Homeowners can pay equity release back early to accelerate mortgage repayment, though this decision requires careful consideration of early repayment charges and financial implications. Equity release options like lifetime mortgages allow early and partial repayments, but early repayment charges might apply depending on the specific plan terms. Evaluating these charges alongside interest rates becomes critical to determine financial benefits, as lower interest rates on mortgages compared to equity release may incentivise early repayments. Consulting qualified mortgage advisers ensures informed decisions that maximise financial outcomes whilst navigating the complexities of UK equity release regulations.

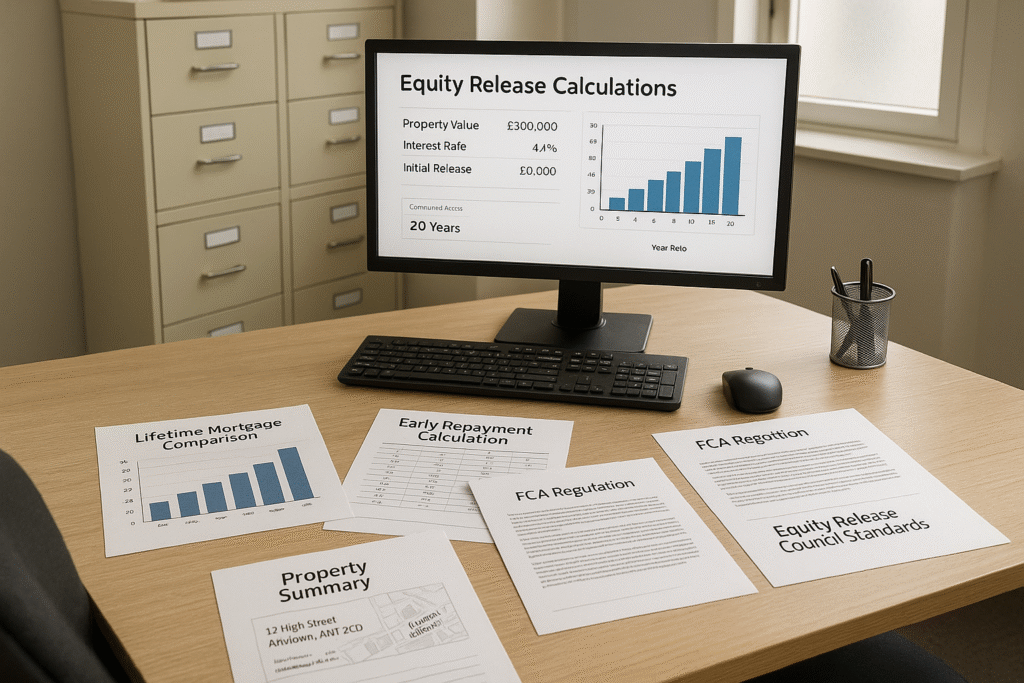

Understanding the relationship between equity release and mortgage repayment strategies enables homeowners to make informed financial decisions that align with their long-term goals. The UK equity release market, regulated by the Financial Conduct Authority and guided by Equity Release Council standards, offers various options for accessing property wealth whilst maintaining homeownership. However, the decision to repay equity release early involves complex calculations considering compound interest effects, early repayment penalties, and alternative financial strategies that may better serve individual circumstances.

Understanding Equity Release and Early Repayment Options

Equity release represents a significant financial decision for UK homeowners seeking to access property wealth without selling their homes. The market offers two primary types of equity release products, each with distinct characteristics and implications for early repayment strategies. Understanding these options and their regulatory framework enables homeowners to make informed decisions about accessing property equity whilst maintaining control over their financial future.

Equity Release Product Types and Regulatory Framework establish the foundation for understanding how early repayment works within the UK financial system. Lifetime mortgages represent the most popular form of equity release, allowing homeowners to borrow against their property value whilst retaining ownership. These products typically accrue interest over time, with the loan and accumulated interest repaid when the property is sold or the homeowner passes away. However, modern lifetime mortgages increasingly offer flexibility for early repayment, either in full or through partial payments, though early repayment charges may apply depending on the specific plan terms.

