Enhancing your mortgage credit score might seem overwhelming at first. Many may wonder how to improve their credit score, concerned that it could affect their chances of securing the ideal home.

Our extensive research has helped reveal efficient steps to correct these inaccuracies and further improve your comprehensive credit rating. Our guide will steer you through techniques such as managing loan balances and understanding the influence credit reference agencies have on your scores.

What are some ways to improve my credit score before applying for a mortgage?

We appreciate the need to elevate credit ratings prior to initiating the mortgage application process. Frequently reviewing your credit report is a crucial step in this direction.

It helps you identify any inaccuracies or outdated details that may reduce your score, such as wrongly noted late payments or obligations you’ve already fulfilled. Keeping all details up to date and correct can significantly improve your chances of obtaining a mortgage with desirable terms.

Furthermore, effective control of outstanding debt is crucial, especially if you are considering managing multiple mortgages. Try to maintain your credit card balances considerably lower than their limits, as this indicates prudent use of credit and can positively influence your credit history.

Regular on-time payment of loan balances indicates reliability to lenders, painting you as a borrower with less risk. These actions jointly help to improve your profile for mortgage lenders.

A good credit score paves the way in the mortgage market, leading to better rates and more choices, notes our experienced Mortgage Adviser at Mortgages RM.

What strategies can boost your credit score?

Enhancing your credit score is essential, particularly when you’re looking to apply for a mortgage. We want to guide you through strategies that can help boost your credit scores, making the mortgage process smoother for you.

- Always pay bills on time. Late payments can have a detrimental impact on your credit score.

- Maintain low credit card balances relative to your credit limit. This shows lenders you manage credit well.

- Regularly check your credit report for errors. Incorrect information can lower your score.

- Avoid closing old accounts as they contribute to a long credit history, which lenders favour.

- Limit applying for new credit. Multiple applications in a short period suggest higher risk to lenders.

- Register on the electoral roll at your current address; it helps agencies confirm personal details.

- Use a mix of different types of credit to show you can manage various accounts responsibly.

- If dealing with bad debt, paying off loan balances promptly boosts future lender confidence in your financial management.

- Maintain a well-managed joint bank account if applicable, as these can impact both parties’ scores positively or negatively based on their use.

- Ensure all direct debits and monthly repayments are set up correctly and cover at least the minimum payment due.

By focusing on these strategies, you will gradually improve your overall financial health and position yourself as a reliable borrower when applying for mortgages or other forms of credit in the future.

How does checking your credit report help improve your credit score?

Evaluating your credit report is instrumental in elevating your mortgage credit score. This action enables us to detect any errors or outdated details that could lower your score.

For example, you could uncover inaccuracies such as payments marked as late, which were actually punctual, or debts listed that you’ve already taken care of. Detecting these discrepancies quickly allows us to dispute them with the credit reference agencies to ensure they are corrected or eliminated.

This exercise can significantly uplift your credit score, improving your prospects of obtaining a mortgage.

Additionally, regular scrutiny of your credit file provides a transparent perspective on how lenders perceive your financial circumstances. It simplifies for us the process of understanding our present status and pinpointing areas that need improvement prior to applying for a mortgage.

If we discover high balances across several credit cards, we can aim to settle these, which positively affects our score progressively. Managing all accounts responsibly and staying aware of our financial status through our credit reports becomes a critical step in our journey for an improved credit score.

How to handle errors on your credit report

Addressing inaccuracies on your credit report can seem like an overwhelming task, yet it’s of utmost importance to ensure a mortgage with favourable terms. A poor credit score due to inaccuracies can hinder your chances of obtaining approval for a mortgage. Here’s how we suggest you address inaccuracies effectively:

