Mortgage details can be confusing when you first examine them within the UK market. One lender might offer a seemingly low rate, whilst another shows different fees and terms that could significantly impact your overall costs. If you ignore comparing options across the diverse UK lending landscape, you might pay more than necessary over the life of your mortgage. A little effort on mortgage comparison can protect your finances and secure your future within the competitive British mortgage market.

Understanding Interest Rates: Why You Should Compare UK Mortgages Before You Borrow

Interest rates represent a key component of financing your home within the UK property market. If you rush and forget to compare mortgage options across the wide range of UK lenders, you could lock into higher payments that persist throughout your mortgage term. To borrow for a mortgage in a smart way within the UK market, check different lenders including high street banks, building societies, and specialist mortgage providers. A small rate difference can lead to substantial savings over many years, particularly given the long-term nature of UK mortgage commitments.

The UK mortgage market offers diverse products from various types of lenders, each with different pricing strategies and risk assessments. Understanding how these different institutions price their mortgages helps borrowers navigate the market effectively and secure optimal terms.

The Impact of a Small Rate Shift on UK Mortgage Payments

A fraction of a percentage point in interest can change how much you owe monthly within the UK mortgage market. When UK lenders compete, those minor differences could add or subtract thousands of pounds over decades. This becomes especially clear when you calculate your first mortgage payment, as even a small shift in interest can immediately alter your monthly outgoings. Consider a scenario where you have a fixed-rate loan for £200,000 at 3.0 percent interest for 30 years. The monthly payment might be around £843. If the interest rises to 3.5 percent, you could pay about £898 each month. That gap accumulates significantly over time.

| Interest Rate | Approx. Monthly Payment | Total Interest Over 30 Years |

|---|---|---|

| 3.0% | £843 | About £103,000 |

| 3.5% | £898 | About £123,000 |

This difference becomes even more pronounced when considered over the full mortgage term. The additional £55 monthly payment at the higher rate results in approximately £20,000 more in total interest payments over 30 years. Within the UK market, where property values are substantial and mortgage terms lengthy, these differences can represent significant sums that affect long-term financial planning and wealth accumulation.

It’s not mere speculation; even a small change can feel substantial when multiplied by hundreds of monthly payments. Every lender comparison proves worthwhile if you want to keep more money available for other financial goals. The UK mortgage market’s competitive nature means that rates can vary significantly between lenders, making comparison essential for securing optimal terms.

Market Fluctuations and UK Mortgage Lender Comparisons

Mortgage rates within the UK can fluctuate based on economic conditions, Bank of England monetary policy decisions, and broader market forces. Lender policies, Bank of England base rate changes, and global market movements all influence pricing. Because of these shifts, comparing UK lenders at one point in time might give different results weeks later, making timing an important consideration in the mortgage application process.

Bank of England Impact: The Bank of England’s Monetary Policy Committee meets regularly to set the base rate, which directly affects variable rate mortgages and influences fixed rate pricing across the UK market. Understanding these cycles helps borrowers time their applications effectively and secure favourable terms when market conditions align with their needs.

That’s why conducting a mortgage lender comparison isn’t about a single day’s quote. It’s about understanding trends, asking informed questions, and knowing how each UK lender adjusts pricing in response to market conditions. A thorough lender comparison check can reveal better deals or additional fees hidden in the fine print. Using a comprehensive approach usually leads to a more secure financial commitment that aligns with long-term objectives.

Key Factors for the Best UK Mortgage Rate and Overall Mortgage Interest

Several factors determine the interest you pay within the UK mortgage market. Your credit score, the loan-to-value ratio, mortgage term length, and property type all shape your costs. You can hunt for the best mortgage rate by improving your credit profile, increasing your deposit, or adjusting the loan period. Paying attention to these factors means you can save substantial amounts over your mortgage term.

FCA Regulatory Framework: The UK mortgage market operates within a regulatory framework established by the Financial Conduct Authority, which requires lenders to assess affordability comprehensively. This regulatory environment influences how lenders evaluate applications and price their products, making understanding of the assessment process valuable for borrowers seeking optimal terms.

