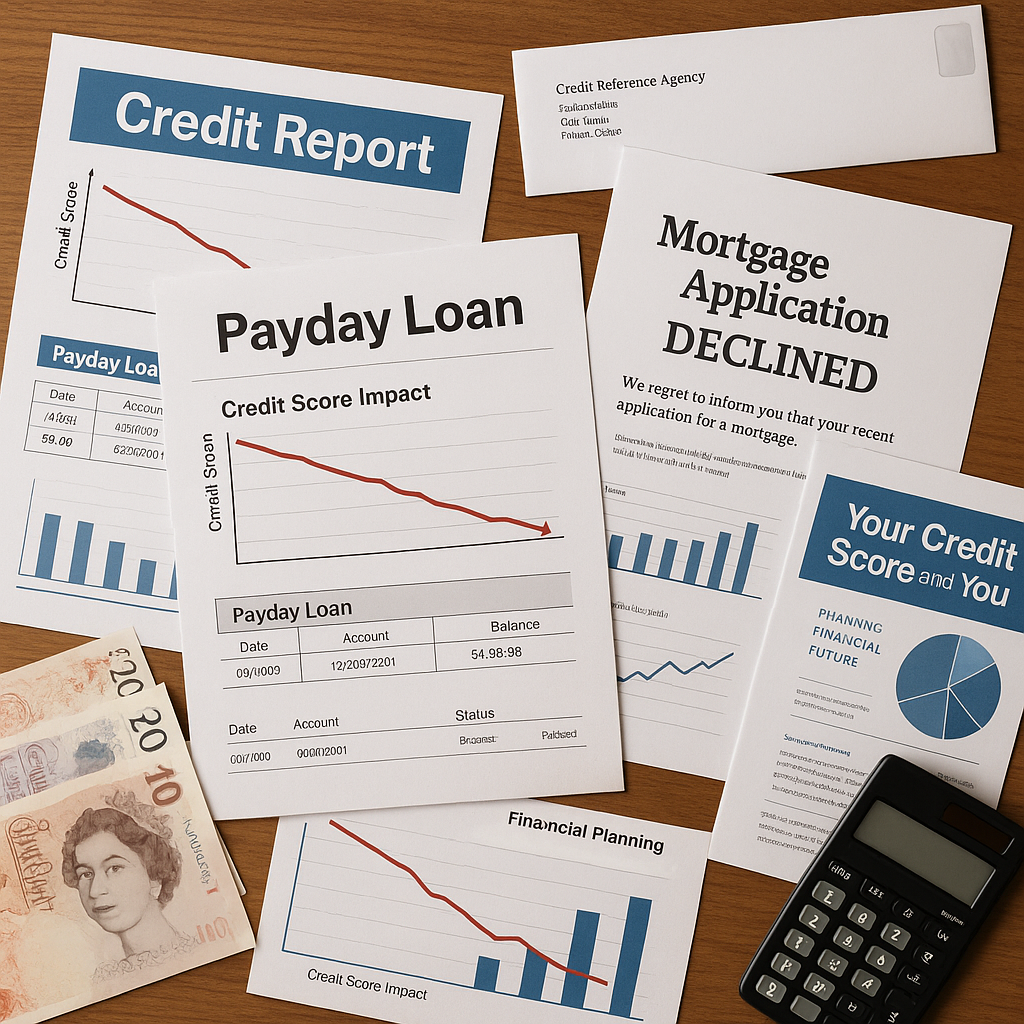

Exploring the intersection of payday loans and mortgage applications is a crucial area of financial scrutiny, raising questions about the implications for potential homeowners. When contemplating a home purchase, the presence of payday loans in one’s financial history can be perceived by lenders as an indicator of high-risk credit behaviour, which might lead to more stringent evaluation criteria or outright denial of a mortgage application. This perception stems from the typically high interest rates and the short-term nature of payday loans, suggesting a desperate need for immediate financial relief, which could undermine lenders’ trust in one’s ability to manage long-term debt obligations. As we delve into the nuanced relationship between these short-term financial solutions and the pursuit of a mortgage, it’s essential to consider how these past financial choices could shape one’s future housing opportunities.

