The process of acquiring a residential mortgage within the UK market and receiving formal offers typically spans four to eight weeks, though this timeline can vary significantly based on individual circumstances and current market conditions. The journey begins with obtaining a mortgage in principle from an FCA-regulated lender and progresses through comprehensive affordability assessments mandated by the Mortgage Market Review guidelines.

Key Takeaways

The UK mortgage application process typically requires between four to eight weeks from initial application to formal mortgage offer, though complex cases or market conditions may extend this timeline. Initial mortgage in principle applications should ideally be submitted three to six months before serious property searching begins, allowing sufficient time to address any potential issues and secure optimal terms within the current UK market environment.

Missing documentation, incomplete applications, or changes in financial circumstances can cause significant delays in receiving mortgage offers from UK lenders, emphasising the importance of thorough preparation and professional guidance from FCA-regulated mortgage advisers. Obtaining a mortgage in principle typically takes between 24 to 48 hours when accurate information is provided, though some lenders may require additional time for complex financial situations.

How Long Does It Take to Get a UK Mortgage and Buy a Home?

The timeline for obtaining a mortgage and purchasing a residential property within the UK market encompasses several distinct phases, each governed by regulatory requirements established by the Financial Conduct Authority and influenced by current market dynamics. The comprehensive process involves multiple stakeholders including mortgage lenders, estate agents, solicitors, and surveyors, all operating within the framework of UK property law and mortgage regulations that have evolved significantly following the implementation of the Mortgage Market Review in 2014.

Understanding the intricacies of the UK mortgage application process requires appreciation of the regulatory environment that prioritises consumer protection whilst maintaining market efficiency. The Financial Conduct Authority’s mortgage conduct rules ensure that lenders conduct thorough affordability assessments, considering not only current income and expenditure but also potential future changes in circumstances and interest rates.

UK Market Insight: The UK mortgage market’s diversity, encompassing high street banks, building societies, challenger banks, and specialist lenders, means that processing times can vary considerably between institutions. Each lender maintains distinct underwriting criteria, risk appetites, and operational procedures that influence both the likelihood of mortgage approval and the time required to reach a lending decision.

How Long Does the UK Mortgage Application Process Usually Take?

Navigating the UK mortgage application process requires understanding of the structured timeline that typically spans four to eight weeks from initial submission to formal mortgage offer, though this duration can extend significantly based on the complexity of individual circumstances and prevailing market conditions. The process commences with the submission of a comprehensive mortgage application to an FCA-regulated lender, often facilitated by a qualified mortgage adviser who can navigate the diverse landscape of UK mortgage products and lender criteria.

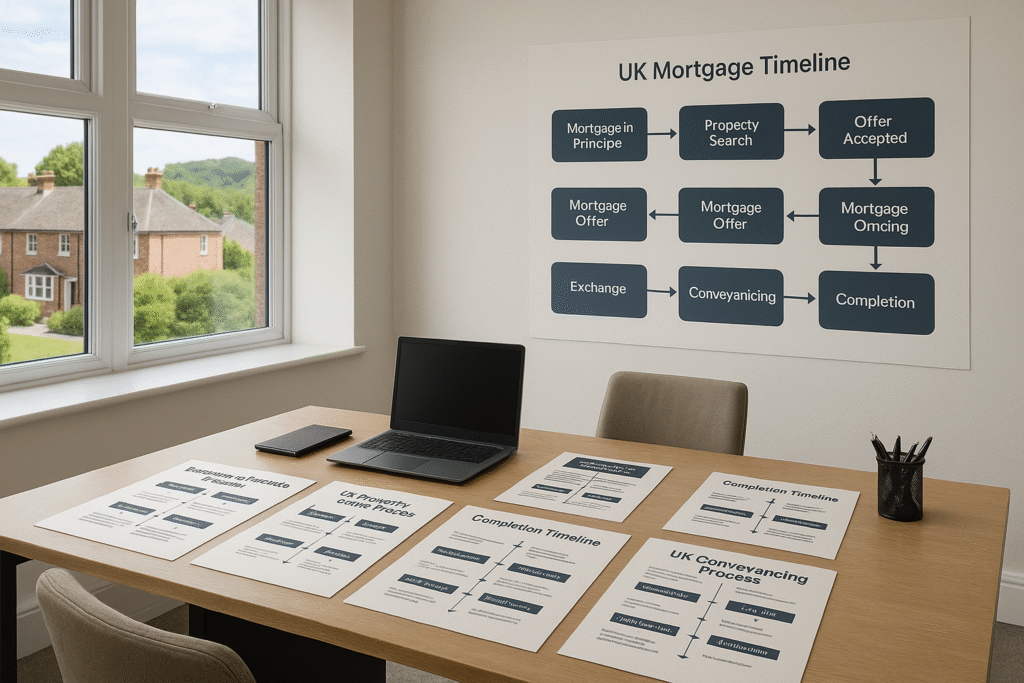

UK Mortgage Application Timeline

Week 1-2: Application submission and initial assessment, including automated credit scoring and preliminary affordability calculations