How Credit History and Loan-to-Value Ratios Affect UK Mortgage Interest

Credit history carries significant weight within the UK mortgage market. A high credit score suggests you’re likely to repay on time, so UK lenders charge you less in interest. If your credit score dips, lenders may view you as higher risk and raise your rate accordingly. The UK credit scoring system, managed by agencies like Experian, Equifax, and TransUnion, provides lenders with detailed information about your financial behaviour and creditworthiness.

Loan-to-value ratio (LTV) also matters considerably within UK mortgage pricing. When you put more money down as a deposit, your LTV drops, and the lender sees a lower chance of losing money if property values decline. That could unlock a more favourable rate and access to better mortgage products. UK mortgage lender comparisons across the board often boil down to seeing which company rewards strong financial habits most effectively.

UK LTV Pricing Tiers: The UK mortgage market typically offers the best rates to borrowers with LTVs of 60% or lower, with pricing tiers that increase as LTV ratios rise. Understanding these thresholds helps borrowers structure their deposits optimally and access the most competitive rates available. Even if you’re not there yet, small improvements can raise your credit score, lower your LTV, and unlock better terms that save thousands over the mortgage term.

Why Loan Terms and Property Type Matter in the UK Market

A 15-year mortgage within the UK often carries a lower rate than a 30-year deal, but the monthly payments become significantly larger. Conversely, a 30-year plan gives you more time to repay but might carry additional total interest over the full term. Understanding this trade-off helps UK borrowers balance monthly affordability with long-term cost efficiency.

Property type also shapes your deal within the UK mortgage market. If you buy a standard residential property, a flat, or a house, UK lender policies might vary considerably. Some lenders are more accommodating with standard properties but stricter with non-standard construction, flats above commercial premises, or properties requiring significant renovation work.

UK Property Categories: The UK market also distinguishes between residential mortgages and buy-to-let products, with different criteria and pricing for each category. Buy-to-let mortgages typically require higher deposits and carry higher rates, reflecting the different risk profile and regulatory requirements associated with rental properties.

How to Compare UK Mortgage Deals and Get a Mortgage with Confidence

Before you get a mortgage within the UK market, it’s wise to shop around comprehensively. Compare mortgage deals from many sources and note any additional fees that could affect overall costs. High street banks, building societies, online lenders, and specialist institutions can show different offers that cater to various borrower profiles. This is your money, so don’t be hesitant about asking questions or gathering multiple quotes from different types of UK lenders.

The UK mortgage market’s diversity means that different lenders excel in different areas. Some may offer competitive rates for first-time buyers, whilst others specialise in complex cases or high-value properties. Understanding each lender’s strengths helps you target your applications effectively and improve your chances of securing favourable terms.

Gathering Rate Information and Checking Hidden Costs in the UK Market

Many UK lenders advertise attractive interest rates but may include fees in the fine print that significantly impact overall costs. Arrangement fees, booking fees, valuation costs, and early repayment charges can appear and increase overall expenses substantially. When making a mortgage lender comparison within the UK market, list each potential cost carefully and systematically.

Hidden Costs to Watch: You can create a comprehensive spreadsheet or note them systematically on paper. Then compare them side by side to get a true picture of total costs. This approach keeps conversations honest when you speak to lenders or mortgage advisers. UK lenders might try to highlight their biggest strengths whilst downplaying less obvious charges that could affect your decision.

By conducting your own thorough check, you’ll see which rate represents the best value when all costs are considered. The UK mortgage market’s complexity means that the lowest headline rate doesn’t always translate to the lowest total cost, making comprehensive comparison essential for informed decision-making.

Using Online Tools and Organising Your Documents for UK Applications

Online comparison sites let you check multiple UK mortgage offers efficiently. They can show you which lenders have promotions or discount points that might lower your interest rate. If you upload details about your income, credit standing, and deposit amount, you often receive more accurate quotes that reflect your specific circumstances.