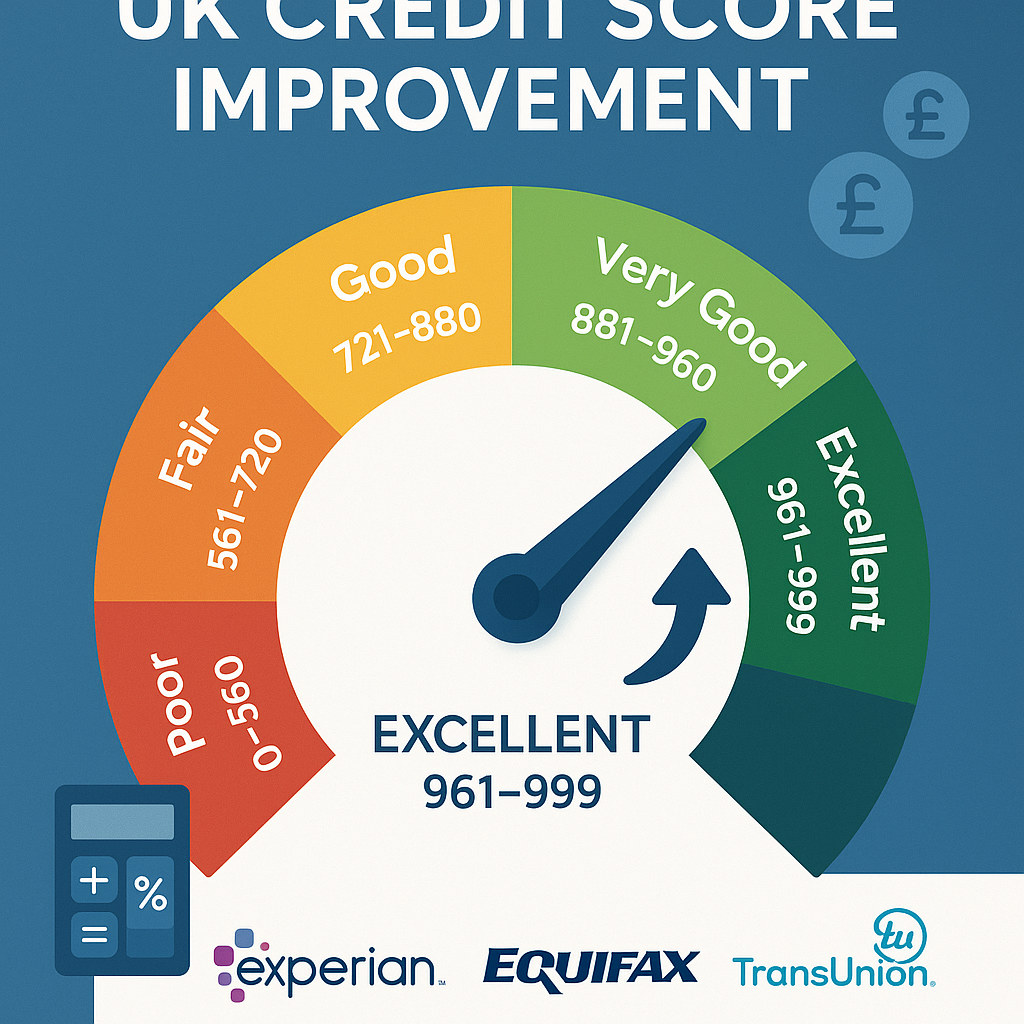

- Obtain a copy of your credit report from prominent UK credit reference agencies (Experian, Equifax, and TransUnion). Each agency might possess differing data; hence, it’s fundamental to check them all.

- Review your credit report thoroughly for any irregularities or errors. Look for outdated data, incorrect account status, or transactions you don’t recognise.

- Gather supporting documents for your claim. This could include bank statements, payment confirmations, or email correspondence.

- Contact the credit reference agency to dispute any inaccuracies you discover. Supply them with all relevant documentation and a clear outline of the error.

- Liaise with the creditor involved in the error if necessary. Some discrepancies may require you to resolve them directly with the creditor.

- Allow time for the agencies and creditors to investigate and amend the issue, usually 28-45 days is standard.

- Re-examine your credit report after this period to confirm the corrections have been implemented.

- Preserve all communication records during this process for your files, including emails, letters, and call transcripts.