What Impact Does a Payday Loan Have on a Mortgage Application?

When considering the implications of payday loans on mortgage applications, it is critical to evaluate their impact on one’s credit score. Potential homebuyers must understand whether obtaining a mortgage is feasible after taking out a payday loan.

Additionally, it is essential to explore how mortgage lenders perceive applicants’ use of payday loans.

How Does a Payday Loan Affect Your Credit Score

Taking out a payday loan can negatively impact your credit score, potentially complicating future mortgage applications. This type of borrowing is noted by credit reference agencies and recorded in your credit file as being older than the loan amount, potentially painting a picture of financial instability to lenders. The implications of obtaining a payday loan extend beyond a simple transaction; they can influence your financial reputation for years.

Applying for payday loans frequently can signal to creditors that you rely on short-term debt, suggesting financial distress. Each payday loan appears on your credit report, and multiple entries from payday lenders can be seen as negative marks by mortgage lenders. Payday loans can lead to detrimental records if payments are missed or loans are rolled over, directly affecting your credit rating. Lenders review your payday loan history, which can influence their decision on whether to offer a mortgage, as they may question your ability to manage long-term, larger loans.

Understanding these factors underscores the importance of managing your credit responsibly, especially if you intend to apply for significant financial products like mortgages in the future.

Is It Possible to Get a Mortgage After Using a Payday Loan

Obtaining a mortgage after taking out a payday loan is challenging, as lenders may view this as a sign of financial instability. When applying for a mortgage, a recent payday loan can be a significant red flag for mortgage lenders, indicating potential difficulties in managing finances. This perception could lead to stricter scrutiny of your mortgage application.

Lenders are wary of applicants with a history of using payday loans because this could suggest a pattern of financial distress and reliance on short-term debt solutions. However, securing a mortgage after using a payday loan is not impossible. Specialist lenders and adverse credit lenders may be more willing to consider your application, albeit often at higher interest rates and with additional requirements.

To enhance your chances of approval, it’s important to demonstrate improved financial behaviour, such as stable income and a solid record of recent financial transactions without further payday loans.

It’s advisable to wait a period after settling payday loan debts before applying for a mortgage to distance your financial history from any negative impacts.

How Do Mortgage Lenders View Payday Loans

Mortgage lenders typically view payday loans as indicators of financial volatility, which can adversely affect the assessment of a mortgage application. When processing a mortgage application, lenders scrutinise an applicant’s financial history to determine their creditworthiness and ability to maintain mortgage payments.

Payday loans, often associated with high interest rates and short repayment terms, may signal to lenders that the borrower has faced recent financial distress or manages finances poorly.

Mortgage lenders may have several key concerns when they see payday loans on a credit history. They may perceive an increased risk that the borrower may not meet future financial obligations. Frequent use of payday loans might suggest a history of struggling to manage debts or financial instability. Payday loans can lead to detrimental effects on one’s credit score, especially if payments are missed, which is important in mortgage approval. Such financial behaviour can categorise a borrower as high risk, potentially leading to higher mortgage rates or denial of the mortgage application.

Understanding these implications is important for anyone considering both payday loans and future homeownership.

Can You Get a Mortgage After Using Payday Loans?

Obtaining a mortgage after using payday loans presents distinct challenges, primarily due to the perception of high-risk behaviour it suggests to lenders. Engaging a specialist mortgage broker can be instrumental in navigating through this complex scenario and enhancing the possibility of approval.

Additionally, applicants can adopt specific strategies to bolster their chances, which include improving credit scores and stabilising financial profiles.