Home reversion plans offer an alternative approach, involving the sale of a portion or all of the property to a provider in exchange for a lump sum or regular payments whilst retaining the right to live in the property. These plans differ significantly from lifetime mortgages in their repayment implications, as they involve actual property ownership transfer rather than secured lending. The early repayment options for home reversion plans are typically more limited, as they involve buying back the sold portion of the property at current market values.

The Financial Conduct Authority regulates all equity release products in the UK, ensuring consumer protection through strict standards for product design, sales processes, and ongoing management. The Equity Release Council provides additional industry standards, including the requirement for independent legal advice, the right to remain in the property for life, and protection against negative equity. These regulatory frameworks create a secure environment for equity release whilst establishing clear guidelines for early repayment procedures and consumer rights.

Early Repayment Conditions and Charge Structures determine the financial implications of paying back equity release before the natural end of the plan. Most modern equity release plans include provisions for early repayment, though the terms and charges vary significantly between providers and product types. Understanding these conditions becomes essential for homeowners considering early repayment as part of their broader financial strategy.

Early repayment charges typically apply to protect lenders against the financial impact of premature loan settlement, particularly given the long-term nature of equity release products and their pricing models, and the Mortgage in Principle Validity Period. These charges often follow a sliding scale, with higher penalties in the early years of the plan that gradually reduce over time. Some plans offer penalty-free periods or allowances for partial repayments, enabling homeowners to reduce their loan balance without incurring charges.

The calculation of early repayment charges varies between providers but commonly involves a percentage of the outstanding loan amount or a fixed fee structure. Some plans link early repayment charges to gilt yields or other financial benchmarks, reflecting the lender’s cost of funds and market conditions at the time of repayment. Understanding these calculation methods enables homeowners to estimate the cost of early repayment and compare it against potential benefits.

Partial repayment options provide flexibility for homeowners who wish to reduce their equity release balance without full settlement. Many modern plans allow annual penalty-free partial repayments up to a specified percentage of the outstanding balance, typically ranging from 10% to 15%. These provisions enable homeowners to manage interest accumulation whilst maintaining access to the remaining equity release funds for future needs.

Interest Accumulation and Compound Effects significantly impact the long-term cost of equity release and the potential benefits of early repayment. Unlike traditional mortgages where borrowers make regular payments, equity release products typically allow interest to compound over time, creating substantial growth in the outstanding balance. Understanding these effects becomes crucial for evaluating the financial benefits of early repayment strategies.

Compound interest on equity release products means that interest charges are added to the outstanding balance and themselves earn interest in subsequent periods. This compounding effect can result in dramatic growth of the debt over time, particularly given the long-term nature of equity release plans. For example, a £50,000 lifetime mortgage at 5% annual interest would grow to approximately £132,000 after 20 years without any repayments, demonstrating the significant impact of compound interest.

Early repayment can substantially reduce the total cost of equity release by limiting the period over which compound interest accumulates. Even partial repayments can have significant long-term benefits by reducing the principal balance on which future interest is calculated. The earlier in the plan term that repayments are made, the greater the potential savings from reduced compound interest effects.

The timing of early repayments becomes particularly important given the exponential nature of compound interest growth. Repayments made in the early years of an equity release plan have a much greater impact on total cost reduction than similar payments made later in the plan term. This mathematical reality makes early repayment particularly attractive for homeowners who experience improved financial circumstances or receive windfalls that enable debt reduction.

Regulatory Protections and Consumer Rights provide important safeguards for homeowners considering equity release and early repayment options. The UK regulatory framework ensures that consumers receive appropriate protection whilst maintaining flexibility to manage their equity release arrangements according to changing circumstances.

