Demystifying UK Mortgage Options: A Clear Guide to Choosing the Right Loan for You

Exploring the variety of mortgage options can certainly feel like a challenging task. When faced with a multitude of choices, it’s quite common to feel a little overwhelmed about the correct direction to take, particularly if you’re entering the property or mortgage market either for the first time or considering remortgaging.

We comprehend how perplexing it can all appear at the start. A startling statistic reveals that nearly half of homeowners don’t fully understand their own mortgage terms. This sparked us to clarify these intricacies for you.

In this article, we will outline and discuss various UK mortgage types – from fixed-rate mortgages to those intriguing interest-only loans – hoping to illuminate how each operates. Our goal is to eliminate any confusion, providing you with a clear understanding so that you are equipped to make an informed decision about which mortgage suits your circumstances best.

Shall we begin demystifying these concepts together?

What Are the Different Types of UK Mortgages Available?

Moving on from the introduction, we’ll explain the different types of mortgages available to first-time homebuyers, homeowners, and real estate professionals. Understanding these different mortgage variations is essential for anyone looking to buy a home or finance property in the United Kingdom.

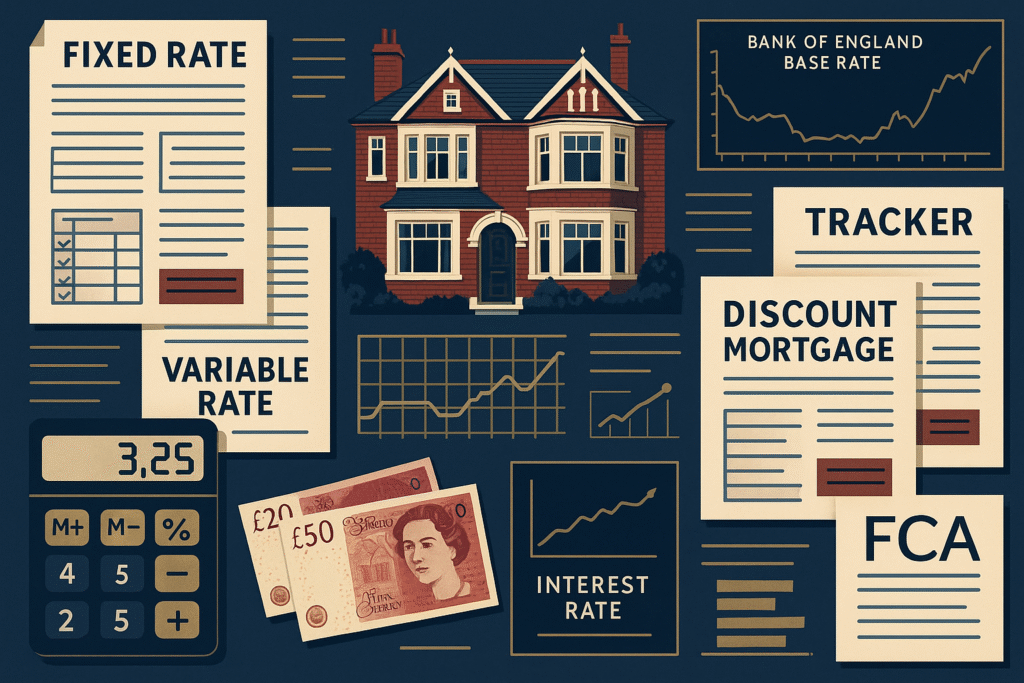

The UK mortgage market offers several main types of mortgage deals that you need to know about: fixed-rate mortgages, variable rate mortgages, tracker mortgages, and discount mortgage deals. A fixed-rate mortgage locks in your interest rate for a set period, meaning your monthly payments stay the same throughout that term.

With a variable rate mortgage, your interest can go up or down depending on changes in the market or Bank of England base rate. Tracker mortgages follow the Bank of England base rate plus an agreed-upon percentage, directly affecting your repayments if rates change.

Discount mortgages offer a reduction on the lender’s standard variable rate (SVR) for a specific time, making it easier to manage expenses early on but subject to increase afterwards when the discount period ends.

Understanding the UK mortgage landscape requires familiarity with regulatory frameworks established by the Financial Conduct Authority (FCA), which governs mortgage lending practices and ensures consumer protection. The FCA’s Mortgage Market Review (MMR) has significantly shaped how lenders assess borrowers’ ability to repay mortgages, introducing stricter affordability criteria and stress testing requirements.

The Bank of England’s Monetary Policy Committee plays a crucial role in determining the base rate, which directly influences mortgage interest rates across the UK. This base rate serves as the foundation for many mortgage products, particularly tracker mortgages, and its movements can significantly impact monthly mortgage payments for millions of homeowners.