Week 2-3: Property valuation arranged through RICS-qualified surveyors, typically taking 5-10 working days

Week 3-6: Comprehensive underwriting assessment, including detailed analysis of financial circumstances and regulatory compliance checks

Week 6-8: Final mortgage offer issued, valid for 3-6 months, with specific conditions detailed

Following the initial application submission, UK lenders conduct a thorough mortgage valuation of the intended property, typically arranged through RICS-qualified surveyors who assess the property’s condition, market value, and suitability as security for the proposed mortgage advance. This valuation process serves multiple purposes within the UK regulatory framework, ensuring that the property provides adequate security for the loan whilst identifying any structural or legal issues that might affect the lender’s willingness to proceed.

What Are the Key Steps in the UK Mortgage Application Process?

Manoeuvring the UK mortgage application timeline requires methodical understanding of sequential steps that collectively determine the overall timeframe for securing residential finance within the British regulatory framework. The process begins with initial consultation with FCA-regulated mortgage advisers who assess borrowing capacity, review available mortgage products across the UK market, and provide guidance on the most appropriate lenders based on individual circumstances.

Important: The formal application stage involves comprehensive documentation submission, including proof of income through payslips, P60 certificates, and bank statements, alongside detailed expenditure analysis that demonstrates compliance with the Mortgage Market Review’s affordability requirements.

Following documentation review, the mortgage valuation survey represents a critical milestone within the UK application process, conducted by qualified surveyors who assess the property’s market value, structural condition, and suitability as mortgage security. This professional assessment, typically costing between £150 to £1,500 depending on property value and survey type, provides essential information that influences the lender’s final lending decision.

When Should I Apply for a UK Mortgage to Buy a Home Smoothly?

Understanding optimal timing for UK mortgage applications proves essential for ensuring smooth property transactions within the competitive British housing market, where preparation and strategic planning can significantly influence both the likelihood of successful mortgage approval and the ability to secure desired properties at acceptable prices. Prospective homebuyers should ideally commence their mortgage journey three to six months before beginning serious property searches.

Optimal UK Mortgage Timeline:

3-6 months before: Obtain mortgage in principle, address credit issues, gather documentation

1-3 months before: Active property searching with valid mortgage in principle

Upon offer acceptance: Submit formal mortgage application immediately

8-12 weeks later: Complete purchase with mortgage funds released

What Does the UK Mortgage Process Look Like from Start to Finish?

The comprehensive UK mortgage process encompasses multiple interconnected stages that collectively ensure both regulatory compliance and consumer protection whilst facilitating efficient property transactions within the British housing market. This structured approach, refined through decades of regulatory development and market evolution, balances the need for thorough risk assessment with practical considerations of timing and market dynamics.

How Long Does It Take to Get a UK Mortgage in Principle?

Securing a mortgage in principle represents the foundational step in the UK home-buying journey, typically achievable within 24 to 48 hours when complete and accurate information is provided to FCA-regulated lenders or their appointed representatives. This preliminary assessment involves initial evaluation of borrowing capacity based on basic financial information including income, expenditure, existing commitments, and credit profile.

Digital Advantage: Modern UK mortgage in principle applications can often be completed online or through telephone consultations with qualified mortgage advisers, streamlining the process whilst ensuring that applicants receive appropriate guidance on product selection and lender suitability based on their specific circumstances.

The validity period for UK mortgage in principle agreements typically ranges from 60 to 90 days, though some lenders may offer shorter or longer validity periods depending on their risk management policies and market conditions. This timeframe provides sufficient opportunity for property searching and offer negotiation whilst protecting lenders against significant changes in applicant circumstances.

What Is the Best Timeline for Buying a Home in the UK Today?

Establishing an optimal timeline for UK property purchase requires careful consideration of current market conditions, regulatory requirements, and individual circumstances that collectively influence both the likelihood of successful completion and the financial terms achievable within the prevailing economic environment. The contemporary UK property market, characterised by supply constraints, regional price variations, and evolving lending criteria, demands strategic planning.