The Equity Release Council’s standards require all member firms to offer products that include the right to make penalty-free partial repayments, typically allowing annual repayments of up to 10% of the initial loan amount without charges. This standard provides important flexibility for homeowners whilst ensuring that lenders can manage their business models effectively. The Council also requires that all equity release plans include a no-negative-equity guarantee, protecting homeowners and their estates from owing more than the property value.

Independent legal advice requirements ensure that homeowners fully understand the implications of equity release, including early repayment options and charges. Solicitors must explain the terms and conditions of the proposed plan, including scenarios for early repayment and their financial implications. This requirement provides an important safeguard against unsuitable equity release arrangements whilst ensuring that homeowners understand their options for future plan management.

The Financial Conduct Authority’s conduct rules require equity release advisers to assess the suitability of products for individual circumstances, including consideration of early repayment intentions and capabilities. Advisers must explore whether early repayment is likely and ensure that the recommended product offers appropriate flexibility for the client’s circumstances. This regulatory requirement helps ensure that homeowners receive products that align with their financial planning objectives.

Plan Flexibility and Modern Product Features reflect the evolution of the equity release market towards greater consumer choice and flexibility. Modern equity release products increasingly offer features that support early repayment and ongoing plan management, responding to consumer demand for greater control over their financial arrangements.

Drawdown lifetime mortgages allow homeowners to access equity release funds in stages rather than taking the full amount initially. This approach can reduce interest accumulation by limiting the outstanding balance to the amount actually drawn, whilst providing access to additional funds when needed. The ability to make early repayments on drawdown plans can further enhance their cost-effectiveness by reducing the balance on which interest is calculated.

Interest payment options on some lifetime mortgages allow homeowners to pay the monthly interest charges, preventing compound interest accumulation whilst maintaining access to the borrowed capital. These products bridge the gap between traditional mortgages and equity release, offering greater control over debt growth whilst providing access to property equity. Early repayment of the capital balance remains possible with these products, often with more favourable terms than traditional roll-up lifetime mortgages.

Enhanced inheritance protection features allow homeowners to ring-fence a portion of their property value for inheritance purposes, ensuring that a specified percentage remains available for beneficiaries regardless of house price movements or interest accumulation. These features can work alongside early repayment strategies to maximise inheritance preservation whilst providing access to needed funds during the homeowner’s lifetime.

Benefits and Costs of Early Repayment

The decision to repay equity release early involves complex financial calculations that must account for early repayment charges, interest savings, opportunity costs, and alternative uses of available funds. Understanding these factors enables homeowners to make informed decisions about whether early repayment aligns with their financial objectives and circumstances.

Financial Impact Analysis and Cost-Benefit Calculations require careful evaluation of multiple factors that influence the overall financial outcome of early repayment decisions. The primary benefit of early repayment lies in reducing or eliminating future interest accumulation, which can result in substantial savings over the long term. However, these benefits must be weighed against early repayment charges, the opportunity cost of using funds for repayment rather than other investments, and the potential need for alternative financing in the future.

Early repayment charges represent the most immediate cost of settling equity release early, and these charges can be substantial, particularly in the early years of a plan. Typical early repayment charges range from 1% to 25% of the outstanding balance, depending on the plan terms, the time elapsed since inception, and market conditions. Some plans calculate charges based on gilt yields or other financial benchmarks, meaning that charges can vary with market conditions and may be higher during periods of low interest rates.

The calculation of potential interest savings requires projecting the future growth of the equity release balance under compound interest and comparing this to the cost of early repayment. For example, repaying a £100,000 lifetime mortgage with a 5% interest rate after five years might incur early repayment charges of £15,000 but could save over £200,000 in interest charges over a 20-year period. These calculations become more complex when considering partial repayments, which reduce future interest accumulation whilst potentially avoiding or minimising early repayment charges.

Opportunity cost analysis considers what returns could be achieved by investing the funds used for early repayment in alternative investments. If the equity release interest rate is 5% but the homeowner could achieve 7% returns through other investments, the opportunity cost of early repayment might outweigh the benefits of interest savings. However, this analysis must also consider the risk profiles of different investments and the certainty of equity release interest accumulation compared to variable investment returns.

