Mortgage interest tax relief in the UK varies significantly depending on whether you’re a homeowner or a landlord. For residential properties, mortgage interest is generally not deductible against personal income tax. However, for buy-to-let properties, landlords can claim tax relief on mortgage interest, though recent changes have restricted this benefit for higher-rate taxpayers. Understanding these regulations is essential for effective financial planning and tax compliance.

Key Takeaways

- Mortgage interest on your main residence is not tax deductible in the UK for personal income tax purposes.

- Buy-to-let mortgage interest can be claimed as a tax credit at the basic rate (20%) for all landlords, regardless of their tax band.

- Higher-rate taxpayers can no longer claim full tax relief on buy-to-let mortgage interest at their marginal rate.

- Proper documentation and record-keeping are essential for claiming legitimate tax relief on rental properties.

- Professional tax advice is recommended to navigate the complex UK tax regulations effectively.

- Capital gains tax implications must be considered when selling investment properties.

Understanding Mortgage Interest Tax Relief in the UK

The UK tax system treats mortgage interest differently from many other countries. For residential homeowners, mortgage interest payments on their main residence are not deductible against personal income tax.

However, for landlords with buy-to-let properties, mortgage interest can be claimed as a business expense, though significant changes have been implemented that affect how this relief is calculated and applied.

These changes, introduced gradually from 2017, have fundamentally altered the tax landscape for property investors and require careful consideration when planning property investments.

Who Can Claim Mortgage Interest Tax Relief?

Residential Property Owners: Cannot claim mortgage interest relief on their main residence for personal income tax purposes.

Buy-to-Let Landlords: Can claim tax relief on mortgage interest, but this is now restricted to a basic rate tax credit (20%) regardless of the landlord’s actual tax rate.

Property Companies: Companies owning rental properties can still deduct mortgage interest as a business expense against corporation tax.

Landlords must maintain accurate records of all mortgage interest payments and ensure they can substantiate their claims with proper documentation from their mortgage lender.

Types of Properties and Mortgage Interest Relief

Understanding which types of properties qualify for mortgage interest relief is vital for UK property owners and investors.

| Property Type | Tax Relief Available | Rate of Relief |

|---|---|---|

| Main Residence | No | N/A |

| Second Home (Personal Use) | No | N/A |

| Buy-to-Let Property | Yes (Tax Credit) | 20% (Basic Rate) |

| Holiday Let | Yes (Tax Credit) | 20% (Basic Rate) |

| Commercial Property | Yes (Full Deduction) | Marginal Rate |

How Buy-to-Let Mortgage Interest Tax Relief Works

The UK government has significantly changed how mortgage interest relief works for buy-to-let properties. These changes have been phased in and now apply to all landlords.

The New Tax Credit System

Under the current system, all landlords receive a tax credit equivalent to 20% of their mortgage interest costs, regardless of whether they are basic rate, higher rate, or additional rate taxpayers.

Example Calculation:

Scenario: Landlord pays £10,000 in mortgage interest annually

Previous System (Higher Rate Taxpayer): £10,000 × 40% = £4,000 tax relief

Current System (All Taxpayers): £10,000 × 20% = £2,000 tax credit

Impact: £2,000 reduction in tax relief for higher rate taxpayers

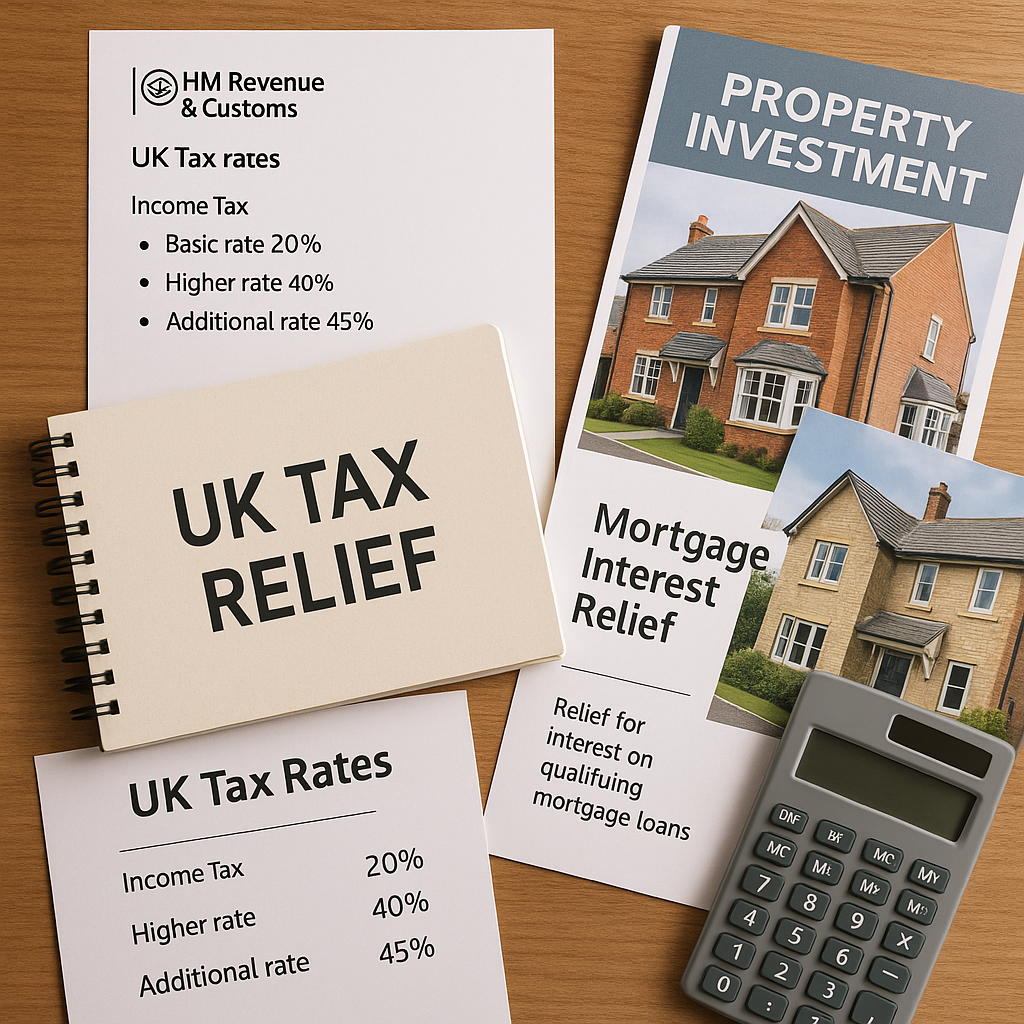

Impact on Different Types of Taxpayers

The changes affect different taxpayers in various ways:

- Basic Rate Taxpayers: No change – still receive 20% relief

- Higher Rate Taxpayers: Significant reduction from 40% to 20% relief

- Additional Rate Taxpayers: Major reduction from 45% to 20% relief

Claiming Mortgage Interest Relief on Rental Properties

To claim mortgage interest relief on rental properties, landlords must follow specific procedures and maintain proper documentation.

Required Documentation

Landlords must keep detailed records including:

- Annual mortgage statements showing interest paid

- Monthly payment breakdowns separating capital and interest

- Rental income records

- All property-related expenses

- Professional fees and maintenance costs

How to Calculate Your Tax Relief

Step 1: Calculate your total rental income

Step 2: Deduct allowable expenses (excluding mortgage interest)

Step 3: Add back mortgage interest to determine taxable profit

Step 4: Calculate tax on the profit

Step 5: Apply 20% tax credit on mortgage interest paid

Refinancing and Home Equity Considerations

When landlords refinance their buy-to-let mortgages or take additional borrowing, the tax treatment of interest payments remains consistent with the current rules.