Ideal UK Home-Buying Timeline

Months 1-2: Mortgage in principle applications, credit profile optimisation, market research

Months 2-4: Active property searching with valid mortgage in principle documentation

Months 4-6: Formal mortgage application, surveys, legal processes, completion

How Many Days Does It Take to Buy a House After You Apply?

The timeline from formal UK mortgage application submission to property completion typically spans eight to twelve weeks, encompassing multiple sequential and parallel processes that must align successfully to achieve smooth transaction completion within the British regulatory framework. This comprehensive period includes mortgage underwriting and approval, property surveys and valuations, legal searches and enquiries, and final completion procedures.

The initial mortgage processing phase, spanning approximately two to four weeks from application submission to formal mortgage offer, involves detailed underwriting assessment that evaluates borrower affordability under current Mortgage Market Review guidelines, property valuation through qualified surveyors, and comprehensive risk analysis that ensures compliance with lender criteria and regulatory requirements.

How Can I Speed Up the Process of Getting a UK Mortgage Offer?

Expediting the UK mortgage application process requires strategic preparation, efficient communication, and thorough understanding of lender requirements and potential obstacles that commonly cause delays within the British mortgage landscape. Successful acceleration of mortgage timelines depends on proactive management of documentation, early identification and resolution of potential issues, and effective coordination with professional advisers.

What Delays the UK Mortgage Application and How to Avoid Them?

Common UK Mortgage Delays:

- Documentation deficiencies: Incomplete bank statements, employment verification, or proof of deposit sources

- Financial changes: Job changes, salary variations, or new credit commitments during application

- Property issues: Survey findings, valuation discrepancies, or legal complications

- Lender capacity: Extended processing times during high market activity periods

Documentation deficiencies represent the most frequent cause of UK mortgage delays, particularly when applicants fail to provide complete bank statements, employment verification, or proof of deposit sources that satisfy lender requirements for anti-money laundering compliance and affordability assessment. Self-employed applicants face particular challenges, as UK lenders typically require two to three years of certified accounts, SA302 forms, and detailed business information.

How Fast Can I Get a UK Mortgage Offer After I Make an Offer?

Following property offer acceptance, the timeline for receiving a formal UK mortgage offer typically ranges from two to six weeks, depending on the complexity of the application, lender processing capacity, and any issues identified during the underwriting assessment or property valuation phases. This period encompasses comprehensive evaluation of both borrower affordability and property suitability as mortgage security.

Acceleration Strategy: Expediting mortgage offers after property offer acceptance requires immediate submission of complete and accurate mortgage applications, accompanied by all supporting documentation in formats that meet specific lender requirements for processing efficiency.

How to Get the Best UK Mortgage Agreement When Buying a Home?

Securing optimal mortgage terms within the UK market requires comprehensive research, strategic timing, and professional guidance that enables access to the most competitive products available across the diverse landscape of British lenders, including high street banks, building societies, challenger banks, and specialist mortgage providers that serve different market segments with varying criteria and pricing structures. This includes exploring New Mortgage Deals When Moving Homes to ensure borrowers can benefit from favourable rates and terms when relocating.

The foundation of securing favourable mortgage terms lies in maintaining excellent credit profiles through consistent payment histories, low credit utilisation ratios, and minimal adverse entries that might negatively impact lender risk assessments and pricing decisions. UK borrowers should regularly monitor their credit reports through agencies including Experian, Equifax, and TransUnion.

What Should I Know Before Starting the UK Application Process?

Comprehensive preparation before commencing UK mortgage applications encompasses understanding regulatory requirements, gathering necessary documentation, assessing personal financial circumstances, and developing realistic expectations regarding available products and likely outcomes within the current market environment. This preparatory phase substantially improves the likelihood of successful mortgage approval whilst potentially accessing more competitive terms.

How Long Does a UK Mortgage in Principle Last in 2025?

UK mortgage in principle agreements typically maintain validity for 60 to 90 days from the date of issue, though specific validity periods vary between lenders based on their risk management policies, market conditions, and regulatory compliance requirements that govern preliminary lending decisions within the British mortgage landscape. This timeframe provides adequate opportunity for property searching and offer negotiation.

2025 Market Conditions: Market conditions in 2025, including interest rate environments, regulatory changes, and economic uncertainty, may influence lender policies regarding mortgage in principle validity periods, with some institutions potentially adjusting periods based on market volatility and risk management objectives.