Interest Rate Comparisons and Market Timing significantly influence the attractiveness of early repayment decisions. The relationship between equity release interest rates, mortgage rates, and investment returns creates different scenarios where early repayment may or may not be financially beneficial. Understanding these relationships enables homeowners to time their repayment decisions for maximum financial advantage.

Equity release interest rates typically exceed mortgage rates due to the different risk profiles and product structures involved. While mortgage rates might range from 2% to 6% depending on market conditions and borrower circumstances, equity release rates often range from 4% to 8% or higher. This differential makes early repayment of equity release potentially attractive when funds could be used to reduce higher-cost debt or when mortgage rates are significantly lower than equity release rates.

Market timing considerations become important when homeowners have flexibility about when to make early repayments. Interest rate cycles can affect both the cost of early repayment charges (which may be linked to gilt yields) and the opportunity cost of using funds for repayment rather than investment. Periods of rising interest rates might make early repayment more attractive by reducing early repayment charges whilst increasing the relative cost of maintaining the equity release debt.

The comparison between equity release rates and potential investment returns requires careful analysis of risk-adjusted returns and the certainty of different outcomes. While equity release interest accumulation is certain and compounds over time, investment returns are variable and subject to market risk. Conservative investors might prefer the certainty of eliminating equity release interest accumulation, whilst those comfortable with investment risk might choose to maintain the equity release and invest available funds for potentially higher returns.

Tax Implications and Estate Planning Considerations add complexity to early repayment decisions and may influence the optimal timing and structure of repayment strategies. Understanding these implications ensures that early repayment decisions align with broader financial and estate planning objectives whilst maximising tax efficiency.

Equity release proceeds are typically tax-free when received, as they represent borrowing against property equity rather than income or capital gains. However, the tax treatment of funds used for early repayment depends on their source and may have implications for income tax, capital gains tax, or inheritance tax planning. Funds from pension withdrawals, investment sales, or other sources may have different tax implications that affect the net cost of early repayment.

Inheritance tax planning considerations become important for homeowners with estates that may exceed the nil-rate band thresholds. Early repayment of equity release can preserve more property value for inheritance purposes, potentially reducing inheritance tax liabilities for beneficiaries. However, the use of funds for early repayment might reduce other assets that could have been gifted or structured more tax-efficiently for inheritance purposes.

The residence nil-rate band for inheritance tax provides additional relief for property passed to direct descendants, making property preservation through early equity release repayment potentially valuable for inheritance tax planning. The interaction between equity release balances, property values, and inheritance tax thresholds creates scenarios where early repayment might provide significant tax benefits for beneficiaries.

Estate planning considerations also include the impact of early repayment on the homeowner’s overall asset allocation and liquidity position. While early repayment preserves property equity, it may reduce liquid assets that provide flexibility for future care needs or other expenses. Balancing these considerations requires careful analysis of likely future needs and the relative importance of property preservation versus maintaining liquid assets.

Cash Flow and Liquidity Management considerations affect the practical feasibility of early repayment and its impact on the homeowner’s ongoing financial security. Understanding these factors ensures that early repayment decisions do not compromise financial flexibility or create future financial difficulties.

The source of funds for early repayment significantly affects its financial impact and appropriateness. Funds from windfalls, inheritance, investment gains, or pension withdrawals may make early repayment attractive without compromising ongoing cash flow. However, using funds needed for living expenses or emergency reserves could create financial stress and might not be appropriate despite potential long-term savings.

Partial repayment strategies can provide a middle ground between full early repayment and maintaining the entire equity release balance. Many plans allow annual penalty-free partial repayments, enabling homeowners to reduce their balance gradually whilst maintaining liquidity for other needs. This approach can provide significant long-term benefits whilst preserving financial flexibility.

The impact of early repayment on future borrowing capacity requires consideration, particularly for homeowners who might need access to credit for care costs, home improvements, or other major expenses. Early repayment of equity release preserves property equity that could support future borrowing, but it also reduces current liquid assets that might be needed for immediate expenses.