Still, be mindful that real approvals might shift if your data changes or if the lender’s policy updates between quote and application. The UK mortgage market moves quickly, and rates can change daily based on market conditions and lender appetite for new business.

Document Preparation: During this process, have your proof of income, bank statements, and credit report ready for UK lender requirements. The clearer you are with lenders, the more precise your quotes will be. This level of organisation often leads to stronger positions when you negotiate and can speed up the application process significantly.

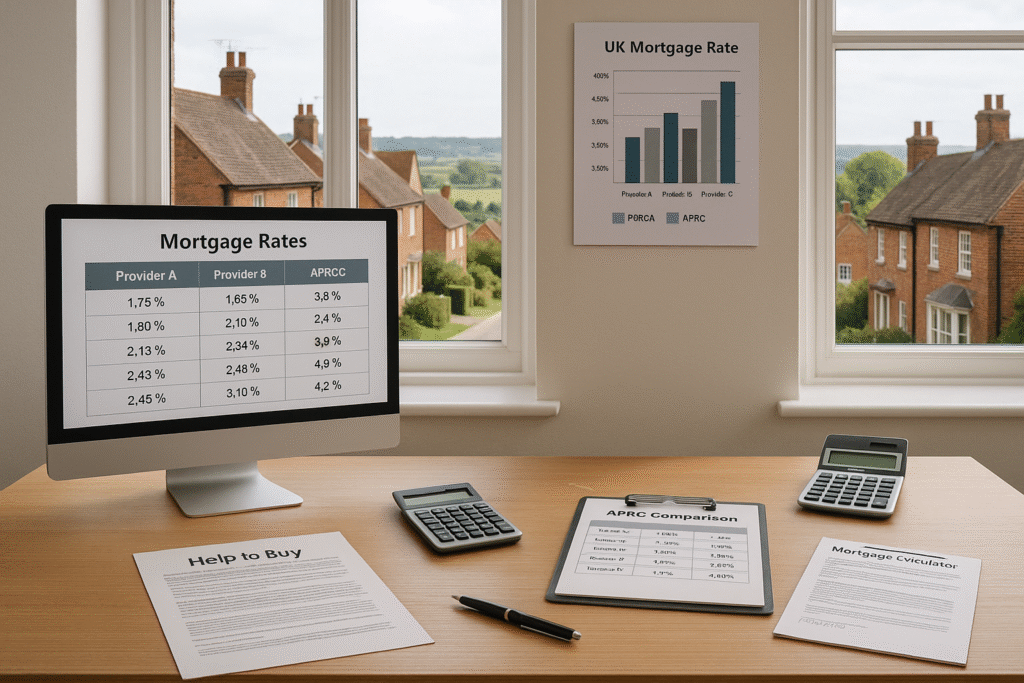

Evaluating the Annual Percentage Rate of Charge in Your UK Mortgage Comparison

Annual Percentage Rate of Charge, or APRC, goes beyond the basic interest rate within the UK mortgage market. It incorporates most fees into one figure, giving a fuller picture of the loan’s true cost. By checking APRC, you can see if a rate that seems low might become more expensive once fees are counted, helping you make more informed comparisons between UK lenders.

The APRC calculation follows standardised methodology across the UK market, making it a reliable tool for comparing different mortgage offers. However, it’s important to understand what the APRC includes and excludes to use it effectively in your decision-making process.

Understanding APRC vs. Advertised Interest in the UK Market

The advertised interest rate might be eye-catching, but APRC shows the loan’s true cost over time within the UK mortgage market. If one UK lender has a 3.2 percent interest rate and another offers 3.4 percent, that first deal may seem better initially. But if the first lender’s APRC is higher due to substantial fees, you might pay more in total over the mortgage term.

APRC includes certain charges mandated by UK regulations, so it can paint a broader picture of total costs. Conversely, a lender with a slightly higher official rate might have a lower APRC due to minimal fees. The difference often reveals how fees affect the real cost of borrowing within the UK market, helping you avoid surprises and choose wisely.

