Joint mortgages represent a fundamental approach to property ownership in the UK, enabling multiple parties to combine their financial resources and creditworthiness to secure mortgage finance for residential property purchases. This collaborative lending arrangement has become increasingly popular among first-time buyers, family members, and investment partners seeking to navigate the competitive UK property market whilst sharing both the financial responsibilities and benefits of homeownership.

The UK joint mortgage market operates under specific regulatory frameworks established by the Financial Conduct Authority, with lending criteria that reflect the complexities of shared financial responsibility and property ownership. From joint tenancy arrangements to tenants in common structures, understanding the various forms of joint ownership is essential for making informed decisions about shared property investment and mortgage obligations.

This comprehensive guide explores the complete landscape of UK joint mortgages, covering eligibility requirements, application processes, ownership structures, and exit strategies that influence successful shared property finance. Understanding these elements enables prospective joint borrowers to navigate the complexities of collaborative homeownership whilst maximising the benefits of combined financial strength and shared property investment.

Understanding UK Joint Mortgage Fundamentals

Joint mortgages in the UK operate on the principle of shared financial responsibility, where multiple borrowers collectively assume liability for mortgage debt whilst benefiting from combined income assessment and enhanced borrowing capacity. Unlike individual mortgage applications where a single borrower bears full responsibility, joint mortgages distribute both the financial obligations and ownership rights among all named parties, creating a collaborative approach to property finance that can significantly improve access to homeownership.

The regulatory framework governing UK joint mortgages involves comprehensive oversight by the Financial Conduct Authority, which ensures that lenders assess all joint applicants according to established affordability criteria and responsible lending standards. This regulatory environment requires lenders to evaluate the combined financial circumstances of all parties whilst maintaining individual accountability for the full mortgage debt, creating a structure that protects both borrowers and lenders in collaborative lending arrangements.

UK lenders offer various joint mortgage products tailored to different borrower profiles and property ownership objectives, ranging from standard joint mortgages for couples and families to specialist products designed for investment partnerships and multi-generational property purchases. Understanding the distinctions between these products is crucial for selecting the most appropriate mortgage structure that aligns with the specific needs and circumstances of all joint borrowers.

The assessment process for UK joint mortgages involves detailed evaluation of all applicants’ financial circumstances, including income verification, credit history analysis, and affordability calculations that consider the combined financial strength of the borrowing group. This comprehensive assessment often results in enhanced borrowing capacity compared to individual applications, as lenders can consider multiple income sources and credit profiles when determining maximum loan amounts and interest rates.

Interest rates and terms for UK joint mortgages typically mirror those available for individual borrowers with similar combined credit profiles and financial circumstances, though the enhanced borrowing capacity and reduced individual risk may result in access to more competitive products and larger loan amounts. The shared nature of the financial responsibility can also provide additional security for lenders, potentially resulting in more favourable terms for borrowers with strong combined financial profiles.

Types of UK Joint Mortgage Arrangements

Standard joint mortgages represent the most common form of shared property finance in the UK, where all named borrowers assume equal responsibility for mortgage payments and typically hold equal ownership stakes in the property. This arrangement is particularly popular among married couples, civil partners, and long-term cohabiting partners who wish to purchase property together whilst sharing both the financial obligations and ownership benefits equally among all parties.

Joint Borrower Sole Proprietor mortgages offer a unique arrangement where multiple parties assume joint responsibility for mortgage payments whilst only one borrower holds legal ownership of the property. This structure is particularly beneficial for first-time buyers who require additional income support from family members to meet lending criteria whilst maintaining sole ownership of the property, often used by parents helping children access homeownership without becoming property owners themselves.

Family offset mortgages and guarantor arrangements provide alternative approaches to joint mortgage finance, where family members can support mortgage applications through savings deposits or guarantee arrangements without becoming joint borrowers or property owners. These products enable family support for property purchases whilst maintaining clear distinctions between financial support and property ownership, offering flexibility for multi-generational property finance strategies.