Emergency fund considerations become important when evaluating early repayment decisions. Financial advisers typically recommend maintaining emergency funds equivalent to three to six months of expenses, and using these funds for early equity release repayment could leave homeowners vulnerable to unexpected expenses. The balance between long-term savings from early repayment and short-term financial security requires careful evaluation based on individual circumstances.

Alternatives and Professional Guidance

Homeowners considering early equity release repayment should evaluate alternative strategies that might achieve similar financial objectives with different risk profiles or cost structures. Understanding these alternatives, combined with professional guidance, enables informed decision-making that aligns with individual circumstances and long-term financial goals.

Alternative Debt Management Strategies provide options for homeowners seeking to optimise their financial position without necessarily pursuing full early repayment of equity release. Some of these strategies, including Mortgage Options Without Employment, can offer flexibility whilst achieving many of the benefits associated with early repayment, often with lower immediate costs or greater ongoing flexibility.”

Partial repayment strategies represent the most direct alternative to full early repayment, allowing homeowners to reduce their equity release balance whilst maintaining access to remaining funds. Most modern equity release plans allow annual penalty-free partial repayments of up to 10% of the initial loan amount, providing significant flexibility for debt reduction without early repayment charges. This approach enables homeowners to reduce interest accumulation gradually whilst preserving liquidity for other needs.

Interest payment options on some lifetime mortgages allow homeowners to pay monthly interest charges, preventing compound interest accumulation whilst maintaining the capital balance. This approach provides the benefit of controlling debt growth without the large upfront cost of early repayment, though it requires ongoing monthly payments that may not suit all homeowners’ cash flow situations. The ability to switch between interest payment and roll-up options provides additional flexibility for changing circumstances.

Downsizing strategies offer an alternative approach to accessing property equity whilst potentially eliminating equity release debt entirely. Moving to a smaller, less expensive property can release sufficient funds to repay equity release whilst providing ongoing housing that better suits changing needs. This approach requires careful consideration of moving costs, stamp duty implications, and the emotional aspects of leaving a long-term family home.

Investment and Savings Alternatives enable homeowners to potentially achieve better financial outcomes than early equity release repayment whilst maintaining liquidity and flexibility. These alternatives require careful risk assessment and may be more suitable for homeowners comfortable with investment risk and market volatility.

ISA investments provide tax-efficient savings options that might generate returns exceeding equity release interest rates whilst maintaining access to funds for future needs. Stocks and Shares ISAs offer potential for higher returns through equity investments, whilst Cash ISAs provide security with lower but guaranteed returns. The annual ISA allowance enables significant tax-efficient savings that could accumulate to enable future equity release repayment whilst potentially generating superior returns.

Premium Bonds offer a unique savings option that combines capital security with the potential for tax-free prizes, making them attractive for homeowners seeking alternatives to early equity release repayment. While the average return may be lower than equity release interest rates, the combination of capital security and prize potential provides an alternative approach to managing available funds whilst maintaining flexibility.

Pension contributions might provide superior long-term returns whilst offering immediate tax relief that enhances the effective return on investment. For homeowners still able to make pension contributions, the combination of tax relief and potential investment growth might exceed the benefits of early equity release repayment whilst providing additional retirement security.

Property investment alternatives, such as buy-to-let properties or Real Estate Investment Trusts (REITs), offer exposure to property markets whilst maintaining liquidity and potentially generating income. These investments might provide returns that exceed equity release interest rates whilst offering diversification benefits and potential capital appreciation.

Professional Advisory Services and Specialist Guidance play crucial roles in helping homeowners navigate the complex decisions surrounding equity release management and early repayment strategies. Understanding the different types of professional support available ensures that homeowners receive appropriate guidance for their specific circumstances and objectives.