In some cases, landlords may also explore paying off a mortgage early to reduce long-term interest costs, but this decision should be balanced against the potential tax benefits of retaining deductible interest payments.

Refinancing Impact

Refinancing a buy-to-let mortgage does not change the tax treatment of mortgage interest. The 20% tax credit still applies to all interest payments on the refinanced loan, provided the property continues to be let commercially.

However, any additional borrowing beyond the original purchase price may have different tax implications and should be reviewed with a tax professional.

Additional Borrowing Considerations

If landlords take additional borrowing secured against their rental property, the tax treatment depends on how the funds are used:

- Property Improvements: Interest may qualify for tax relief

- Personal Use: Interest typically not allowable

- Further Property Investment: May qualify for relief on the new property

Capital Gains Tax and Property Disposal

When selling rental properties, landlords must consider capital gains tax implications alongside the mortgage interest relief they’ve claimed.

Calculating Capital Gains

Capital gains tax is calculated on the profit made when selling a property. Key considerations include:

- Original purchase price plus acquisition costs

- Improvement costs (not repairs or maintenance)

- Disposal costs (legal fees, estate agent fees)

- Annual exemption allowances

Capital Gains Example:

Purchase Price: £200,000

Improvements: £20,000

Sale Price: £300,000

Disposal Costs: £5,000

Capital Gain: £300,000 – £200,000 – £20,000 – £5,000 = £75,000

Maximising Your Tax Position

To optimise tax benefits from property investments, landlords should consider various strategies and seek professional advice.

Professional Tax Advice

Given the complexity of UK tax regulations, professional advice is essential for:

- Tax Planning: Structuring investments for optimal tax efficiency

- Compliance: Ensuring all obligations are met correctly

- Record Keeping: Maintaining proper documentation

- Strategic Decisions: Timing of property purchases and sales

Alternative Investment Structures

Some landlords consider alternative structures such as:

- Limited Companies: May offer better tax treatment for higher rate taxpayers

- Property Partnerships: Can provide flexibility in tax planning

- Pension Investment: Self-invested personal pensions (SIPPs) for property investment

Is Property Investment Still Worthwhile?

Despite the changes to mortgage interest relief, property investment can still be profitable, but requires more careful consideration.

Factors to Consider

- Rental Yields: Higher yields may offset reduced tax relief

- Capital Growth: Long-term property appreciation potential

- Tax Band: Impact varies by taxpayer’s marginal rate

- Portfolio Size: Economies of scale for larger portfolios

- Location: Regional variations in rental demand and growth

Making Informed Decisions

Property investors should:

- Calculate the true cost of borrowing after tax relief

- Model different scenarios and tax rates

- Consider the total return including rental income and capital growth

- Evaluate alternative investment options

- Seek professional advice for complex situations

Conclusion

Mortgage interest tax relief in the UK has undergone significant changes, particularly affecting buy-to-let landlords. Whilst residential property owners cannot claim relief on their main residence, landlords can still benefit from tax credits on rental property mortgage interest, albeit at a reduced rate for higher taxpayers.

Understanding these rules is crucial for making informed property investment decisions. The restriction of relief to the basic rate has made property investment less attractive for some higher-rate taxpayers, but opportunities still exist for those who plan carefully.

Professional advice is strongly recommended to navigate the complex UK tax system effectively and ensure compliance with all regulations. Regular reviews of your property portfolio’s tax efficiency can help optimise your investment returns whilst meeting all legal obligations.

This information is for guidance only and does not constitute tax or financial advice. Tax rules can change and their application depends on individual circumstances. Always seek professional advice from qualified tax advisers and FCA authorised mortgage advisers before making property investment decisions. If you have a complaint about tax or mortgage advice, you can contact the relevant professional body or the Financial Ombudsman Service free of charge.