When a Higher Rate Could Actually Be Cheaper in the UK Market

Sometimes you’ll encounter a UK mortgage with a higher interest rate but fewer additional costs. Perhaps they waive the arrangement fee or reduce valuation charges. Over years, that might save more money than a lower rate with substantial upfront costs. UK mortgage lender comparisons can highlight these important details that affect overall value.

| Lender | Interest Rate | Arrangement Fee | APRC |

|---|---|---|---|

| Lender A | 3.3% | £1,999 | 3.7% |

| Lender B | 3.5% | £0 | 3.5% |

For instance, you might pay 3.5 percent interest but minimal arrangement fees. That could cost you less than paying 3.3 percent interest with substantial upfront charges. So it’s wise to examine the whole mortgage profile rather than focusing solely on the interest rate.

Discovering the Best Ways to Compare UK Mortgage Rates with Lenders

UK mortgage lenders can compete for your business, particularly if you have good credit and stable finances. They might adjust terms or offer incentives to secure your application. Don’t settle on the first quote you receive from any UK lender. Compare mortgage rates carefully across the market. Your aim is to find a balance of competitive rates, reasonable fees, good service, and comfortable monthly payments that align with your long-term financial objectives.

The UK mortgage market’s competitive nature means that lenders are often willing to negotiate, particularly for borrowers who represent lower risk or who are considering substantial loan amounts. Understanding your position in the market helps you negotiate more effectively.

Negotiating and Deciding Between Mortgage Adviser or Direct UK Lender

Negotiation might seem daunting if you’re not accustomed to it, but it can pay off substantially within the UK mortgage market. Ask if the lender can match or beat a competing offer. Sometimes they will, particularly if you represent an attractive borrower profile. Also, consider mortgage adviser services within the UK market.

Professional Guidance: A qualified mortgage adviser shops multiple UK lenders and may secure a better package, though this could mean an adviser fee. Direct lenders might skip additional intermediary costs, though you’ll need to conduct more rate shopping yourself. Each path has advantages and disadvantages within the UK market context.

If you want a broader search with less legwork, a mortgage adviser can help navigate the UK market’s complexity. If you prefer controlling the process directly, then speak with banks, building societies, or specialist lenders independently. Real clarity about total costs remains key regardless of your chosen approach.

Timing Your Application and Checking Special UK Programs

Interest rates within the UK can shift daily, tied to broader economic factors and Bank of England policy decisions. If you monitor market news and economic indicators, you might spot a dip in rates. That could be an ideal moment to lock in your loan with a UK lender.

Some people wait for favourable economic signals, especially if they expect rates to decline. Others secure a decent rate to avoid the risk of rates climbing again. Meanwhile, special programs can help if you meet certain conditions within the UK market.

UK Government Schemes: First-time buyers may access Help to Buy schemes, Shared Ownership programs, or other government initiatives that reduce deposit requirements or provide favourable terms. Some self-employed borrowers might find UK lenders more accommodating with flexible income verification or specialist products designed for their circumstances.

Each niche can alter your strategy within the UK mortgage market. Understanding available programs and timing your application appropriately can keep more money available for other financial priorities whilst securing the home you want.

Conclusion

Comparing UK lenders proves worthwhile if it helps you avoid a costlier loan that persists for decades. A competitive mortgage rate means you enjoy more manageable monthly payments and greater financial security. Look beyond one headline number and weigh the fees, terms, and your own long-term goals carefully.

By staying thorough in your approach to the UK mortgage market, you can find confidence in a fair plan that serves your interests. The time invested in comprehensive comparison typically pays dividends through reduced costs and better terms that benefit you throughout your mortgage term.

The UK mortgage market’s complexity requires careful navigation, but the potential savings make the effort worthwhile. Professional advice, thorough comparison, and understanding of your own financial position combine to help you secure the best possible mortgage for your circumstances within the diverse and competitive British lending landscape.