UK mortgage terms typically range from 15 to 35 years, with 25 years being the most common choice among borrowers. The length of the mortgage term affects both monthly payment amounts and the total interest paid over the life of the loan. Longer terms generally result in lower monthly payments but higher total interest costs, whilst shorter terms increase monthly payments but reduce overall interest expenses.

Loan-to-value (LTV) ratios represent another fundamental aspect of UK mortgages, indicating the percentage of the property’s value that the mortgage covers. Higher LTV ratios generally result in higher interest rates and may require mortgage indemnity insurance to protect lenders against potential losses. First-time buyers often face challenges in achieving low LTV ratios due to deposit requirements, though government schemes like Help to Buy have been designed to address these barriers.

Understanding Fixed-Rate Mortgages in the UK

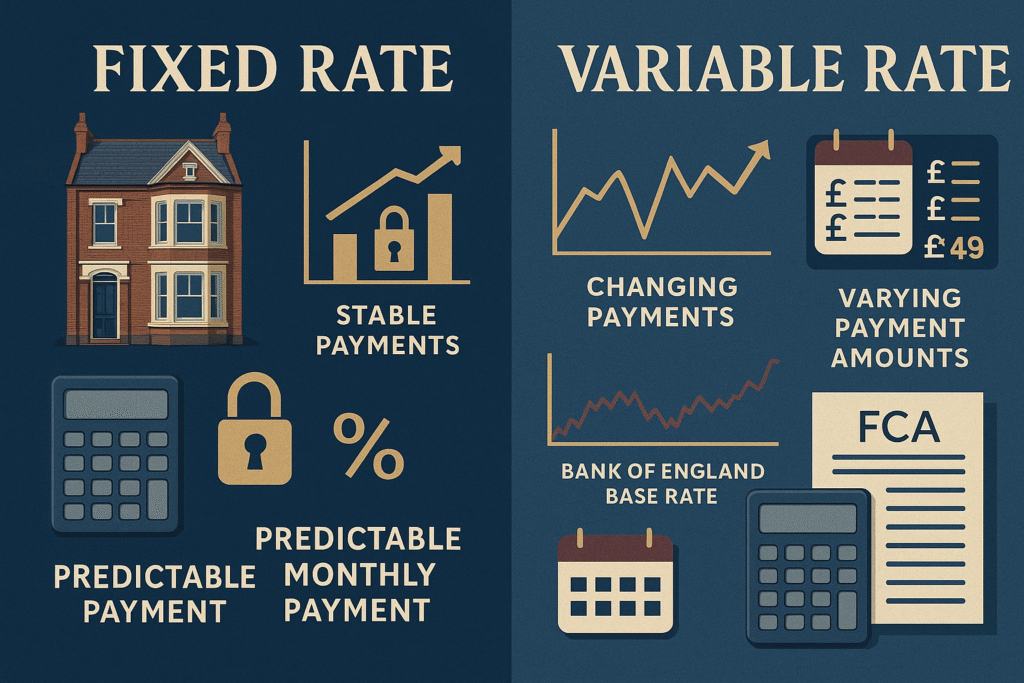

Fixed-rate mortgages represent one of the most popular mortgage types in the UK, offering borrowers certainty and predictability in their monthly payments. These mortgages lock in an interest rate for a specified period, typically ranging from two to ten years, with five-year fixed deals being particularly common among UK homeowners.

The appeal of fixed-rate mortgages lies in their ability to provide payment stability during the fixed period. Regardless of what happens to the Bank of England base rate or broader economic conditions, borrowers know exactly what their monthly mortgage payments will be. This predictability makes budgeting easier and provides protection against interest rate rises that could otherwise increase monthly costs significantly.

UK lenders offer fixed-rate mortgages with various term lengths, each serving different borrower needs and market conditions. Two-year fixed-rate deals often provide the lowest initial rates but require borrowers to remortgage more frequently. Five-year fixed deals offer a balance between competitive rates and longer-term stability, whilst ten-year fixed mortgages provide extended certainty but may carry higher rates to compensate lenders for the extended rate guarantee.

The structure of fixed-rate mortgages means that borrowers pay both interest and capital each month, gradually reducing the outstanding mortgage balance over time. This repayment structure ensures that borrowers build equity in their properties whilst making progress toward eventual mortgage-free ownership. The early years of a fixed-rate mortgage typically involve higher interest payments relative to capital repayment, with this balance shifting over time as the outstanding balance decreases.

Fixed-rate mortgages are particularly attractive during periods of low interest rates when borrowers can lock in favourable terms for extended periods. However, they also provide valuable protection during times of economic uncertainty when interest rates might be expected to rise. The trade-off for this certainty is that borrowers cannot benefit from interest rate decreases during the fixed period without remortgaging to a new deal.

