Selling a property whilst still owing money on your mortgage is a common situation that millions of UK homeowners face each year. Whether you’re relocating for work, downsizing, upsizing, or simply need to move for personal reasons, having an outstanding mortgage doesn’t prevent you from selling your home. Understanding the process, legal requirements, and financial implications ensures a smooth transaction that protects your interests whilst satisfying your lender’s requirements.

The UK property market operates under specific legal frameworks and regulatory oversight that govern how mortgaged properties can be sold. From obtaining redemption statements to managing negative equity situations, this comprehensive guide covers everything you need to know about selling your UK property with an outstanding mortgage, including the roles of conveyancers, estate agents, and mortgage lenders throughout the process.

Understanding UK Mortgage Redemption Process

When you sell a UK property with an outstanding mortgage, the legal process requires full redemption of your mortgage debt before ownership can transfer to the buyer. This redemption process involves several key steps that must be coordinated carefully to ensure completion occurs smoothly and all parties receive their required payments on the agreed completion date.

Your mortgage lender holds a legal charge over your property, which means they have a secured interest that must be satisfied before the property can be transferred to new owners. This legal charge is registered with HM Land Registry and forms part of the official property records, ensuring that any potential buyer and their legal representatives are aware of the outstanding mortgage obligation.

The redemption process begins when you instruct your conveyancer to contact your mortgage lender and request a redemption statement. This document provides a precise calculation of the amount required to fully discharge your mortgage, including the outstanding capital balance, accrued interest up to the completion date, and any applicable early repayment charges or administrative fees.

Timing is crucial in the redemption process, as mortgage interest accrues daily and the redemption figure changes accordingly. Most lenders provide redemption statements that remain valid for a specific period, typically 30 days, after which an updated statement may be required if completion is delayed beyond the original timeframe.

Your conveyancer coordinates with your lender to ensure that mortgage redemption occurs simultaneously with completion of the sale. This coordination involves arranging for the redemption funds to be transferred directly from the sale proceeds to your lender, ensuring that the mortgage is discharged and the legal charge is removed from the property title on the same day that ownership transfers to the buyer.

Financial Implications and Equity Calculations

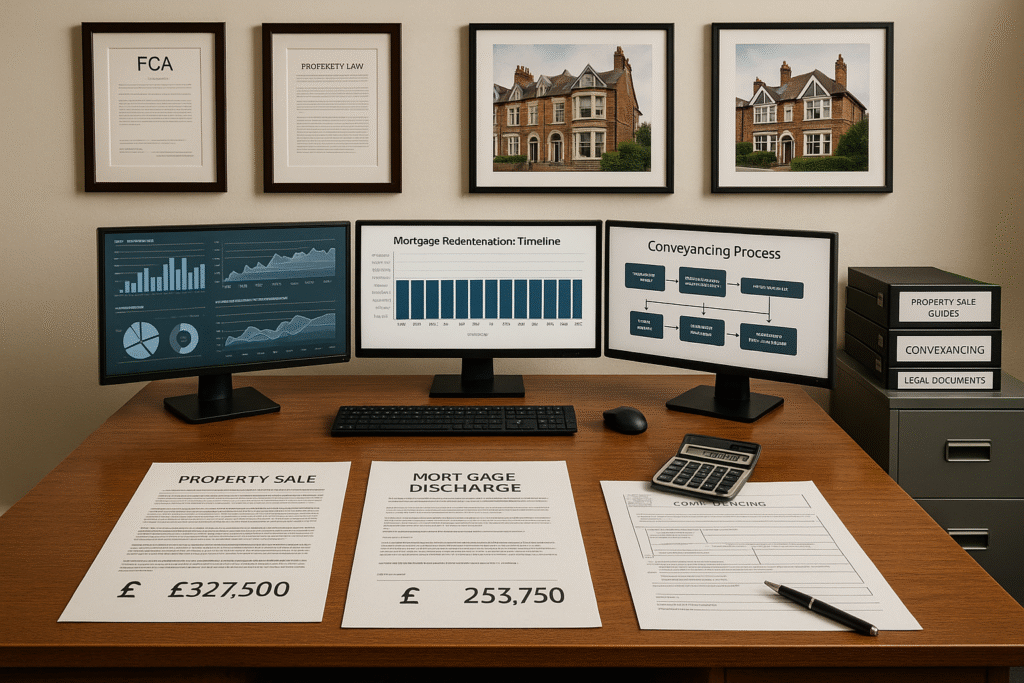

The financial outcome of selling a mortgaged property depends primarily on the relationship between your property’s sale price and your outstanding mortgage balance. When your property sells for more than you owe, you retain the surplus equity, which can be used for your next property purchase, invested, or applied to other financial goals according to your circumstances.