What to Prepare Before You Apply for a UK Mortgage or Buy a Home?

Comprehensive preparation for UK mortgage applications requires systematic gathering of financial documentation, assessment of personal circumstances, and strategic planning that optimises the likelihood of successful approval whilst accessing competitive terms within the current market environment. This preparation phase encompasses multiple components including credit profile optimisation, documentation compilation, financial planning, and market research.

Essential UK Mortgage Preparation Checklist

Financial Documents: 3 months payslips, P60 certificates, bank statements, proof of deposit sources

Credit Profile: Credit reports from Experian, Equifax, TransUnion; address any adverse entries

Employment Records: Employment contracts, HR letters, accountant-prepared documents for self-employed

Market Research: Local property values, transport links, school catchments, development plans

What Affects How Long It Takes to Get a Formal UK Mortgage Offer?

Multiple factors influence the timeline for receiving formal UK mortgage offers, ranging from borrower-specific circumstances and documentation quality to lender processing capacity and market conditions that collectively determine the efficiency of mortgage assessment and approval processes within the British lending landscape. Understanding these variables enables borrowers to manage expectations whilst taking proactive steps to optimise processing timelines.

Borrower complexity represents a primary determinant of processing timelines, with straightforward employed applicants typically experiencing faster assessment compared to self-employed individuals, those with multiple income sources, or applicants with adverse credit histories that require specialist underwriting review. Complex financial arrangements may necessitate additional documentation and specialist assessment that extends processing times.

How Long Does It Take to Get a UK Mortgage and Buy a Home?

The comprehensive timeline for securing a UK mortgage and completing a residential property purchase typically spans twelve to sixteen weeks from initial mortgage application through to legal completion, encompassing multiple sequential and parallel processes that must align successfully within the British regulatory framework and market environment. This extended timeline reflects the thorough due diligence requirements, consumer protection measures, and risk management procedures that characterise the UK mortgage and property markets.

What’s the Full Timeline for Finding a Home and Applying?

The complete UK home-buying journey typically commences with preliminary mortgage research and in-principle applications three to six months before serious property searching begins, allowing adequate time for financial preparation, market analysis, and strategic planning that optimises prospects for successful completion within the competitive British property market. This extended preparation phase enables comprehensive comparison of mortgage products and resolution of any credit profile issues.

Complete UK Home-Buying Timeline:

Months 1-2: Mortgage research, in-principle applications, financial preparation

Months 2-5: Active property searching with valid mortgage documentation

Months 5-6: Formal applications, surveys, legal processes, completion

How Long Does It Take to Get a UK Mortgage in Principle Approval?

Securing UK mortgage in principle approval typically requires 24 to 48 hours for straightforward applications when complete and accurate information is provided through digital channels or qualified mortgage advisers, though complex financial circumstances or specialist requirements may extend this timeline to several working days for manual underwriting review and assessment.

What’s Involved in the Steps to Getting a UK Mortgage Today?

Contemporary UK mortgage applications involve comprehensive digital processes that combine automated assessment systems with human underwriting expertise to ensure thorough evaluation of borrower circumstances whilst maintaining processing efficiency within the regulatory framework established by the Financial Conduct Authority. The modern mortgage journey encompasses multiple touchpoints including initial consultation, documentation submission, automated scoring, manual underwriting review, and final approval procedures.

Conclusion

The UK mortgage application timeline, typically spanning four to eight weeks from initial submission to formal offer, reflects the comprehensive regulatory framework and consumer protection measures that characterise the British lending landscape whilst ensuring thorough risk assessment and market stability. Understanding this timeline, including aspects such as Mortgage Offer Expiry, enables prospective homebuyers to plan effectively, prepare thoroughly, and manage expectations whilst navigating the complexities of mortgage applications within the current market environment.

Successful navigation of the UK mortgage process requires strategic preparation, professional guidance, and realistic timeline expectations that account for potential delays whilst optimising prospects for favourable outcomes through comprehensive documentation, credit profile management, and effective communication with all transaction parties. The investment in thorough preparation and professional advice typically yields significant benefits through improved approval prospects and competitive terms.

The evolving UK mortgage landscape, characterised by technological advancement, regulatory refinement, and market competition, continues to offer opportunities for well-prepared borrowers to secure competitive mortgage arrangements whilst benefiting from enhanced consumer protection and market transparency. Prospective homebuyers who understand these dynamics and adapt their strategies accordingly can optimise their mortgage prospects whilst contributing to the continued development of the UK housing market.