Early repayment charges (ERCs) are a common feature of fixed-rate mortgages, designed to compensate lenders for the interest rate guarantee they provide. These charges typically apply during the fixed-rate period and can be substantial, often calculated as a percentage of the outstanding mortgage balance. Understanding ERC structures is crucial for borrowers who might need to repay their mortgages early due to property sales or other circumstances.

The end of a fixed-rate period represents a critical decision point for borrowers, who typically face a choice between remortgaging to a new fixed-rate deal or moving to their lender’s standard variable rate. Most borrowers choose to remortgage to avoid the higher costs associated with SVRs, making it important to begin the remortgaging process several months before the fixed period expires.

Fixed-rate mortgages are subject to the same regulatory requirements as other UK mortgage products, including affordability assessments and stress testing. Lenders must ensure that borrowers can afford payments not only at the initial fixed rate but also at higher rates that might apply after the fixed period ends. This stress testing helps protect borrowers from payment shock when fixed-rate periods expire.

Variable Rate Mortgages: Flexibility and Risk in the UK Market

Variable rate mortgages offer a different approach to home financing, with interest rates that can change throughout the mortgage term. Unlike fixed-rate mortgages, these products expose borrowers to interest rate movements, creating both opportunities for savings and risks of increased costs depending on market conditions and Bank of England policy decisions.

The UK variable rate mortgage market encompasses several distinct product types, each with different characteristics and risk profiles. Standard variable rate mortgages represent the most basic form, with rates set by individual lenders based on their own criteria and market conditions. These rates typically move in response to Bank of England base rate changes but are not directly linked to them, giving lenders discretion in rate-setting decisions.

Tracker mortgages provide a more transparent form of variable rate lending, with rates explicitly linked to the Bank of England base rate plus a specified margin. When the base rate increases by 0.25%, tracker mortgage rates increase by the same amount, providing clear visibility into rate movements. This transparency appeals to borrowers who want to understand exactly how their mortgage rates are determined and who believe they can benefit from base rate decreases.

Discount variable rate mortgages offer reductions from lenders’ standard variable rates for specified periods, typically two to five years. These products can provide attractive initial rates but expose borrowers to potential rate increases when discount periods end. The underlying SVR can also change during the discount period, affecting the discounted rate accordingly.

The appeal of variable rate mortgages lies in their potential for rate decreases that can reduce monthly payments and total mortgage costs. Borrowers who choose variable rates often believe that interest rates will remain stable or decrease over time, allowing them to benefit from lower payments compared to fixed-rate alternatives. This strategy can be particularly attractive when fixed rates are high relative to current variable rates.

However, variable rate mortgages also carry significant risks that borrowers must carefully consider. Interest rate increases can substantially raise monthly payments, potentially straining household budgets and reducing funds available for other purposes. Unlike fixed-rate borrowers, those with variable rate mortgages cannot predict their future payment obligations with certainty, making financial planning more challenging.

The timing of variable rate mortgage decisions can significantly impact outcomes, with market conditions and interest rate cycles playing crucial roles in determining success. Borrowers who choose variable rates during periods of high interest rates may benefit from subsequent decreases, whilst those who select these products when rates are low may face increases that make fixed-rate alternatives appear more attractive in retrospect.

Variable rate mortgages are subject to the same regulatory oversight as other UK mortgage products, with lenders required to assess borrowers’ ability to afford payments at higher interest rates. This stress testing helps ensure that borrowers can manage payment increases, though it cannot eliminate the financial pressure that rate rises can create for household budgets.

Tracker Mortgages: Transparency in UK Interest Rate Movements

Tracker mortgages represent a specific category of variable rate mortgages that offer complete transparency in interest rate movements by directly linking to the Bank of England base rate. These products have gained popularity among UK borrowers who value clarity in rate-setting mechanisms and believe they can benefit from base rate movements over time.

The structure of tracker mortgages is straightforward: the interest rate consists of the Bank of England base rate plus a fixed margin set by the lender. For example, a tracker mortgage with a 1.5% margin would charge 1.75% when the base rate is 0.25%, and 2.25% when the base rate increases to 0.75%. This direct relationship ensures that borrowers immediately benefit from base rate decreases and face increased costs when rates rise.

UK tracker mortgages are available with various margin levels, typically ranging from 0.5% to 3% above the base rate depending on the borrower’s credit profile, loan-to-value ratio, and market conditions. Lower margins generally require larger deposits and stronger credit histories, whilst higher margins may be available to borrowers with smaller deposits or less perfect credit records.

