A home extension can provide extra space without the hassle of moving house. Many families choose to add a room or expand their kitchen rather than searching for a larger property. In numerous cases, remortgaging for an extension can be a practical way to fund building work. You might borrow more than your existing mortgage balance, based on your available equity. When managed wisely, this approach can reduce overall borrowing costs and help you avoid juggling multiple loans. However, it’s important to consider your long-term budget carefully to ensure you don’t overstretch your monthly commitments.

When Remortgaging Works for Extensions

Remortgaging to fund a home extension works best when you have substantial equity in your property. Lenders typically require you to maintain at least 10-20% equity after the additional borrowing, though this varies between institutions. If your property has increased in value since you first purchased it, you may find you have more equity available than expected. This equity acts as security for the additional funds needed for your extension project.

The process involves replacing your existing mortgage with a new, larger one that covers both your outstanding balance and the extension costs. Interest rates on mortgages are generally more favourable than personal loans or credit cards, making this an attractive option for substantial building projects. Many homeowners find that the monthly payment increase is manageable when spread over the full mortgage term, typically 25-30 years.

Timing plays a crucial role in determining whether remortgaging suits your situation. If you’re currently on a competitive fixed rate with several years remaining, early repayment charges might make switching expensive. Conversely, if you’re approaching the end of your current deal or already on your lender’s standard variable rate, remortgaging could provide both better rates and the funds for your extension.

Your financial circumstances must demonstrate affordability for the increased borrowing. Lenders assess your income, expenditure, and credit history to ensure you can comfortably manage the higher monthly payments. Stable employment and a good credit score significantly improve your chances of approval and access to competitive rates.

The extension itself should add value to your property. Most lenders want assurance that the building work will increase the property’s worth by at least the amount being borrowed. Single-storey rear extensions, loft conversions, and additional bedrooms typically add substantial value, whilst more unusual modifications might be viewed less favourably by lenders.

Planning permission and building regulations approval are essential requirements. Lenders need confidence that your extension is legal and properly planned. Having these approvals in place before applying demonstrates that your project is well-organised and reduces the lender’s perceived risk.

Alternative Funding Options

Not everyone wants to change their existing mortgage arrangement. Several alternatives to remortgaging might save money or offer more flexible terms, depending on your circumstances and the scale of your extension project.

Secured Loans and Second Charge Mortgages provide access to funds whilst leaving your primary mortgage untouched. A secured loan places a charge on your property, similar to your main mortgage, but operates as a separate agreement. This option works particularly well if your current mortgage has excellent terms that you don’t want to lose. Interest rates on secured loans typically sit between mortgage rates and unsecured loan rates, making them competitive for larger extension projects.

The application process for secured loans resembles that of a primary mortgage, including credit checks, property valuations, and legal fees. However, you’ll have two separate monthly payments to manage, which requires careful budgeting. Secured loans often offer more flexibility in terms of early repayment and can sometimes be arranged more quickly than a full remortgage.

Unsecured Personal Loans work best for smaller extension projects or when you want to avoid using your property as security. These loans rely on your creditworthiness rather than your property value, making approval potentially faster with less paperwork. However, borrowing limits are typically lower, and interest rates higher than secured options.

Unsecured loans usually have shorter repayment terms, resulting in higher monthly payments but less interest paid overall. This option suits homeowners who want to clear the debt quickly and have sufficient income to manage the higher monthly commitments. The lack of security against your property means your home isn’t at risk if you encounter repayment difficulties.

Savings and Family Assistance can eliminate borrowing costs entirely. If you have substantial savings or access to family loans with favourable terms, this might prove the most cost-effective approach. Using savings avoids interest charges and debt commitments, though it does reduce your financial cushion for emergencies.

Some families arrange interest-free loans between relatives, dramatically reducing the cost of funding extensions. However, such arrangements should be properly documented to avoid misunderstandings and potential relationship difficulties. Consider the impact on your savings goals and emergency fund before committing all available cash to building work.

Mixed Funding Approaches combine different sources to optimise costs and flexibility. For instance, you might use savings for part of the project and a small loan for the remainder. Using buy-to-let equity for new investments can also provide additional funds for extensions without impacting your primary mortgage. This strategy can reduce the total amount borrowed whilst maintaining some financial reserves. Some homeowners use promotional credit card rates for materials and labour costs, though this requires careful management to avoid high interest charges.

Government grants and schemes occasionally support certain types of home improvements, particularly those improving energy efficiency. Whilst these don’t typically cover entire extension costs, they can reduce the overall funding requirement. Research local authority grants and national schemes that might apply to your project.

Application Process and Requirements

Applying for a remortgage to fund your extension requires careful preparation and organisation. The process typically takes 6-12 weeks from application to completion, so planning ahead is essential if you have specific timelines for your building work.

Financial Documentation forms the foundation of your application. Employed applicants need recent payslips, usually covering the last three months, plus bank statements showing income and expenditure patterns. Self-employed borrowers require more extensive documentation, including tax returns, accountant’s statements, and business bank statements covering 12-24 months.

Your credit report should be checked before applying, as any issues can delay or derail the process. Ensure all information is accurate and consider addressing any problems before submitting your application. Lenders use credit scoring to assess risk, and a strong credit history can secure better interest rates.