Investment partnership mortgages cater to joint borrowers seeking to purchase property for rental income or capital appreciation, with lending criteria that consider rental income potential and investment objectives alongside personal financial circumstances. These arrangements often involve more complex ownership structures and may require specialist legal advice to ensure appropriate protection for all parties’ investment interests and exit strategies.

Buy-to-let joint mortgages enable multiple investors to combine resources for rental property purchases, with lending criteria that focus on rental income potential and the combined investment experience of all parties. These arrangements require careful consideration of tax implications, rental income distribution, and property management responsibilities among all joint borrowers to ensure successful collaborative property investment.

Eligibility Criteria and Application Requirements

UK joint mortgage eligibility requires all named borrowers to meet individual lending criteria whilst demonstrating combined financial strength that enhances the overall application, whether applying for a standard residential mortgage or a Mortgage for Land. Lenders assess each applicant’s income, employment status, credit history, and existing financial commitments before evaluating the combined financial profile to determine maximum borrowing capacity and appropriate interest rates for the joint mortgage arrangement.

Income verification for joint mortgage applications involves comprehensive assessment of all borrowers’ earnings, including employment income, self-employment profits, rental income, and other regular income sources. Lenders typically require multiple years of financial documentation for each applicant, including payslips, tax returns, bank statements, and employment confirmations to verify the stability and sustainability of combined income levels.

Credit history requirements for UK joint mortgages involve individual credit assessments for each applicant, with lenders considering the strongest credit profile among the group whilst ensuring that no applicant has significant adverse credit that could compromise the application. The combined credit strength often enhances the overall application, though individual credit issues may require explanation and could affect interest rates or require larger deposits.

Deposit requirements for joint mortgages typically mirror those for individual applications, though the enhanced borrowing capacity may enable access to properties requiring larger deposits whilst maintaining the same loan-to-value ratios. Joint borrowers can combine their savings to meet deposit requirements, often enabling access to more expensive properties or more competitive mortgage products that require substantial deposits.

Employment and income stability requirements apply to all joint borrowers, with lenders seeking evidence of secure employment or established self-employment income that demonstrates the ability to maintain mortgage payments over the loan term. The combined employment stability of all parties often strengthens the application, though lenders may require additional security if any applicant has irregular income or recent employment changes.