The transparency of tracker mortgages appeals to borrowers who want to understand exactly how their mortgage rates are determined and who prefer not to rely on lender discretion in rate-setting. Unlike standard variable rate mortgages, where lenders can choose whether and by how much to adjust rates in response to base rate changes, tracker mortgages provide automatic and proportional adjustments that mirror Bank of England policy decisions.

Tracker mortgages can be particularly attractive during periods when the Bank of England is cutting interest rates, as borrowers immediately benefit from reduced monthly payments. The 2008 financial crisis and subsequent period of ultra-low interest rates demonstrated the potential benefits of tracker mortgages, with some borrowers enjoying rates below 1% when the base rate was reduced to historic lows.

However, tracker mortgages also expose borrowers to the full impact of interest rate increases, with monthly payments rising immediately when the Bank of England raises the base rate. This exposure can create significant payment shock during periods of rapid rate increases, as experienced by many tracker mortgage holders during previous interest rate cycles.

The choice between tracker mortgages and other variable rate products often depends on borrowers’ views about future interest rate movements and their tolerance for payment uncertainty. Borrowers who believe that base rates will remain stable or decrease may prefer tracker mortgages for their transparency and immediate benefit from rate cuts. Those who are concerned about rate increases might prefer discount variable rate mortgages or fixed-rate products that provide more predictable payments.

Tracker mortgages are available for various terms, from short-term deals lasting two to three years to lifetime trackers that maintain the base rate link throughout the mortgage term. Lifetime trackers can be particularly attractive to borrowers who want to avoid the need for regular remortgaging whilst maintaining the flexibility to benefit from interest rate movements over the long term.

Discount Mortgages: Temporary Relief in the UK Market

Discount mortgages offer borrowers reduced interest rates for specified periods by providing discounts from lenders’ standard variable rates. These products can provide attractive initial rates and lower monthly payments during the discount period, making them appealing to borrowers seeking short-term payment relief or those who expect their financial circumstances to improve over time.

The structure of discount mortgages involves two key components: the lender’s standard variable rate and the discount amount. The discount is typically expressed as a percentage reduction from the SVR, such as 1% or 2% below the standard rate. The actual interest rate paid by borrowers equals the SVR minus the discount amount, creating a rate that can still fluctuate as the underlying SVR changes.

UK discount mortgages are commonly available for periods ranging from two to five years, with the discount applying only during this initial term. After the discount period expires, borrowers typically move to the lender’s full standard variable rate unless they choose to remortgage to a new deal. This structure means that borrowers must plan for potentially significant payment increases when discount periods end.

The appeal of discount mortgages lies in their ability to provide immediate payment relief compared to other mortgage products. Borrowers facing affordability constraints or those who expect their incomes to increase over time may find discount mortgages helpful in managing initial homeownership costs. First-time buyers, in particular, may benefit from the lower initial payments whilst they establish themselves in their careers and improve their financial positions.

However, discount mortgages carry several risks that borrowers must carefully consider. The underlying standard variable rate can increase during the discount period, raising the discounted rate accordingly. Additionally, SVRs are typically higher than competitive fixed or tracker rates, meaning that even discounted rates may not represent the best available deals in the market.

The temporary nature of discount mortgages creates uncertainty about future payment obligations, as borrowers cannot predict what their payments will be when discount periods end. This uncertainty can complicate financial planning and may result in payment shock if SVRs have increased significantly by the time discounts expire. Borrowers must be prepared to remortgage at the end of discount periods to avoid potentially expensive SVR payments.

Discount mortgages are particularly sensitive to lender pricing strategies, as changes to standard variable rates directly affect the discounted rates paid by borrowers. Lenders may adjust SVRs for various reasons, including changes in funding costs, competitive positioning, or profit margin requirements. These adjustments can occur independently of Bank of England base rate movements, creating additional uncertainty for discount mortgage holders.

The regulatory environment surrounding discount mortgages requires lenders to assess borrowers’ ability to afford payments at the full standard variable rate, not just the discounted rate. This stress testing helps ensure that borrowers can manage payments when discount periods end, though it cannot eliminate the financial pressure that rate increases can create.

Interest-Only Mortgages: Capital Repayment Strategies in the UK

Interest-only mortgages represent a specialised segment of the UK mortgage market, allowing borrowers to pay only the interest charges on their loans whilst deferring capital repayment until the end of the mortgage term. These products have become more restricted since the 2008 financial crisis but remain available for borrowers who meet stringent lender criteria and demonstrate credible repayment strategies.

The fundamental structure of interest-only mortgages differs significantly from traditional repayment mortgages. Monthly payments cover only the interest charges on the outstanding loan balance, which remains unchanged throughout the mortgage term unless borrowers make voluntary capital repayments. This structure results in lower monthly payments compared to repayment mortgages but requires separate arrangements for accumulating the capital needed to repay the loan at maturity.