Positive equity situations provide financial flexibility and often represent the accumulation of wealth through property ownership over time. The amount of equity you retain depends not only on the sale price and mortgage balance but also on various costs associated with the sale, including estate agent fees, legal costs, survey fees, and any early repayment charges imposed by your lender.

Calculating your net proceeds requires careful consideration of all costs involved in the sale process. Estate agent fees typically range from 1% to 3% of the sale price, whilst legal fees for conveyancing services generally cost between £500 and £1,500 depending on the complexity of the transaction and the location of the property.

Early repayment charges represent a significant consideration for many homeowners, particularly those with fixed-rate mortgages or special rate products. These charges compensate lenders for the loss of expected interest payments when mortgages are repaid before the end of the agreed term, and can amount to several thousand pounds depending on your mortgage terms and the timing of your sale.

Negative equity situations, whilst less common in recent years due to general property price appreciation, can occur when property values decline or when homeowners purchased near market peaks. In these circumstances, your mortgage balance exceeds your property’s current market value, creating a shortfall that must be addressed before the sale can complete.

Managing Negative Equity Situations

Negative equity presents unique challenges that require careful planning and often negotiation with your mortgage lender. When your property’s sale price falls short of your outstanding mortgage balance, you must arrange to pay the difference from other sources or negotiate alternative arrangements with your lender to facilitate the sale.

Most mortgage lenders prefer to avoid repossession proceedings and will often work with homeowners to find mutually acceptable solutions for negative equity situations. These solutions may include allowing you to carry the shortfall forward to a new mortgage, arranging a personal loan to cover the difference, or in some cases, accepting a reduced settlement amount.

Porting your mortgage to a new property can sometimes provide a solution for negative equity situations, allowing you to transfer your existing mortgage terms to a new property whilst addressing the shortfall through additional borrowing or personal funds. This approach requires lender approval and depends on your financial circumstances and the suitability of your intended new property.

Communication with your lender should begin as early as possible when negative equity is anticipated. Lenders can provide guidance on available options and may offer forbearance or modified terms that make the sale more feasible whilst protecting their interests in recovering the outstanding debt.

Professional advice from mortgage brokers or financial advisers can be invaluable in negative equity situations, as they understand lender policies and can help negotiate the most favourable terms for your circumstances. They may also identify alternative lenders or products that could provide more flexible solutions for your specific situation.

Legal Requirements and Conveyancing Process

The legal process of selling a mortgaged property in the UK involves specific requirements and procedures that must be followed to ensure valid transfer of ownership and proper discharge of the mortgage. Your conveyancer plays a central role in managing these legal requirements and coordinating with all parties to ensure a successful completion.

Property information forms and legal documentation must be completed accurately and comprehensively, providing potential buyers and their legal representatives with all necessary information about the property, including details of the existing mortgage, any restrictions or covenants, and relevant planning permissions or building regulations compliance.

Title deeds and Land Registry documentation must be reviewed and prepared for transfer, ensuring that all legal interests in the property are properly identified and addressed. Your mortgage lender typically holds the title deeds as security for the loan, and these must be released as part of the redemption process.

Energy Performance Certificates and other required documentation must be obtained and provided to potential buyers, ensuring compliance with current regulations governing property sales. These requirements have evolved over time and your conveyancer ensures that all current legal obligations are met.

The exchange of contracts represents a crucial milestone in the legal process, creating binding obligations for both buyer and seller to complete the transaction on the agreed date. At this point, your conveyancer will have confirmed the redemption arrangements with your lender and ensured that all necessary funds will be available for completion.

Completion day involves the simultaneous transfer of ownership to the buyer and redemption of your mortgage. Your conveyancer coordinates these transactions to ensure that the buyer’s funds are received, your mortgage is redeemed, and the property title is transferred, all occurring on the same day to protect all parties’ interests.

