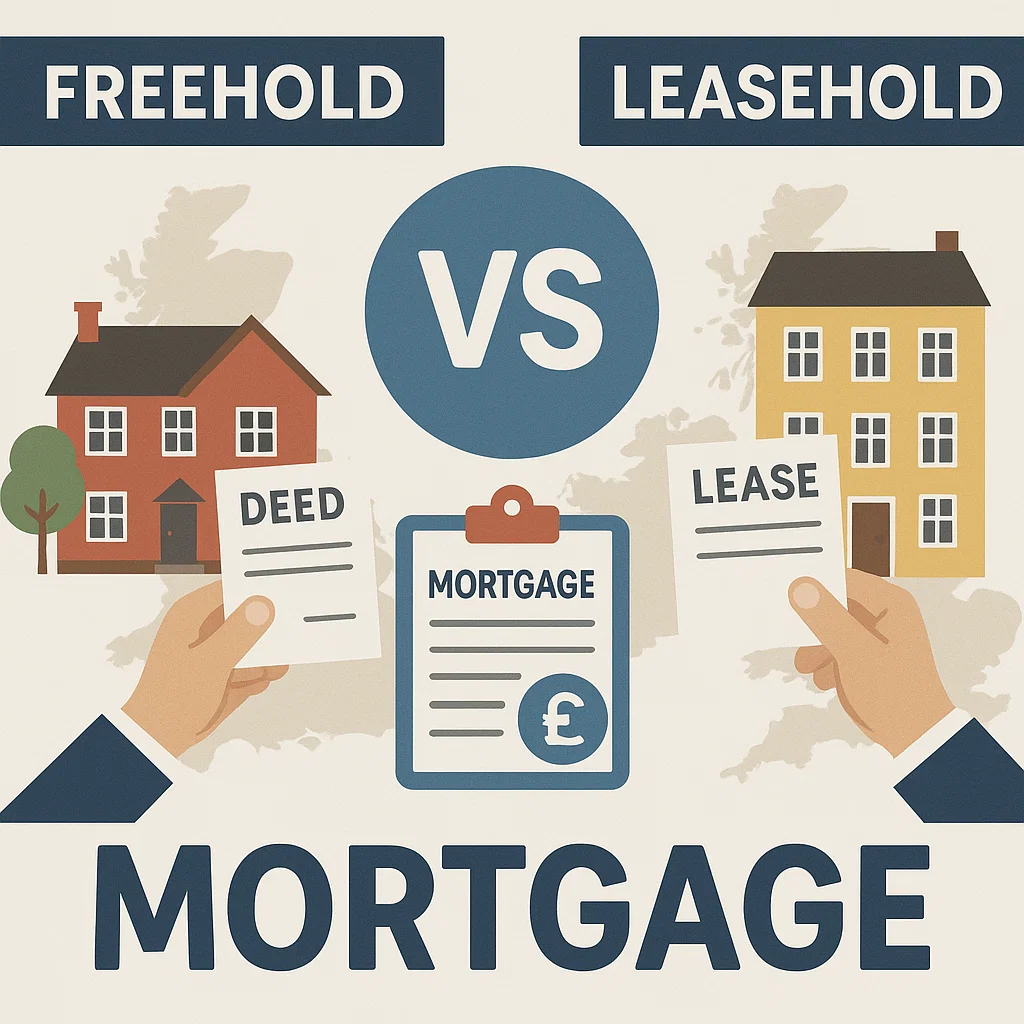

Many UK buyers wonder what sets a freehold property apart from a leasehold one—especially when thinking about getting a mortgage. Both ownership types come with unique rights and responsibilities, which can impact borrowing options and long-term costs. Understanding the difference between freehold and leasehold UK homes helps you make confident decisions, whether you’re buying your first home or searching for a better mortgage deal.

It’s reassuring to know that mortgages vary depending on the property’s legal status. A freehold vs leasehold mortgage isn’t just about interest rates; it also involves considerations like ground rent, service charges, and lease length requirements. By exploring each aspect of these ownership types, you’ll gain clarity on how to plan your budget effectively and safeguard your property interest. That’s where Mortgages RM’s specialist guidance becomes invaluable, ensuring a smooth and hassle-free journey.

Understanding Freehold vs Leasehold Ownership

Owning a freehold property means you have complete ownership of both the building and the land. Leasehold ownership, by contrast, grants you the right to occupy a property for a set number of years, while the freeholder retains ownership of the land. UK buyers often compare leasehold vs freehold ownership because each arrangement carries separate fees, obligations, and limitations that can affect mortgage eligibility.

Freehold Mortgages – Key Considerations

Many borrowers ask, “Can you get a mortgage on a freehold house?” The answer typically is yes, because lenders see freehold properties as more straightforward investments. Freehold mortgages often do not include ground rent or service charges, reducing long-term costs. Mortgages RM helps assess property value, deposit requirements, and suitable lenders so you can select a deal that aligns with your budget.

Leasehold Mortgages – Key Considerations

If you’re wondering, “Can I get a mortgage on a leasehold property?” lenders often look for a minimum remaining lease term. The shorter the lease, the more complicated securing finance can become. Leasehold property mortgage eligibility also depends on affordability checks, ground rent costs, and service charges. Mortgages RM can guide you through these details, ensuring you approach the right lenders who understand the complexities of leasehold properties.

Comparing Fees, Responsibilities, and Potential Pitfalls

An important “difference between freehold and leasehold UK” concern is ongoing costs. Freeholders generally cover maintenance themselves. Meanwhile, leaseholders share repair fees or management charges through the freeholder. While freeholders tend to have more autonomy, they also shoulder complete responsibility for repairs. Leaseholders usually enjoy a cheaper purchase price but must comply with freeholder rules. Unanticipated charges and limited freedom around property changes can be stumbling blocks if you’re unprepared.

Switching from Leasehold to Freehold

Some homeowners ask, “Can I move my leasehold mortgage to freehold mortgage?” Buying the freehold of your house can simplify future financing and reduce extra costs like ground rent. Before you purchase the freehold, factors such as the number of remaining lease years, property valuation, and potential legal fees come into play. Mortgages RM can help you assess your current lease agreement, evaluate the cost of extending a leasehold property, or explore purchasing the freehold outright.

How Mortgages RM Can Help

With property rules and mortgage regulations in constant flux, our mission at Mortgages RM is to provide trusted support. We specialise in clarifying options for everything from first-time buyers to those uncertain about shifting from a leasehold to a freehold mortgage. Suppose you’re looking for help navigating complex lending criteria. In that case, we offer personalised guidance that factors in property type, financial circumstances, and your long-term goals—ensuring you land the deal that truly matches your needs.

Conclusion

Navigating the freehold vs leasehold mortgage landscape becomes simpler once you understand each ownership structure’s unique demands. Professional guidance can be the difference between confident decision-making and facing unexpected expenses or delays.

Mortgages RM offers a transparent, personal service designed to meet every borrower’s needs. We take the complexity out of your mortgage journey, whether you’re extending a leasehold property, buying a freehold house, or reviewing remortgage possibilities. If you’re applying for a mortgage with irregular income, our advisers can help you explore tailored options that take your financial situation into account. Book your free mortgage consultation today and secure the right deal for your home or investment goals. We’re here to help you find a solution that fits—every step of the way.