UK regulatory changes following the financial crisis have significantly tightened the criteria for interest-only mortgages. The Financial Conduct Authority’s Mortgage Market Review introduced strict requirements for repayment strategy verification, with lenders required to assess the credibility and adequacy of borrowers’ plans for capital accumulation. These regulations aim to prevent the problems experienced during the previous decade when many borrowers reached the end of interest-only terms without sufficient funds for repayment.

Interest-only mortgages are now primarily available to borrowers with higher incomes, substantial deposits, and credible repayment strategies. Typical requirements include minimum annual incomes of £75,000 or more, deposits of at least 25% of the property value, and detailed evidence of how borrowers plan to repay the capital at maturity. These stringent criteria reflect lenders’ assessment of the additional risks associated with interest-only lending.

Acceptable repayment strategies for interest-only mortgages include regular contributions to investment accounts, pension planning, property sales, or business asset accumulation. Lenders require detailed documentation of these strategies, including investment projections, pension statements, or business plans. The credibility of repayment strategies is crucial for mortgage approval, with lenders assessing both the likelihood of success and the adequacy of projected returns.

The buy-to-let market represents a significant portion of interest-only mortgage lending, with property investors using these products to maximise cash flow from rental properties. Buy-to-let interest-only mortgages are assessed differently from residential products, with lenders focusing on rental yield and property investment experience rather than personal income alone. The ability to claim mortgage interest as a tax-deductible expense has historically made interest-only mortgages attractive to property investors, though recent tax changes have reduced these benefits.

Interest-only mortgages can provide significant cash flow advantages for borrowers who can productively use the money that would otherwise go toward capital repayment. Sophisticated investors might direct these funds toward higher-yielding investments, additional property acquisitions, or business expansion. The success of this strategy depends on achieving investment returns that exceed mortgage interest rates whilst successfully accumulating capital for eventual repayment.

The risks associated with interest-only mortgages are substantial and require careful consideration. Capital repayment risk represents the primary concern, as borrowers must successfully execute their repayment strategies over many years. Investment underperformance, market volatility, or changes in personal circumstances can jeopardise capital accumulation, potentially leaving borrowers unable to repay their mortgages when due.

Specialist Mortgages: Addressing Unique Circumstances in the UK

The UK mortgage market includes various specialist products designed to serve borrowers whose circumstances don’t fit standard lending criteria. These mortgages address specific needs such as property investment, credit history challenges, or unique employment situations, providing financing solutions that might not be available through mainstream mortgage products.

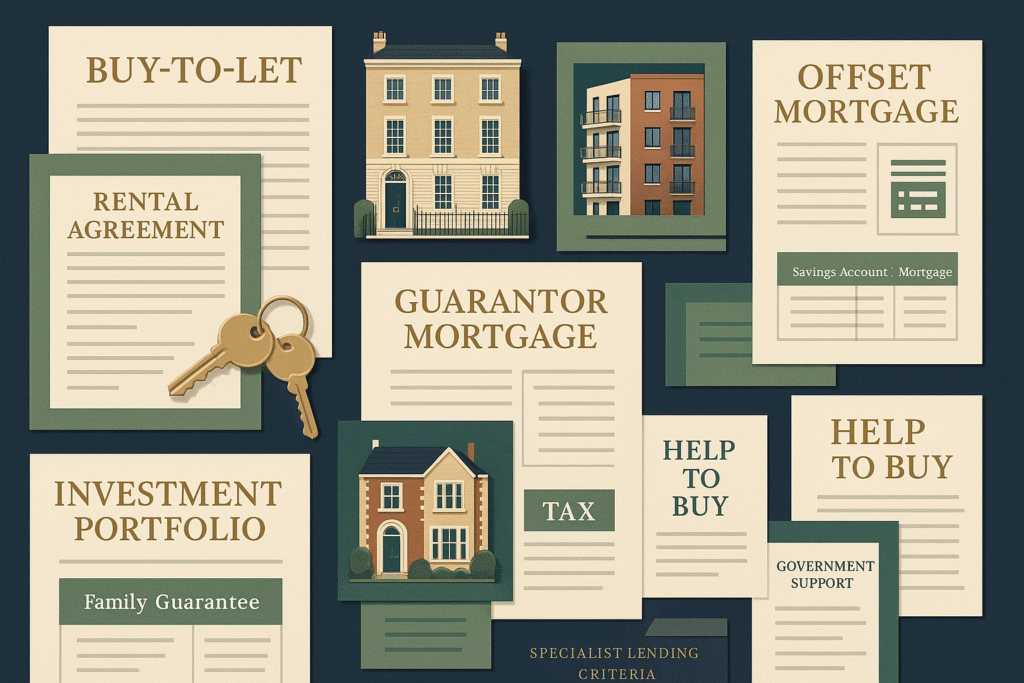

Buy-to-let mortgages represent the largest category of specialist mortgages, designed specifically for property investors who purchase properties to rent to tenants. These mortgages are assessed differently from residential products, with lenders focusing on rental income potential rather than borrowers’ personal incomes alone. Typical buy-to-let mortgages require rental income to cover 125% to 145% of monthly mortgage payments, ensuring adequate cash flow to manage void periods and property maintenance costs.