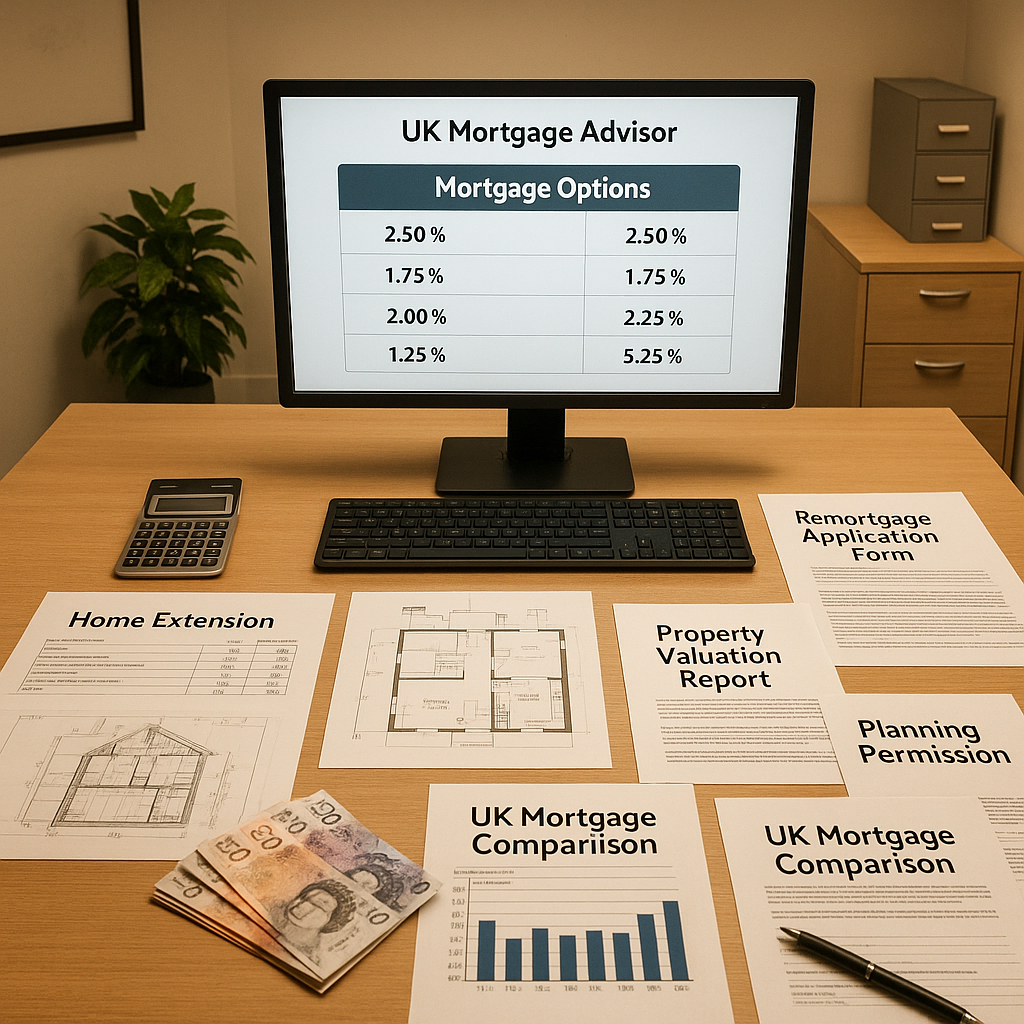

Extension Planning Documentation demonstrates that your project is well-considered and legally compliant. Building quotes from reputable contractors provide evidence of costs and help lenders assess whether the borrowing amount is reasonable. Detailed architectural plans show the scope and quality of the proposed work.

Planning permission and building regulations approval are typically required before funds are released. Some lenders accept applications subject to these approvals being obtained, but most prefer them to be in place. The planning process can take several months, so starting early is advisable.

Property Valuation assesses your home’s current worth and the likely value after completion of the extension. Lenders arrange this independently, though you’ll typically pay the fee. The valuation considers both the existing property and the proposed improvements, determining how much equity is available for borrowing.

Some lenders offer retention schemes where part of the loan is held back until the extension is completed and inspected. This protects the lender’s interests whilst ensuring you have access to funds as needed during construction.

Managing the Timeline requires coordination between your mortgage application, planning approvals, and construction schedule. Starting the mortgage process early provides flexibility if delays occur. Many homeowners begin mortgage applications whilst finalising building plans and obtaining quotes.

Consider seasonal factors that might affect both construction and property valuations. Building work is often easier in warmer months, whilst property valuations can fluctuate based on market conditions and seasonal demand.

Avoiding Common Pitfalls protects your application from unnecessary delays or rejection. Maintaining stable finances during the application process is crucial – avoid taking on new credit commitments or making large purchases that might affect your debt-to-income ratio.

Underestimating extension costs is a frequent problem that can leave you short of funds mid-project. Include contingency allowances of 10-20% for unexpected costs or changes to plans. Lenders prefer realistic budgets that account for potential overruns rather than optimistic estimates that might prove insufficient.

Ensure all contractors are properly qualified and insured, as lenders may request evidence of this. Using reputable builders with good references reduces the risk of problems that could affect your property’s value or the project’s completion.

Conclusion

Remortgaging to fund a home extension can be an effective way to create additional space whilst managing borrowing costs efficiently. Success depends on having sufficient equity, stable finances, and a well-planned extension that adds value to your property. The lower interest rates available through mortgage borrowing often make this approach more cost-effective than alternative funding methods for substantial projects.

However, remortgaging isn’t suitable for everyone. Consider your current mortgage terms, the scale of your extension, and your long-term financial plans before committing to increased borrowing. Alternative funding options like secured loans, personal loans, or savings might better suit smaller projects or specific circumstances.

Careful planning and realistic budgeting are essential regardless of your chosen funding method. Start the process early, gather all necessary documentation, and ensure your extension plans are properly approved before beginning construction. Professional advice from mortgage advisers can help you navigate the options and find the most suitable solution for your circumstances.

With the right approach, you can enjoy a larger, improved home without creating unmanageable debt. Focus on what aligns with your personal finances and extension goals, ensuring that your monthly commitments remain comfortable throughout the mortgage term.