCA and individual lenders. These include having a steady income, demonstrating affordability, and maintaining a good credit history. Lenders conduct thorough affordability assessments, examining your income, regular expenditure, and potential future changes to ensure you can maintain payments even if interest rates rise.

Interest rates can be fixed for a specific period or variable, changing with the Bank of England base rate or the lender’s standard variable rate. Choosing between these options depends on your risk tolerance, financial situation, and market outlook. Many borrowers opt for an initial fixed-rate period to provide payment certainty, then remortgage when the fixed term ends.

The mortgage application process typically involves providing extensive documentation, including payslips, bank statements, proof of deposit, and details of the property you’re purchasing. A qualified surveyor will value the property to ensure it provides adequate security for the loan amount.

Now, let’s examine the key differences between various mortgage products and how they might suit different circumstances.

Comparing UK Mortgage Products: Key Features and Differences

Understanding the distinctions between various mortgage products is crucial for making informed decisions about your property finance. Rather than viewing mortgages as fundamentally different products, it’s more helpful to understand them as variations of the same basic concept, each tailored to specific circumstances and needs.

The primary differences lie in how interest is calculated and charged, the flexibility of repayment terms, and the specific features designed to meet different borrower requirements. These variations can significantly impact your monthly payments, the total cost of borrowing, and your overall financial strategy.

Interest Rate Structures: Fixed vs Variable Options

The choice between fixed and variable interest rates represents one of the most significant decisions you’ll make when selecting a mortgage. This choice affects not only your monthly payments but also your long-term financial planning and exposure to interest rate risk.

Fixed-Rate Mortgages provide certainty and predictability. When you choose a fixed rate, you know exactly what your monthly payments will be for the fixed period, regardless of what happens to the Bank of England base rate or broader economic conditions. This stability makes budgeting easier and protects you from rising interest rates. However, you won’t benefit if rates fall during your fixed period.

Variable-Rate Mortgages offer different advantages and risks. Your payments will fluctuate with interest rate changes, which means you could benefit from falling rates but face higher payments if rates rise. Variable rates often start lower than fixed rates, making them attractive to borrowers who believe rates will remain stable or fall.

Tracker Mortgages provide transparency by following the Bank of England base rate directly. You’ll know exactly how your rate will change when the base rate moves, making it easier to predict payment changes. However, you’re fully exposed to base rate movements throughout the tracking period.

Repayment Methods: Capital and Interest vs Interest-Only

The way you repay your mortgage significantly affects both your monthly payments and the total cost of borrowing over the mortgage term.

Capital and Interest Mortgages (also called repayment mortgages) are the most common type. Each monthly payment includes both interest on the outstanding balance and a portion of the capital borrowed. Over time, the interest portion decreases while the capital portion increases, ensuring the mortgage is fully repaid by the end of the term.

Interest-Only Mortgages require you to pay only the interest charges each month, with the full capital amount due at the end of the term. While this results in lower monthly payments, you must have a credible strategy to repay the capital, such as investments, savings, or the sale of the property. These mortgages are less common for residential purchases due to stricter regulatory requirements.

Eligibility Criteria for UK Mortgages

Securing a mortgage involves meeting various criteria set by lenders and regulatory requirements established by the FCA. Understanding these requirements helps you prepare your application and improve your chances of approval.

Income Assessment: Lenders typically require evidence of stable income, usually through employment or self-employment. Employed borrowers need recent payslips and P60s, while self-employed applicants must provide accounts or tax returns, typically covering two to three years. Some lenders accept other income sources, including benefits, pensions, and rental income.

Affordability Testing: Since the Mortgage Market Review in 2014, lenders must conduct thorough affordability assessments. They examine your income, regular expenditure, existing commitments, and potential future changes. Lenders also stress-test your ability to afford payments if interest rates rise, typically adding 2-3% to the current rate.

Credit History: Your credit score and history significantly influence mortgage approval and the rates offered. Lenders examine your credit report for evidence of responsible borrowing, looking for consistent payment history and manageable debt levels. Previous defaults, CCJs, or bankruptcy can affect your options, though specialist lenders cater to those with impaired credit.

Deposit Requirements: Most mortgages require a deposit, typically ranging from 5% to 25% of the property value. Larger deposits generally secure better interest rates and more product choices. First-time buyer schemes may accept smaller deposits, while buy-to-let mortgages typically require at least 25%.

Employment Status: Lenders prefer borrowers with stable employment, though they accommodate various employment types. Permanent employees often find the process straightforward, while contractors, freelancers, and those in probationary periods may face additional scrutiny or need specialist lenders.

Age Considerations: Lenders consider your age at application and when the mortgage term ends. Most require the mortgage to be repaid by retirement age, though some offer mortgages into later life or accept pension income for affordability calculations.