The buy-to-let mortgage market has evolved significantly in response to regulatory and tax changes affecting property investment. The introduction of additional stamp duty charges for second properties and restrictions on mortgage interest tax relief have impacted the economics of property investment, leading to changes in buy-to-let mortgage products and lending criteria. Despite these challenges, buy-to-let mortgages remain popular among investors seeking to build property portfolios or generate rental income.

Guarantor mortgages provide solutions for borrowers who cannot meet standard lending criteria due to insufficient deposits, limited credit history, or affordability constraints. These products involve a family member or close friend agreeing to guarantee the mortgage payments, providing additional security for lenders and enabling borrowers to access mortgage finance that might otherwise be unavailable. Guarantor mortgages can be particularly valuable for first-time buyers struggling to save large deposits or establish credit histories.

The structure of guarantor mortgages varies among lenders, with some requiring guarantors to provide security against their own properties whilst others accept guarantees based on income and creditworthiness alone. Guarantors must understand their obligations and potential liabilities, as they become responsible for mortgage payments if borrowers default. Legal advice is often recommended for both borrowers and guarantors to ensure they understand the implications of these arrangements.

Offset mortgages link borrowers’ savings accounts to their mortgages, reducing the balance on which interest is calculated. These products can provide tax-efficient benefits for higher-rate taxpayers who would otherwise pay tax on savings interest, whilst also offering flexibility to access savings when needed. Offset mortgages are particularly attractive to borrowers with substantial savings who want to reduce mortgage costs without losing access to their funds.

The mechanics of offset mortgages involve calculating interest on the mortgage balance minus any savings held in linked accounts. For example, a borrower with a £200,000 mortgage and £50,000 in savings would pay interest on only £150,000. This arrangement can significantly reduce mortgage costs over time whilst preserving savings liquidity for emergencies or opportunities.

Self-employed mortgages address the unique challenges faced by borrowers with non-standard employment arrangements. Self-employed individuals often find it difficult to demonstrate stable income through traditional payslips and employment contracts, requiring alternative approaches to income verification. Specialist self-employed mortgages may accept business accounts, tax returns, or accountant references as evidence of income sustainability.

The assessment of self-employed mortgage applications typically requires longer trading histories and more comprehensive financial documentation compared to employed borrowers. Lenders may average income over two or three years to account for fluctuations in self-employed earnings, whilst also considering the nature and stability of the business. Professional contractors and freelancers may face additional scrutiny regarding the sustainability of their income streams.

Government Schemes and Support for UK Homebuyers

The UK government has introduced various schemes designed to support homebuyers, particularly first-time buyers and those with limited deposits. These initiatives aim to address affordability challenges in the housing market and help more people achieve homeownership despite rising property prices and deposit requirements.

Help to Buy schemes have been among the most significant government interventions in the UK housing market, providing support through equity loans and mortgage guarantees. The Help to Buy equity loan scheme allows eligible buyers to borrow up to 20% of the property value (40% in London) from the government, requiring only a 5% deposit and a 75% mortgage to complete the purchase. This arrangement significantly reduces the deposit burden for first-time buyers whilst providing developers with increased demand for new-build properties.

The structure of Help to Buy equity loans involves interest-free periods for the first five years, after which borrowers pay interest on the government loan at rates that increase annually. Borrowers can repay the equity loan at any time without penalty, with repayment amounts based on the property’s current value rather than the original loan amount. This arrangement means that borrowers benefit from property value increases but also bear the risk of value decreases.

Shared Ownership schemes provide alternative routes to homeownership for buyers who cannot afford full ownership. These schemes allow buyers to purchase shares in properties (typically 25% to 75%) whilst paying rent on the remaining portion. Buyers can increase their ownership shares through a process called “staircasing,” eventually achieving full ownership if desired and affordable.

The assessment criteria for Shared Ownership schemes typically focus on local connection requirements and income limits designed to target support at those who need it most. Eligible buyers must demonstrate that they cannot afford suitable housing through conventional mortgage arrangements whilst having sufficient income to manage the combined costs of mortgage payments, rent, and service charges.

Right to Buy schemes continue to provide opportunities for council tenants to purchase their homes at discounted prices. These schemes offer substantial discounts based on tenancy length and property type, enabling long-term tenants to achieve homeownership at below-market prices. However, Right to Buy purchases are subject to restrictions on resale for specified periods to prevent immediate speculation.