Equity release advisers provide specialist knowledge of the equity release market and can help homeowners understand their options for early repayment, plan modifications, or alternative strategies. These advisers must be qualified and regulated by the Financial Conduct Authority, ensuring they meet professional standards for competence and conduct. Specialist equity release advisers often have access to the full market of products and can provide comparative analysis of different options.

Independent financial advisers offer broader financial planning expertise that can help homeowners understand how equity release decisions fit within their overall financial strategy. These advisers can provide analysis of alternative investment options, tax planning strategies, and estate planning considerations that might influence early repayment decisions. The holistic approach of independent financial advice ensures that equity release decisions align with broader financial objectives.

Solicitors specialising in equity release and later-life planning provide essential legal guidance on the implications of early repayment and alternative strategies. Legal advice becomes particularly important when considering complex arrangements such as family arrangements for early repayment, trust structures, or estate planning strategies that might affect equity release decisions.

Tax advisers and accountants provide specialist guidance on the tax implications of different strategies, including the tax treatment of funds used for early repayment, the impact on inheritance tax planning, and the optimisation of tax-efficient investments as alternatives to early repayment. This guidance becomes particularly valuable for homeowners with complex financial arrangements or significant tax liabilities.

Family Involvement and Intergenerational Planning considerations often influence equity release decisions and early repayment strategies. Understanding how family circumstances and objectives affect these decisions ensures that strategies align with broader family financial planning and inheritance objectives.

Family funding for early repayment represents one option for homeowners whose families wish to preserve inheritance whilst helping with current financial needs. Family members might provide funds for early equity release repayment in exchange for future inheritance rights or through formal lending arrangements. These arrangements require careful legal documentation and consideration of tax implications for all parties involved.

Intergenerational planning strategies might involve family members purchasing the property subject to equity release, enabling the homeowner to remain in residence whilst eliminating the equity release debt. These arrangements require specialist legal and tax advice to ensure they are structured appropriately and achieve the intended objectives for all family members.

Gift and inheritance planning considerations affect the timing and structure of early repayment strategies. The interaction between equity release balances, inheritance tax thresholds, and gift allowances creates opportunities for tax-efficient strategies that might influence the optimal approach to early repayment. Understanding these interactions ensures that decisions support broader estate planning objectives.

Family communication and planning processes become important when equity release affects inheritance expectations or when family members might be involved in funding early repayment. Open communication about intentions and expectations helps ensure that strategies align with family objectives whilst avoiding misunderstandings or conflicts about inheritance planning.

Conclusion

The decision to pay back equity release early requires careful analysis of multiple financial factors, including early repayment charges, interest savings, opportunity costs, and alternative strategies. Whilst early repayment can provide significant long-term savings by eliminating compound interest accumulation, the immediate costs and opportunity costs must be carefully evaluated against potential benefits. The availability of partial repayment options in modern equity release plans provides flexibility for homeowners to reduce their debt burden gradually whilst maintaining liquidity for other needs.

Understanding the regulatory framework and consumer protections available in the UK equity release market ensures that homeowners can make informed decisions about early repayment strategies. The Financial Conduct Authority’s regulation and Equity Release Council standards provide important safeguards whilst ensuring that products offer appropriate flexibility for changing circumstances. Professional guidance from qualified advisers becomes essential for navigating the complex decisions involved in equity release management and early repayment strategies.

The evaluation of alternatives to early repayment, including investment strategies, partial repayments, and downsizing options, enables homeowners to identify the approach that best suits their individual circumstances and objectives. The interaction between equity release decisions and broader financial planning, including tax implications and estate planning considerations, requires holistic analysis that considers both immediate and long-term consequences.

Ultimately, the decision to repay equity release early should align with the homeowner’s overall financial objectives, risk tolerance, and personal circumstances. Professional advice from qualified equity release advisers, independent financial advisers, and specialist solicitors provides essential support for making informed decisions that optimise financial outcomes whilst maintaining appropriate flexibility for future needs. The evolving nature of the equity release market and ongoing product innovation continue to provide new options for homeowners seeking to manage their equity release arrangements effectively.