Property Ownership Structures and Legal Considerations

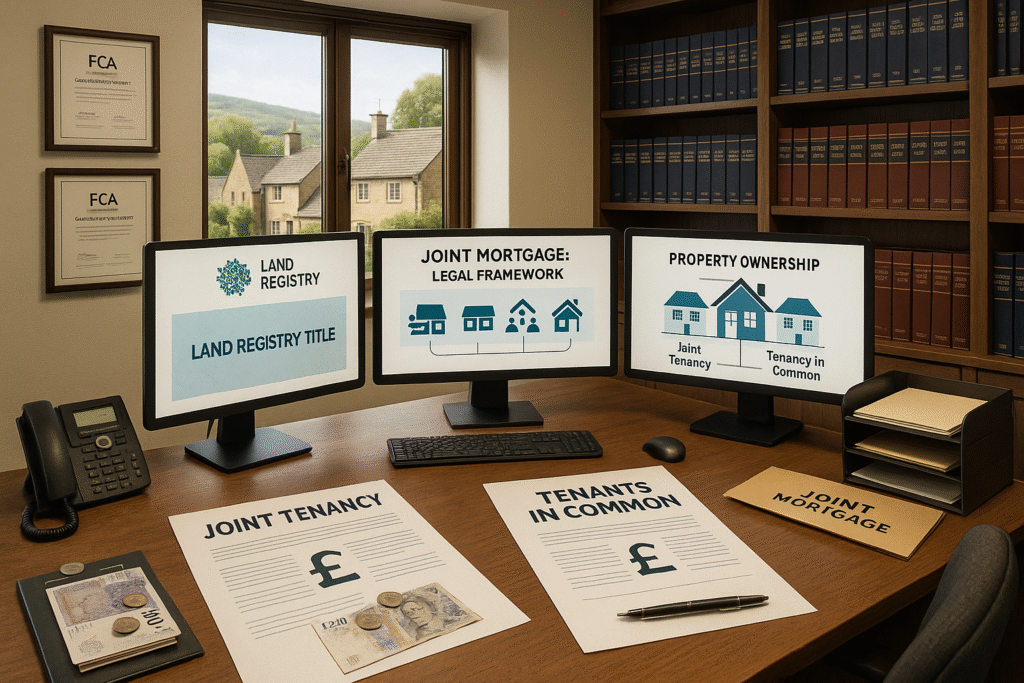

Joint tenancy represents the most common ownership structure for UK joint mortgages, where all owners hold equal shares in the property with automatic rights of survivorship that transfer ownership to surviving joint tenants upon death. This structure provides simplicity and security for married couples and long-term partners, ensuring that property ownership automatically transfers without the need for probate proceedings whilst maintaining equal ownership rights and responsibilities.

Tenants in common arrangements offer greater flexibility for joint mortgage borrowers who wish to hold unequal ownership shares or maintain individual control over their property interests. This structure enables joint borrowers to specify exact ownership percentages that may reflect different financial contributions or investment objectives, whilst allowing individual owners to transfer or inherit their shares independently of other joint owners.

The legal implications of joint property ownership extend beyond mortgage obligations to encompass inheritance planning, relationship breakdown provisions, and property disposal rights that require careful consideration during the mortgage application process. Professional legal advice is essential for joint borrowers to understand their rights and obligations under different ownership structures and to establish appropriate legal protections for all parties’ interests.

Trust arrangements and deed of trust documentation can provide additional legal protection for joint mortgage borrowers, particularly where ownership shares differ from mortgage liability or where parties wish to establish specific arrangements for property disposal or relationship breakdown. These legal structures require specialist advice but can provide valuable protection and clarity for complex joint ownership arrangements.

Property disposal and exit strategy planning should be considered from the outset of joint mortgage arrangements, with clear agreements about how property sales will be managed and proceeds distributed among joint owners. Understanding the legal requirements for property disposal under different ownership structures is essential for avoiding disputes and ensuring smooth exit processes when circumstances change.

Financial Benefits and Enhanced Borrowing Capacity

Combined income assessment represents the primary financial advantage of UK joint mortgages, enabling borrowers to access significantly larger mortgage amounts than would be available through individual applications. Lenders typically assess the combined gross income of all applicants, often applying standard income multiples to the total household income to determine maximum borrowing capacity that can substantially exceed individual borrowing limits.

Shared financial responsibility reduces the individual burden of mortgage payments whilst maintaining access to larger properties and more competitive mortgage products. Joint borrowers can distribute monthly payments according to their financial circumstances and ownership arrangements, often making homeownership more affordable for each individual party whilst accessing properties that would be unaffordable through individual finance.

Enhanced credit profiles result from combining multiple credit histories, often enabling access to more competitive interest rates and mortgage products than would be available to individual applicants with weaker credit profiles. Lenders consider the strongest credit characteristics among joint applicants whilst ensuring that combined creditworthiness meets their lending criteria for the requested mortgage amount and property type.

Deposit pooling enables joint borrowers to combine their savings to meet deposit requirements for more expensive properties or to access mortgage products that require larger deposits for competitive rates. This collaborative approach to deposit funding often enables access to better properties or more favourable mortgage terms than would be available through individual applications with smaller deposits.

Risk distribution among multiple borrowers provides additional security for lenders and can result in more competitive mortgage terms, as the shared responsibility reduces the risk of default compared to individual borrowing arrangements. This risk mitigation can translate into better interest rates, lower fees, or more flexible lending criteria for joint mortgage applications with strong combined financial profiles.