The Mortgage Guarantee Scheme represents a more recent government intervention, providing lenders with guarantees on high loan-to-value mortgages to encourage lending to borrowers with small deposits. This scheme aims to address the reduction in high-LTV lending that occurred following the 2008 financial crisis, making homeownership more accessible to buyers with limited savings.

First Homes schemes provide discounted properties for local first-time buyers, key workers, and existing residents in designated areas. These schemes offer new-build properties at discounts of at least 30% from market value, with restrictions ensuring that discounts are preserved for future eligible buyers. First Homes schemes aim to address local affordability challenges whilst supporting community sustainability.

Choosing the Right UK Mortgage: Assessment and Decision-Making

Selecting the appropriate mortgage product requires careful assessment of personal circumstances, financial objectives, and risk tolerance. The complexity of the UK mortgage market, with its various product types and lending criteria, makes it essential for borrowers to understand their options and make informed decisions based on comprehensive analysis of their situations.

The starting point for mortgage selection involves honest assessment of financial circumstances, including income stability, expenditure patterns, and future plans. Borrowers must consider not only their current ability to afford mortgage payments but also their capacity to manage payments if circumstances change. This assessment should include consideration of potential interest rate increases, changes in employment, or family circumstances that might affect affordability.

Deposit availability represents a crucial factor in mortgage selection, as it directly affects the range of products available and the interest rates offered. Borrowers with larger deposits typically access better rates and more flexible terms, whilst those with smaller deposits may face higher rates and more restrictive criteria. Understanding the relationship between deposit size and mortgage terms helps borrowers make informed decisions about saving strategies and timing of property purchases.

The choice between fixed and variable rate mortgages depends on individual risk tolerance, market outlook, and financial circumstances. Borrowers who prioritise payment certainty and budget stability may prefer fixed-rate mortgages, particularly during periods of low interest rates when attractive fixed rates are available. Those who are comfortable with payment uncertainty and believe interest rates will remain stable or decrease may prefer variable rate products.

Term length decisions significantly impact both monthly payments and total mortgage costs, requiring careful consideration of long-term financial objectives. Longer mortgage terms reduce monthly payments but increase total interest costs, whilst shorter terms increase monthly payments but reduce overall expenses. Borrowers must balance affordability constraints with cost efficiency objectives when selecting mortgage terms.

The importance of professional advice cannot be overstated in mortgage selection, particularly given the complexity of the UK mortgage market and the long-term financial implications of mortgage decisions. Mortgage brokers can provide valuable insights into product availability, lending criteria, and market conditions that individual borrowers might not be able to access independently.

Mortgage brokers offer several advantages in the selection process, including access to exclusive products not available directly to consumers, expertise in matching borrowers with suitable lenders, and assistance with application processes. By understanding the role of a mortgage broker, borrowers can make more informed decisions and leverage their expertise effectively. Experienced brokers understand lender criteria and can identify products that align with borrowers’ specific circumstances, potentially saving time and improving approval prospects.

The timing of mortgage applications can significantly impact available options and rates, making it important to monitor market conditions and plan applications strategically. Interest rate cycles, seasonal variations in lending activity, and changes in lender criteria can all affect mortgage availability and pricing. Understanding these factors helps borrowers optimise their application timing and secure better deals.

Regulatory Framework and Consumer Protection in UK Mortgages

The UK mortgage market operates within a comprehensive regulatory framework designed to protect consumers and ensure responsible lending practices. The Financial Conduct Authority serves as the primary regulator, implementing rules and guidance that govern mortgage lending, advice, and administration throughout the mortgage lifecycle.

The Mortgage Market Review, implemented in 2014, represents the most significant regulatory change in the UK mortgage market in recent decades. The MMR introduced stricter affordability assessment requirements, enhanced consumer protection measures, and improved standards for mortgage advice and sales processes. These changes aimed to address the problems that contributed to the 2008 financial crisis whilst ensuring continued access to mortgage finance for creditworthy borrowers.

Affordability assessment requirements under the MMR mandate that lenders conduct thorough evaluations of borrowers’ income, expenditure, and financial commitments. These assessments must consider not only current circumstances but also potential changes such as interest rate increases, retirement, or family changes that might affect borrowers’ ability to maintain mortgage payments throughout the loan term.

Stress testing requirements ensure that borrowers can afford mortgage payments at interest rates higher than the initial rate, typically involving assessments at rates 2-3 percentage points above the mortgage rate. This stress testing helps protect borrowers from payment shock if interest rates increase significantly, whilst also protecting lenders and the broader financial system from excessive risk exposure.