Choosing the Right Mortgage for Your Circumstances

Selecting the appropriate mortgage involves careful consideration of your current financial situation, future plans, and risk tolerance. Every borrower’s circumstances differ, which affects the most suitable mortgage type and features for their needs.

When planning to purchase a property, understanding your borrowing capacity is crucial. This involves considering the property value, your available deposit, and how much you can comfortably afford to repay monthly. The relationship between these factors determines your loan-to-value (LTV) ratio, which significantly influences the interest rates and products available to you.

Assessing your Mortgage eligibility early helps you understand which products you qualify for and ensures you make informed decisions about borrowing.

Assessing Your Borrowing Requirements

Determining the appropriate borrowing amount requires careful analysis of your financial position and property aspirations. This process involves more than simply calculating the maximum amount lenders might offer—it requires honest assessment of what you can comfortably afford without compromising your financial security.

Begin by evaluating your current financial health, including income stability, existing commitments, and regular expenditure. Consider potential future changes such as career progression, family planning, or lifestyle adjustments that might affect your ability to maintain mortgage payments. This forward-thinking approach helps ensure your mortgage remains affordable throughout its term.

Property prices vary significantly across different regions, and your choice of location will substantially impact your borrowing requirements. Consider not only the purchase price but also associated costs such as stamp duty, legal fees, survey costs, and moving expenses. These additional costs can add thousands to your total expenditure and should be factored into your financial planning.

The size of your deposit directly affects your borrowing options and costs. Larger deposits typically secure better interest rates and access to more competitive products. If you’re struggling to save a substantial deposit, consider government schemes like Help to Buy or shared ownership, which can help you access the property ladder with smaller initial investments.

Understanding Security and Risk Factors

When you take out a mortgage, your property serves as security for the loan. This arrangement provides lenders with confidence to offer substantial sums at relatively low interest rates, but it also means your home is at risk if you cannot maintain payments.

Understanding this risk is essential for responsible borrowing. Lenders have the legal right to repossess your property if you fall significantly behind with payments, though they must follow strict procedures and demonstrate they’ve tried to help you resolve payment difficulties. The FCA requires lenders to treat customers fairly and consider alternatives to repossession wherever possible.

Consider how changes in your circumstances might affect your ability to maintain payments. Job loss, illness, reduced income, or significant interest rate rises could all impact affordability. Many borrowers take out mortgage payment protection insurance to provide some security against these risks, though such policies have limitations and exclusions.

The loan-to-value ratio affects both your borrowing costs and the equity you hold in your property. Higher LTV mortgages (those with smaller deposits) typically carry higher interest rates and may require mortgage indemnity insurance. As you repay your mortgage and property values change, your LTV ratio will alter, potentially opening opportunities to remortgage to better deals.

Key Factors Influencing Your Mortgage Decision

Several critical factors should influence your mortgage choice, each carrying different weight depending on your personal circumstances and priorities.

Credit Score and History: Your credit rating significantly affects the mortgage products available and the interest rates offered. A strong credit history opens access to the most competitive deals, while previous credit problems may limit your options or require specialist lenders. Before applying for a mortgage, check your credit report and address any errors or issues that might affect your application.

Income Stability and Growth Prospects: Lenders assess not only your current income but also its stability and future prospects. Permanent employment with a stable employer generally provides the strongest foundation for mortgage applications. However, lenders increasingly accommodate different employment types, including contractors and self-employed borrowers, though they may require additional documentation or impose different criteria.

Existing Financial Commitments: Your current debts and financial obligations affect how much additional borrowing lenders consider affordable. This includes credit cards, personal loans, car finance, and other regular commitments. Reducing existing debts before applying for a mortgage can improve your borrowing capacity and access to better rates.

Future Financial Plans: Consider how your mortgage fits into your broader financial strategy. If you plan to move again within a few years, a portable mortgage or one without early repayment charges might be beneficial. If you expect your income to increase significantly, you might prefer a mortgage that allows overpayments or has flexible features.

Risk Tolerance: Your comfort with payment uncertainty affects whether fixed or variable rates suit you better. Risk-averse borrowers often prefer the certainty of fixed rates, while those comfortable with some uncertainty might choose variable rates to potentially benefit from rate reductions.

Property Type and Location: Different property types and locations can affect mortgage availability and terms. New-build properties, flats above commercial premises, or properties in certain locations might have limited lender options or require specialist products.

Frequently Asked Questions About UK Mortgages

Many prospective borrowers have similar questions about the mortgage process and different product features. Understanding these common queries can help clarify important aspects of mortgage borrowing and decision-making.