Application Process and Documentation Requirements

UK joint mortgage applications require comprehensive documentation from all named borrowers, including detailed financial information, employment verification, and legal identification that enables lenders to assess the combined application according to their lending criteria. The documentation process typically involves more complex coordination among multiple parties but follows similar principles to individual mortgage applications with additional requirements for joint ownership arrangements.

Financial documentation requirements include recent payslips, bank statements, tax returns, and employment confirmations for each applicant, along with details of existing financial commitments, savings, and investment holdings that contribute to the overall financial assessment. Joint applicants must provide complete financial disclosure to enable accurate affordability calculations and appropriate mortgage structuring for their combined circumstances.

Legal documentation for joint mortgage applications includes proof of identity, address verification, and legal capacity confirmations for each applicant, along with any relevant documentation relating to existing property ownership, divorce settlements, or other legal arrangements that may affect the mortgage application. Specialist legal advice may be required for complex ownership structures or where applicants have existing property interests.

Property documentation requirements include detailed property surveys, valuations, and legal searches that verify the property’s condition, value, and legal status for mortgage security purposes. Joint mortgage applications may require additional legal work to establish appropriate ownership structures and to ensure that all parties’ interests are properly protected through the mortgage and property ownership arrangements.

Professional advice coordination often involves mortgage brokers, solicitors, and financial advisers working together to ensure that joint mortgage applications are properly structured and documented to meet all parties’ needs and lender requirements. This professional support can be particularly valuable for complex joint mortgage arrangements or where applicants are unfamiliar with the joint borrowing process.

Managing Joint Mortgage Responsibilities and Payments

Payment arrangements for UK joint mortgages require clear agreements among all borrowers about how monthly mortgage payments will be managed and distributed, whether through equal sharing, proportional contributions based on income or ownership shares, or other arrangements that reflect the parties’ financial circumstances and ownership structure. Establishing clear payment protocols from the outset helps prevent disputes and ensures consistent mortgage payment management.

Joint and several liability means that each borrower remains fully responsible for the entire mortgage debt, regardless of payment arrangements among the parties or individual financial circumstances. This legal principle ensures that lenders can pursue any or all borrowers for the full mortgage amount if payments are missed, making it essential for joint borrowers to understand their individual exposure and to maintain clear communication about payment responsibilities.

Financial management systems for joint mortgages often involve dedicated bank accounts, automated payment arrangements, and regular financial reviews among all parties to ensure that mortgage obligations are met consistently and that any changes in individual circumstances are addressed promptly. Effective financial management reduces the risk of payment difficulties and helps maintain positive relationships among joint borrowers.

Insurance and protection arrangements should cover all joint borrowers to ensure that mortgage payments can be maintained if any party experiences illness, unemployment, or other circumstances that affect their ability to contribute to mortgage payments. Life insurance, income protection, and mortgage payment protection insurance can provide valuable security for joint mortgage arrangements and may be required by lenders for certain mortgage products.

Regular financial reviews among joint borrowers help identify potential issues early and enable proactive management of changing circumstances that may affect mortgage payments or ownership arrangements. These reviews should consider changes in income, employment, personal circumstances, and property values that may require adjustments to payment arrangements or mortgage terms.

Exit Strategies and Relationship Changes

Mortgage transfer arrangements enable one or more joint borrowers to exit the mortgage whilst transferring their obligations to remaining borrowers or new parties, subject to lender approval and affordability assessments. This process typically requires remortgaging or mortgage transfer applications that demonstrate the remaining borrowers’ ability to service the debt independently or with new joint borrowers.

Property sale and equity distribution provide the most straightforward exit strategy for joint mortgage arrangements, with proceeds distributed according to ownership shares after settling the mortgage debt and associated costs. Clear agreements about property sale procedures, marketing arrangements, and proceeds distribution help ensure smooth exit processes when joint borrowers wish to end their shared ownership arrangement.