What Are the Challenges of Getting a Mortgage After Payday Loan

Securing a mortgage after using payday loans presents several challenges, primarily due to the impact these loans can have on your credit score. Lenders often perceive the use of payday loans as an indication of poor financial management, which can be a critical factor when evaluating mortgage applications. The history of relying on payday loans can suggest to lenders that an individual may face difficulties in meeting mortgage obligations.

High-street lenders may be particularly cautious and scrutinise applications more rigorously if there’s a history of payday loans. Those with a history of payday loans, especially with instances of payday loan default, might be offered mortgages with higher interest rates. Many mainstream lenders may reject applications outright due to previous payday loan usage, leading to a reliance on bad credit mortgages. The payday loan history can affect creditworthiness long after the debt has been settled.

Navigating mortgages after payday loans requires understanding these challenges and how they influence the terms and approval of a mortgage with a payday loan history.

How Can a Specialist Mortgage Broker Help

A specialist mortgage broker can be essential in guiding you through the complexities of obtaining a mortgage after using payday loans. Their expertise and understanding of the specific challenges associated with a payday loan mortgage make them invaluable.

A mortgage broker has access to a wide variety of mortgage options and lenders who might be more amenable to approving borrowers with a history of using payday loans.

Specialist mortgage brokers have a deep knowledge of the criteria used by various lenders to assess loan applications. They can identify the most suitable lender who can offer a mortgage after a payday loan incident, thereby increasing your chances of getting a mortgage.

Their experience allows them to negotiate terms that could mitigate the negative impact of your payday loan history.

Moreover, a specialist mortgage broker can provide tailored advice on how to present your financial situation in the best light. This includes advising on the specific documentation and financial records needed to demonstrate financial stability and responsibility.

Tips to Improve Your Mortgage Approval Chances

Improving your chances of mortgage approval after utilising payday loans involves several strategic steps to enhance your financial profile. Payday loans may have previously helped you manage financial difficulties, but they can also signal risk to mortgage lenders due to the high interest rates and fees associated with them — just as decisions around Overpay Mortgage vs Saving can influence long-term financial stability.

By focusing on rebuilding your credit and demonstrating financial stability, you can increase the likelihood of a successful mortgage application.

Working diligently to pay off outstanding debts and reduce your credit utilisation shows that you can manage credit responsibly, which is important for lenders evaluating your mortgage application. A larger deposit decreases the loan-to-value ratio, reducing the lender’s risk and potentially revealing better mortgage options. Consistent employment and steady income reassure lenders that you can handle mortgage repayments, even if you’ve had bad credit and a payday loan in the past. Steering clear of further payday loans and seeking less risky types of credit can demonstrate improved financial decision-making to mortgage lenders.

How Do Payday Loans Affect My Mortgage Application?

Understanding the influence of payday loans on your mortgage application is essential.

We will explore whether such loans impact your credit report, the ramifications of a payday loan history, and the duration for which payday loans remain visible on your credit file.

These factors are important in evaluating how lenders perceive your financial reliability and decision-making.

Do Payday Loans Affect My Credit Report

Payday loans frequently appear on credit reports and can influence your ability to secure a mortgage. When you apply for a mortgage, lenders scrutinise your credit history to assess your financial behaviour and reliability as a borrower. The presence of payday loans on credit reports can be particularly concerning for many mortgage lenders.

Payday loan usage may suggest financial distress, and frequent or multiple payday loans might lead to lower credit scores, which are important in the mortgage application process. Mainstream lenders often view payday loans as evidence that an individual struggles to manage finances, and this perception can categorise a borrower as a higher risk. Those with payday loans might face higher interest rates or less favourable loan terms, reflecting the increased risk perceived by lenders. Lenders often review bank statements for red flags like outstanding debts from payday loans, which can influence their decisions.

In essence, whilst payday loans can provide immediate financial relief, their presence on your credit report can have long-term implications for major financial undertakings, such as obtaining a mortgage.