What’s the Difference Between Remortgaging and Moving Home?

Remortgaging involves switching your existing mortgage to a new deal, either with your current lender or a different one, while staying in the same property. This process allows you to access better interest rates, release equity, or change your mortgage terms without moving home. Many borrowers remortgage when their initial fixed-rate period ends to avoid moving to their lender’s standard variable rate.

Moving home with a mortgage involves either porting your existing mortgage to a new property or arranging a completely new mortgage. Some mortgages are portable, allowing you to transfer them to a new property, though you’ll need to meet the lender’s criteria for the new property and may need additional borrowing if moving to a more expensive home.

How Can You Manage Your Mortgage Efficiently?

Effective mortgage management involves several strategies that can save money and provide greater financial flexibility throughout your mortgage term.

Consider Overpayments: Most mortgages allow you to make overpayments up to a certain limit (typically 10% of the outstanding balance annually) without penalties. Overpayments reduce the capital balance, saving interest and potentially shortening your mortgage term. Even small regular overpayments can make a significant difference over time.

Review Your Deal Regularly: Mortgage rates and products change frequently, and what was competitive when you first borrowed might no longer be the best available. Review your mortgage annually and consider remortgaging if better deals are available, particularly when your current fixed-rate period is ending.

Maintain a Good Credit Score: Your credit rating affects your ability to remortgage to better deals. Maintain good financial habits, pay bills on time, and monitor your credit report for accuracy. A strong credit score opens access to the most competitive mortgage products.

Plan for Rate Changes: If you have a variable-rate mortgage, budget for potential payment increases. Consider whether you could afford payments if rates rose significantly, and have contingency plans if your financial circumstances change.

Use Offset Facilities Wisely: If you have an offset mortgage, maximise the benefit by keeping substantial savings in the linked account. This reduces the mortgage balance on which you pay interest, providing tax-efficient returns for higher-rate taxpayers.

Consider Professional Advice: Mortgage markets are complex, and professional advice can help you navigate the options and find the most suitable products. Mortgage brokers have access to the whole market and can often secure deals not available directly to consumers.

What Happens If You Can’t Keep Up With Payments?

If you’re struggling with mortgage payments, it’s crucial to contact your lender immediately. Under FCA regulations, lenders must treat customers in financial difficulty fairly and consider various options before pursuing repossession.

Lenders may offer temporary payment holidays, reduced payments, extending the mortgage term, or switching to interest-only payments temporarily. They’re required to work with you to find sustainable solutions and will only consider repossession as a last resort after other options have been exhausted.

Early communication is essential—lenders are more likely to help if you contact them before missing payments rather than after falling into arrears. Free debt advice is available from organisations like Citizens Advice and StepChange, which can help you understand your options and communicate with your lender.

How Do Government Schemes Help First-Time Buyers?

Several government initiatives aim to help first-time buyers access homeownership despite rising property prices and deposit requirements.

Help to Buy Equity Loans provide government loans of up to 20% (40% in London) of the property value for new-build homes, requiring only a 5% deposit and 75% mortgage. The equity loan is interest-free for the first five years, making homeownership more accessible for those with limited deposits.

Shared Ownership allows you to purchase a share of a property (typically 25-75%) and pay rent on the remaining portion. You can increase your share over time through staircasing, eventually owning the property outright. This scheme helps those who can afford mortgage payments but struggle to save large deposits.

First Homes Scheme offers discounts of at least 30% on new-build homes for first-time buyers, key workers, and existing shared ownership customers in certain areas. The discount is retained for future sales, helping maintain affordability for subsequent first-time buyers.

Conclusion: Making Informed Mortgage Decisions

Understanding the UK mortgage landscape empowers you to make informed decisions about one of the most significant financial commitments you’ll ever make. The variety of mortgage products available reflects the diverse needs of borrowers, from first-time buyers taking their initial steps onto the property ladder to experienced investors building property portfolios.

The key to successful mortgage selection lies in honest assessment of your financial circumstances, clear understanding of your priorities, and careful consideration of how different mortgage features align with your needs. Whether you prioritise payment certainty through fixed rates, flexibility through variable products, or accessibility through government schemes, there are options designed to meet your requirements.

Remember that mortgage markets are dynamic, with rates and products changing regularly. What’s most suitable today might not remain optimal throughout your mortgage term, making periodic reviews and potential remortgaging important considerations for ongoing mortgage management.

Professional mortgage brokers provide trusted advice with nationwide reach, helping clients secure the right mortgage for their needs. Whether you’re remortgaging, buying your first home, moving house, or investing in property, expert advisers offer personalised service tailored to your goals. With a commitment to making the mortgage process smooth and stress-free, professional guidance supports you every step of the way.