Buyout arrangements enable one joint borrower to purchase other parties’ ownership shares whilst assuming full responsibility for the mortgage debt, subject to lender approval and property valuation. These arrangements require careful valuation of ownership interests and may involve remortgaging to release funds for purchasing other parties’ shares whilst maintaining appropriate loan-to-value ratios.

Legal separation and divorce procedures require specialist legal advice to ensure that joint mortgage obligations and property ownership rights are properly addressed through financial settlement arrangements. Court orders may be required to resolve disputes about property disposal or mortgage responsibility, making early legal advice essential for protecting all parties’ interests.

Relationship breakdown protection can be established through legal agreements that specify how joint mortgage arrangements will be managed if personal relationships change, including procedures for property disposal, mortgage transfer, or buyout arrangements. These protective measures help prevent disputes and provide clear frameworks for managing difficult circumstances that may arise during the mortgage term.

Tax Implications and Financial Planning

Capital gains tax considerations for joint property ownership depend on the ownership structure, individual circumstances, and property use, with different tax treatments applying to main residences, second homes, and investment properties. Joint owners should understand their individual tax positions and plan appropriately for potential capital gains tax liabilities when disposing of jointly owned property.

Inheritance tax planning for jointly owned property requires consideration of ownership structures, individual estate values, and available reliefs that may affect tax liabilities for surviving joint owners or beneficiaries. Professional tax advice can help optimise inheritance tax arrangements whilst maintaining appropriate property ownership structures for joint mortgage purposes.

Income tax implications for rental income from jointly owned investment properties require careful consideration of income distribution, allowable expenses, and individual tax positions that affect the overall tax efficiency of joint property investment. Proper tax planning can optimise the financial benefits of joint property investment whilst ensuring compliance with tax obligations.

Stamp duty land tax for joint property purchases follows standard rates and reliefs, though joint purchasers should consider their individual circumstances and available reliefs that may affect the overall tax cost of property acquisition. First-time buyer reliefs and other available exemptions should be considered when structuring joint property purchases to minimise tax costs.

Financial planning for joint mortgage arrangements should consider the long-term implications of shared property ownership, including retirement planning, estate planning, and investment strategy coordination among all parties. Professional financial advice can help ensure that joint mortgage arrangements support broader financial objectives whilst maintaining appropriate risk management and tax efficiency.

Professional Advice and Support Services

Mortgage broker services specialising in joint mortgage arrangements can provide valuable assistance in identifying suitable lenders and products whilst managing the complex application process for multiple borrowers. Specialist brokers understand the nuances of joint mortgage lending and can help structure applications to maximise borrowing capacity whilst ensuring appropriate terms and conditions for all parties.

Legal advice from solicitors experienced in joint property ownership is essential for establishing appropriate ownership structures, protecting individual interests, and ensuring compliance with legal requirements for joint mortgage arrangements. Specialist property lawyers can provide valuable guidance on ownership structures, exit strategies, and relationship breakdown protection that supports successful joint property ownership.

Financial planning advice helps joint mortgage borrowers understand the long-term implications of shared property ownership whilst optimising their overall financial arrangements for tax efficiency, investment growth, and risk management. Professional financial advisers can coordinate joint mortgage arrangements with broader financial planning objectives to ensure optimal outcomes for all parties.

Conclusion

Tax advice from qualified accountants or tax specialists ensures that joint property ownership arrangements are structured appropriately for tax efficiency whilst maintaining compliance with current tax legislation. Professional tax advice is particularly important for investment properties, complex ownership structures, or where joint owners have different tax circumstances that may affect optimal structuring.

Insurance and protection advice helps joint mortgage borrowers identify appropriate insurance coverage to protect their mortgage arrangements and property ownership interests against various risks including death, illness, unemployment, and property damage. Professional insurance advice ensures adequate protection whilst avoiding unnecessary costs or coverage gaps that could compromise joint mortgage arrangements.

Professional mortgage and legal advice is recommended when considering joint mortgage arrangements. Your property may be repossessed if you do not keep up repayments on your mortgage. This information is for general guidance only and should not be considered as personalised financial or legal advice.