What Are the Implications of Having a History of Payday Loans

Understanding the impact of payday loans on credit scores, it is important to explore how these loans specifically affect mortgage applications. When a history of payday loan use appears in a financial profile, it often sends specific signals to mortgage lenders. Payday lenders are typically viewed as a last resort due to their high interest rates and fees; consequently, mortgage lenders may perceive those who have used a payday loan as high-risk borrowers.

Getting a mortgage after payday loan use can be challenging. Mortgage lenders may question the applicant’s financial stability and ability to manage finances effectively. This perception might reduce the chances of securing a mortgage or affect the terms and mortgage deals offered. It may necessitate finding the right lender who is more accommodating of applicants with previous payday loan use.

Furthermore, payday loans affect mortgage applications by potentially increasing the scrutiny of financial history. Lenders will likely take a closer look at credit usage and repayment behaviour.

Hence, applicants need to demonstrate financial responsibility and stability post-payday loan use to improve their chances of securing favourable mortgage terms.

How Long Do Payday Loans Stay on My Credit File

Typically, payday loans remain visible on your credit file for six years, influencing lenders’ assessments of your mortgage application. This duration means that even if you had a payday loan five years ago, it could still potentially affect your mortgage application today.

Understanding this timeline is important for planning when to apply for a mortgage, especially if you have a history of payday loans and other borrowings.

A payday loan can influence your ability to secure a mortgage long after having taken one out. Mortgage lenders who are willing to overlook payday loans often require a clean financial period following the loan. It is possible to secure a mortgage with a history of payday loans, depending on the lender’s policies. Demonstrating improved financial behaviour since applying for a payday loan can help mitigate the negative effects.

Given these considerations, it’s evident that the presence of payday loans on your credit file can significantly influence your mortgage application. Still, strategic financial planning can enhance your chances of approval.

How Can You Increase Your Chances of Getting a Mortgage After Payday Loans?

Securing a mortgage after engaging with payday loans can be demanding, but taking deliberate steps to repair your credit history can greatly enhance your eligibility.

It is important to understand the best timing for mortgage applications post-payday loans to avoid potential rejections.

This section explores practical strategies to rehabilitate your financial standing and determine the most advantageous time to apply for a mortgage.

What Steps Can You Take to Repair Your Credit History

To increase your chances of securing a mortgage after using payday loans, it is essential to start by systematically repairing your credit history. Suppose you’ve previously had a payday loan. In that case, it’s important to demonstrate reliable financial behaviour to potential lenders who may be cautious about the risk of a default on your mortgage payments.

Rebuilding credit effectively can mitigate the negative effects that a settled loan or bad credit and a payday loan might have had on your mortgage application.

Regularly monitoring your credit report helps check for errors or inconsistencies that could impact your credit score negatively. Prioritising clearing existing debts, particularly payday loans, demonstrates financial responsibility so that you can keep up with mortgage repayments. This is especially important when considering a mortgage with debt, as lenders may assess your overall financial situation, including existing liabilities, before approving your mortgage application. Making sure that all your bills and existing loans are paid on time shows consistency and demonstrates financial reliability to lenders. Accumulating a higher deposit can influence most lenders, including other lenders who may otherwise be hesitant due to your past with payday loans.

How Long Should You Wait Before Applying for a Mortgage

After implementing credit repair strategies, it is advisable to wait at least a year before applying for a mortgage to enhance your likelihood of approval following payday loan issues. During this period, make sure there is no record of you having taken out any payday loans, as lenders scrutinise recent financial behaviour closely. Ideally, your credit report should not show any payday loan activity, and maintaining a clean financial slate during this period is vital.

An expert mortgage adviser can provide guidance on how long after a payday loan you should apply for a mortgage. Typically, lenders tend to be cautious with applicants who have recently used payday loans due to the risk associated with high-interest, short-term lending. By waiting a year, you demonstrate improved financial stability and responsibility, which can positively influence lenders.

Additionally, focus on building a strong credit history by managing revolving credit effectively and ensuring all other credit obligations, such as credit card payments and existing loans, are met promptly. This helps in building trust with potential lenders who may otherwise limit mortgages or offer less favourable terms due to past payday loan usage.