- If a discrepancy persists despite your efforts, consider seeking assistance from a professional consultant specialised in credit reports.

- Practice patience and perseverance throughout; correcting inaccuracies on your credit report is the cornerstone for enhancing your mortgage credit score.

Following these procedures can significantly influence your prospect of securing a mortgage by ensuring that your credit report provides an accurate representation of your financial history and practices.

What is a credit score, and why is it important for a mortgage?

A credit score is a number that reflects your financial history and responsibility. It shows lenders how well you manage loans, credit card accounts, and other bills. Think of it as a school report card but for your finances.

A high credit score means you’re low risk, which makes mortgage lenders more willing to give you a loan with favourable terms such as lower interest rates.

Your credit score influences the success of your mortgage application.

Mortgage lenders view your credit score as an essential tool in their decision-making process. They use it to determine whether to approve your mortgage application and how much interest they should charge you.

If you have a higher credit score, you stand a better chance of securing not just any mortgage but one with advantageous rates that can save you money over time.

Next up: strategies on boosting this crucial number before applying for your home loan.

How does your credit score impact your ability to secure a mortgage?

Your credit score is a key factor in securing a mortgage. Lenders use it to assess how risky it is to lend you money. A higher credit score means you’re seen as lower risk, leading to more favourable mortgage rates and terms.

Conversely, a poor credit score can result in higher interest rates or even rejection of your application.

We have observed that lenders consider various factors within your credit file, such as missed payments, the age of your accounts, and how much available credit you’re using. These elements influence their decision on whether to offer you a mortgage and at what rate.

Understanding this process helps us appreciate why maintaining a strong credit score is crucial for anyone looking to get onto the property ladder or secure better mortgage options in the future.

What are the components of a credit score?

Understanding how credit scores work is crucial, especially for those of us looking to secure a mortgage. These scores are critical in determining the interest rates you’re offered and whether you’ll be accepted for a mortgage in the first place.

- Payment History (35%): This is the biggest part of your credit score. Lenders want to see that you pay your bills on time. Missed payments, bankruptcies, and other adverse marks can lower your score.

- Credit Utilisation (30%): This shows how much of your available credit you’re using. Keeping this ratio low is key. It’s suggested to use less than 30% of your available credit across all your accounts.

- Credit History Length (15%): Older accounts are valuable because they show you have long-term experience managing credit. The age of your oldest account, new accounts, and the average age of all accounts come under this category.

- Types of Credit Used (10%): Having a mix of accounts, such as mortgages, car loans, and credit cards, can improve your score. It shows that you can manage various types of credit well.

- New Credit Applications (10%): Each time you apply for a new line of credit or loan, it can cause a small drop in your score due to hard inquiries on your report. Applying for multiple lines of credit in a short period can have an adverse effect.

Each component contributes differently to your overall score, helping lenders assess how risky lending money to you might be. Focusing on these areas can help improve both your credit rating and your chances of securing a mortgage with favourable terms.

How do mortgage lenders view credit scores?

Shifting focus from understanding the elements of a credit score, it’s essential to know how mortgage lenders interpret these scores. They consider them as an indicator of your dependability in managing and repaying debt.

High credit scores could result in improved interest rates and terms on your mortgage because they signify low risk to lenders. Conversely, lower scores might raise doubts about your capacity to maintain repayments.

Your credit score has a significant impact in determining not just your eligibility for a mortgage but also the conditions you receive.

Mortgage lenders utilise these scores in conjunction with other factors like income and deposit size while deciding on your loan application during the decision-making process.

If your goal is standard mortgages, being aware that each lender sets their minimum credit score requirements is crucial. Our suggestion? Aim for well-managed accounts and punctual bill payments; this will create a favourable impression on potential lenders and provide access to competitive financing options.

What is the minimum credit score you need to get a UK mortgage?

The minimum credit score needed to obtain a mortgage varies with lenders, but generally, we find that most UK lenders look for credit scores above 600, with many preferring scores of 700 or higher for the best rates. For first-time homebuyers and local residents considering taking this step, understanding this threshold can help set realistic goals.