The FCA’s mortgage conduct rules establish standards for how lenders and intermediaries interact with consumers throughout the mortgage process. These rules require clear disclosure of costs, risks, and obligations, ensuring that borrowers understand the implications of their mortgage decisions. Sales processes must focus on suitability rather than product promotion, with advisers required to recommend products that meet borrowers’ needs and circumstances.

Consumer protection measures include requirements for clear documentation, cooling-off periods for certain products, and standardised information formats that enable comparison between different mortgage offers. The European Standardised Information Sheet (ESIS) provides consistent presentation of mortgage terms and costs, helping borrowers understand and compare different products.

Complaint handling procedures ensure that borrowers have recourse if they experience problems with their mortgages or believe they have been treated unfairly. The Financial Ombudsman Service provides independent dispute resolution for mortgage-related complaints, with the power to order compensation where appropriate. The Financial Services Compensation Scheme protects deposits and provides limited protection for mortgage advice in cases of firm failure.

Responsible lending obligations require lenders to ensure that mortgage products are suitable for borrowers’ circumstances and that lending decisions are based on adequate assessment of creditworthiness and affordability. These obligations help prevent irresponsible lending practices whilst ensuring that credit remains available to borrowers who can afford it.

Future Trends and Developments in UK Mortgages

The UK mortgage market continues to evolve in response to technological developments, regulatory changes, and shifting consumer preferences. Understanding these trends helps borrowers and industry professionals anticipate future developments and make informed decisions about mortgage strategies and product development.

Digital transformation is reshaping the mortgage application and management process, with lenders investing heavily in online platforms, automated decision-making systems, and digital customer service capabilities. These developments aim to improve customer experience, reduce processing times, and lower operational costs whilst maintaining appropriate risk management standards.

Open banking initiatives are enabling new approaches to income and expenditure verification, allowing lenders to access real-time banking data with customer consent. This technology can streamline application processes, improve affordability assessments, and enable more accurate risk pricing based on actual spending patterns rather than estimated budgets.

Environmental considerations are becoming increasingly important in mortgage lending, with green mortgages offering preferential rates for energy-efficient properties or home improvements. These products reflect growing awareness of climate change and the role of housing in carbon emissions reduction, whilst also responding to consumer demand for environmentally responsible financial products.

The development of alternative credit scoring methods is expanding access to mortgage finance for borrowers with limited traditional credit histories. These approaches consider factors such as rental payment history, utility bill payments, and other indicators of financial responsibility that may not be reflected in conventional credit scores.

Flexible mortgage products are evolving to meet changing employment patterns and lifestyle preferences, with features such as payment holidays, overpayment facilities, and offset capabilities becoming more common. These features reflect recognition that borrowers’ circumstances can change over long mortgage terms and that products should accommodate these changes.

Conclusion: Making Informed Mortgage Decisions in the UK

The UK mortgage market offers a diverse range of products designed to meet different borrower needs and circumstances. Understanding the characteristics, benefits, and risks of different mortgage types is essential for making informed decisions that align with individual financial objectives and risk tolerance.

Fixed-rate mortgages provide payment certainty and protection against interest rate increases, making them suitable for borrowers who prioritise budget stability and predictable costs. Variable rate mortgages offer potential savings when interest rates fall but expose borrowers to payment increases when rates rise. The choice between these approaches depends on individual risk tolerance and market outlook.

Specialist mortgages address unique circumstances such as property investment, credit history challenges, or non-standard employment arrangements. These products can provide valuable financing solutions for borrowers who don’t fit standard lending criteria, though they often involve higher costs or more complex terms.

Government schemes continue to play important roles in supporting homeownership, particularly for first-time buyers and those with limited deposits. Understanding these schemes and their eligibility criteria can help borrowers access homeownership opportunities that might not otherwise be available.

The importance of professional advice cannot be overstated in navigating the complexity of the UK mortgage market. Understanding the difference between Mortgage Broker and advisor can help borrowers choose the right type of guidance. Mortgage brokers and financial advisers can provide valuable guidance on product selection, application strategies, and long-term financial planning that can significantly impact mortgage outcomes.

Regular review of mortgage arrangements is essential throughout the mortgage term, as circumstances change and new products become available. Borrowers should consider remortgaging opportunities, particularly when fixed-rate periods expire, to ensure they continue to benefit from competitive rates and suitable product features.

The regulatory framework provides important consumer protections whilst ensuring responsible lending practices. Understanding these protections and obligations helps borrowers make informed decisions and know their rights throughout the mortgage process.

Professional mortgage advice is recommended for all mortgage decisions. Your home may be repossessed if you do not keep up repayments on your mortgage. There may be a fee for mortgage advice. The actual amount you will pay will depend on your circumstances.