Prioritising regular, on-time mortgage payments, post-approval will further solidify your financial reliability.

Are There Mortgage Options Available for Applicants with Bad Credit?

Exploring mortgage options with bad credit can be challenging, yet viable options do exist.

It is essential to understand what a bad credit mortgage entails and how to identify lenders that provide these specialised loans.

Additionally, prospective borrowers should be aware of the typically higher interest rates associated with bad credit mortgages, which can greatly impact the overall cost of the loan.

What Is a Bad Credit Mortgage

A bad credit mortgage is a type of loan specifically designed for potential homebuyers who have low credit scores, offering them an opportunity to purchase a home despite their financial history.

For individuals who have previously taken out a payday loan or relied on payday loans, it may seem challenging to secure a mortgage. However, with the right guidance from a mortgage adviser and thorough preparation, it is possible to get a mortgage even with a payday loan in your financial past.

Showing a stable annual income and employment history can reassure lenders when obtaining a bad credit mortgage. Demonstrating improved financial responsibility since the time you took out the payday loan is crucial. Engaging a mortgage adviser who understands how to navigate bad credit applications can be invaluable. Having proof that you have settled any outstanding debts from payday loans and have managed your finances more responsibly is essential.

Applicants with payday loans should be aware that their options might be limited and interest rates may be higher. However, with adequate preparation and the right support, securing a mortgage lender is still achievable.

How Can You Find Lenders That Offer Bad Credit Mortgages

Finding lenders that offer bad credit mortgages requires understanding which financial institutions have programmes tailored for applicants with lower credit scores. Such lenders typically understand the intricacies of a borrower’s financial history, including instances where you’ve used a payday loan or faced situations necessitating emergency expenses. These lenders are often more flexible with their lending criteria, evaluating the overall financial behaviour of applicants rather than dismissing them solely due to payday loans.

To find these accommodating lenders, start by researching financial institutions that specifically advertise their openness to working with consumers with bad credit. These advertisements might mention their willingness to accept payday loans as part of the applicant’s credit history, particularly if the last payday loan is older. The age of the loan can demonstrate an attempt at improving financial stability, which can be favourable in the eyes of some lenders.

Furthermore, consulting with a mortgage broker who specialises in bad credit mortgages can be immensely beneficial. They usually have a thorough understanding of which lenders are more accepting of circumstances like payday loans. They can guide you through the application process, improving your chances of securing a mortgage despite having a credit history affected by such short-term loans.

What Interest Rates Can You Expect with a Bad Credit Mortgage

Applicants with bad credit can generally expect higher interest rates on mortgages compared to those with better credit histories. This is because many lenders perceive applicants with poor credit as higher risk, which is often reflected in the terms of the loan offered. Despite this challenge, there are mortgage options available for those with less-than-ideal credit scores.

Lenders use risk-based pricing models to determine interest rates, meaning the lower your credit score, the higher the risk, and consequently, the higher your interest rate will be. Subprime loans are specifically designed for borrowers with low credit scores, but they often come with notably higher interest rates. Applicants with bad credit might be more likely to qualify for variable-rate mortgages, which typically have lower initial rates that can increase over time. Government-backed schemes can offer more competitive rates even for those with bad credit, though they may require mortgage insurance, which could increase overall costs.

Understanding these factors can help applicants with bad credit to navigate their mortgage options more effectively and prepare for the financial implications of higher interest rates.

Conclusion

To sum up, the presence of payday loans in financial histories can negatively impact mortgage applications. This indicates financial instability to lenders and potentially results in unfavourable loan conditions.

Applicants who have used payday loans are encouraged to showcase financial responsibility and stability. They should settle outstanding debts and seek advice from experts in bad credit mortgages.

Exploring specialised mortgage options tailored for individuals with compromised credit histories may improve the chances of obtaining a mortgage approval under more favourable terms.