Timing Considerations and Market Factors

The timing of your property sale can significantly impact both the financial outcome and the complexity of the process. Market conditions, seasonal factors, and personal circumstances all influence the optimal timing for selling a mortgaged property, and understanding these factors helps you make informed decisions about when to proceed.

Property market cycles affect both the speed of sale and the achievable sale price, with stronger markets typically providing better prices and faster sales whilst weaker markets may require longer marketing periods and potentially lower prices. Understanding current market conditions in your local area helps set realistic expectations for both timeline and financial outcomes.

Seasonal variations in the UK property market typically see increased activity in spring and early summer, with reduced activity during winter months and holiday periods. These patterns can affect both the number of potential buyers and the speed of the sales process, though individual circumstances may override general market trends.

Interest rate environments influence both buyer demand and your mortgage costs during the sales process. Rising interest rates may reduce buyer demand and affordability whilst also increasing your mortgage costs if you have a variable rate product, whilst falling rates may stimulate buyer activity and reduce your carrying costs. Understanding how the interest rate for home mortgage impacts both your repayment obligations and buyer affordability can help you choose the most strategic time to sell.

Personal timing considerations include employment changes, family circumstances, and financial planning objectives that may influence the optimal timing for your sale. Coordinating your sale with the purchase of a new property requires careful planning to avoid temporary homelessness or the costs of bridging finance.

Early repayment charge periods represent important timing considerations for many homeowners, as these charges typically reduce over time and may disappear entirely at certain points in your mortgage term. Understanding your specific charge structure helps identify optimal timing to minimise these costs.

Professional Support and Advisory Services

Successfully selling a mortgaged property requires coordination between multiple professionals, each bringing specialist expertise to different aspects of the process. Understanding the roles and responsibilities of these professionals helps you assemble an effective team and manage the process efficiently.

Estate agents provide market expertise and marketing services to attract potential buyers and negotiate sale terms. Their local market knowledge helps establish realistic pricing strategies and identify the most effective marketing approaches for your specific property and circumstances.

Conveyancers or solicitors handle the legal aspects of the sale, including liaising with your mortgage lender, preparing legal documentation, and ensuring compliance with all regulatory requirements. Their expertise in property law and transaction management is essential for navigating the complex legal requirements of selling mortgaged properties.

Mortgage advisers can provide valuable guidance on the financial implications of your sale, including advice on early repayment charges, options for negative equity situations, and strategies for your next property purchase. Their understanding of lender policies and market conditions helps optimise your financial outcomes.

Financial advisers may provide broader guidance on how your property sale fits into your overall financial planning, including tax implications, investment strategies for sale proceeds, and coordination with pension planning or other financial objectives.

Surveyors and valuers provide professional assessments of your property’s market value, which can be crucial for understanding your equity position and setting realistic sale expectations. Their expertise becomes particularly important in challenging market conditions or when dealing with unusual properties.

Strategic Planning for Your Next Property

Selling a mortgaged property often forms part of a broader strategy for your housing and financial future. Whether you’re moving to a new area, changing your housing requirements, or adjusting your financial commitments, strategic planning helps ensure that your sale supports your longer-term objectives.

Mortgage portability options allow you to transfer your existing mortgage terms to a new property, potentially avoiding early repayment charges whilst maintaining favourable interest rates or product features. This option requires lender approval and depends on the suitability of your new property and your continued financial eligibility.

Bridging finance may be necessary if you need to purchase a new property before completing the sale of your current home. These short-term financing solutions provide flexibility but come with higher costs and require careful planning to ensure that your sale completes within the bridging loan term.

Deposit planning for your next property purchase requires understanding how much equity you’ll retain from your current sale after all costs and mortgage redemption. This calculation influences your borrowing requirements and available property options for your next purchase.

Chain management becomes crucial when your sale is linked to a purchase, requiring coordination between multiple transactions to ensure that all parties can complete simultaneously. Professional guidance helps navigate these complex arrangements and minimise the risk of chain collapse.

Tax planning considerations may apply to your property sale, particularly if you’ve used the property for business purposes or if it’s not your main residence. Understanding potential capital gains tax implications helps optimise your financial outcomes and ensures compliance with HMRC requirements.

Conclusion

Professional mortgage and legal advice is recommended when selling property with outstanding mortgages. Your home may be repossessed if you do not keep up repayments on your mortgage. This information is for general guidance only and should not be considered as personalised financial or legal advice.