Specialist lenders offer more flexibility; some may consider applications from borrowers with lower credit scores, though typically at higher interest rates and with larger deposit requirements. Review your credit score before applying to see where you stand.

This action ensures you meet the minimum requirements and improves your chances of securing favourable mortgage terms.

We also suggest taking steps to boost your credit if it falls below these benchmarks. Paying bills on time, reducing debt levels, and refraining from applying for new credit in the months before your mortgage application are good strategies.

These actions can significantly help improve your credit score and make your aspiration of homeownership more achievable. Each lender has its criteria, so it’s smart to evaluate different lenders or consult with professionals such as us at Mortgages RM to explore all possible options suitable for you.

How to determine the minimum credit score required by mortgage lenders

We understand the challenge of figuring out the minimum credit score needed for a mortgage. Lenders use this score to decide if they can give you a loan and at what interest rate. Each lender sets their minimum, but generally, scores around 600-700 are required for most standard mortgages.

To find the exact figures, we advise checking with specific lenders or consulting UK credit reference agencies.

Knowing your own credit score is vital before applying for a mortgage. It helps you gauge where you stand and what steps you might need to take to improve it if necessary. Next, we’ll explore what factors influence these minimum requirements and how you can position yourself for success.

Factors that influence minimum credit score requirements

Several factors determine the minimum credit score requirements set by mortgage lenders. Understanding these can help you better prepare for your mortgage application and improve your chances of approval.

- Deposit Size: Larger deposits reduce the lender’s risk, often allowing for more flexible credit score requirements. A deposit of 20% or more typically opens up better mortgage options.

- Income Stability: Steady employment and consistent income can offset a lower credit score. Lenders prefer borrowers with stable job histories and reliable income sources.

- Debt-to-Income Ratio: Your total monthly debt payments compared to your income affects lending decisions. Lower ratios demonstrate better financial management and may compensate for credit score shortfalls.

- Property Type: Standard residential properties typically have lower credit score requirements than buy-to-let properties or unusual property types.

- Lender Type: High street banks, building societies, and specialist lenders all have different criteria. Some specialist lenders cater specifically to borrowers with lower credit scores.

- Mortgage Product: Fixed-rate mortgages might have different requirements compared to variable-rate products or interest-only mortgages.

- Economic Conditions: Market conditions and regulatory changes can influence how strict lenders are with their credit score requirements.

By understanding these factors, you can work on strengthening your overall application, not just your credit score, to improve your mortgage prospects.

How long does it take to improve your credit score for a mortgage?

Improving your credit score for a mortgage application requires patience and consistent effort. The timeline varies depending on your starting point and the specific issues affecting your score.

Quick improvements (1-3 months) can be achieved by:

- Correcting errors on your credit report

- Paying down credit card balances

- Registering on the electoral roll

- Setting up direct debits for all bills

Medium-term improvements (3-6 months) include:

- Establishing a pattern of on-time payments

- Reducing overall debt levels

- Avoiding new credit applications

- Building positive payment history

Long-term improvements (6+ months) involve:

- Demonstrating consistent financial behaviour

- Building a longer credit history

- Recovering from serious adverse events

- Establishing strong financial foundations

The key is to start improving your credit score as early as possible before you plan to apply for a mortgage. Even small improvements can make a significant difference to your mortgage options and the interest rates you’re offered.

Conclusion

Improving your credit score for a UK mortgage requires understanding the specific requirements of the British lending market. By focusing on timely payments, managing debt responsibly, and regularly monitoring your credit report through UK credit reference agencies, you can significantly enhance your mortgage prospects.

Remember that each lender has different criteria, and working with experienced mortgage advisers can help you navigate these requirements effectively. Start your credit improvement journey early, be patient with the process, and maintain consistent financial habits to achieve the best possible mortgage terms.

At Mortgages RM, we’re here to guide you through every step of improving your credit score and securing the right mortgage for your needs.